Russia’s invasion of Ukraine forces Germany to come clean on energy transition strategy

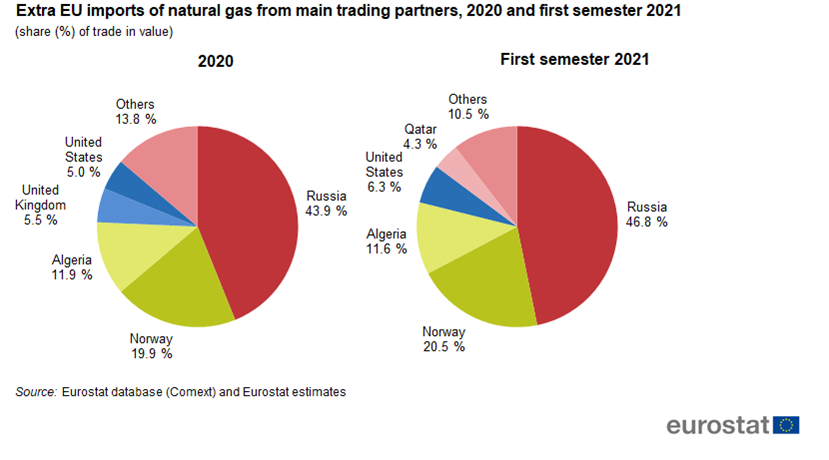

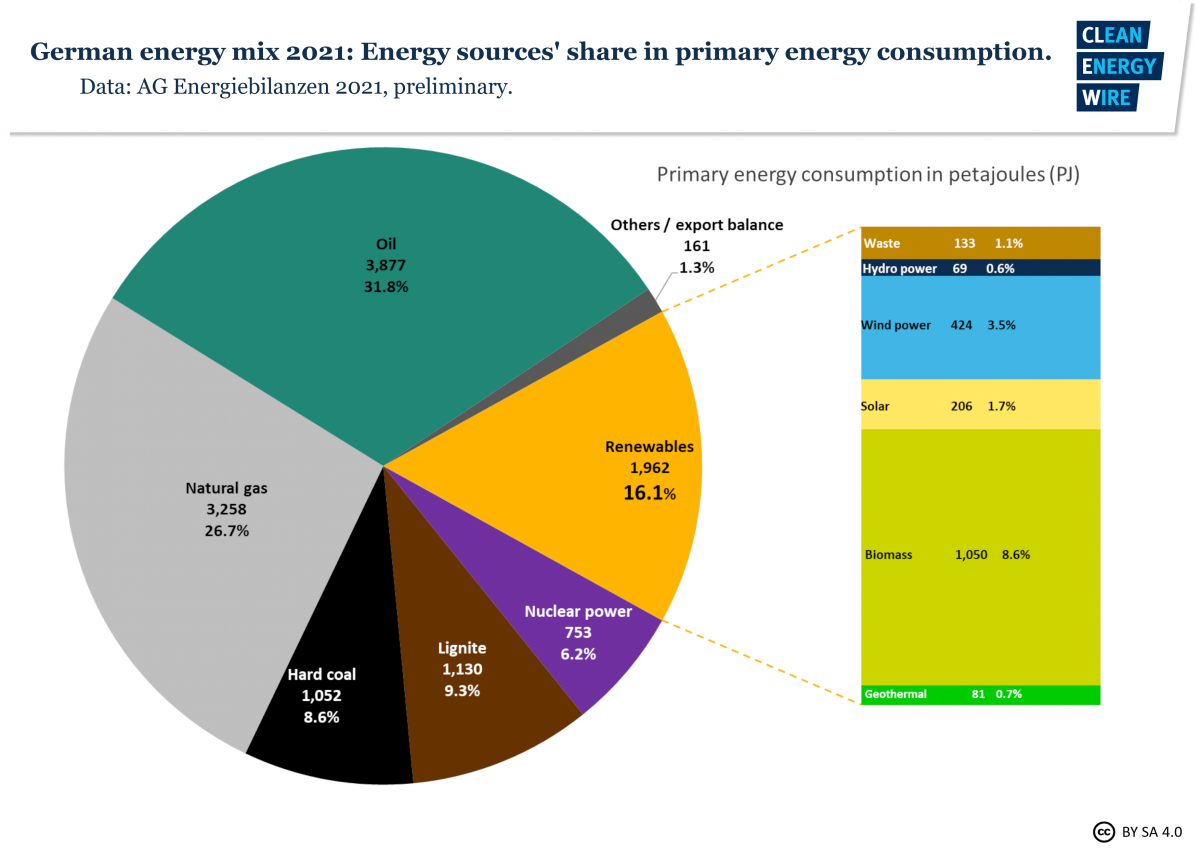

The attack on Ukraine ordered by Russia’s president Vladimir Putin has delivered a blow to years of European and particularly German security and energy policy that reaches far beyond the halting of the controversial Nord Stream 2 gas pipeline project. The country’s strategy for implementing its transition to nuclear-free carbon neutrality has rested on the assumption of readily available Russian gas as a “bridge” towards a future energy system that fully relies on renewable power sources. For several years, a cross-party concept has been that using natural gas would allow the country to phase out nuclear power by the end of this year and coal-fired power generation preferably by the beginning of the 2030s. With the focus of Germany's energy transition so far resting on the power sector, dependence on natural gas is particularly high in the heating sector and for industrial applications, where a substitution with other energy sources is difficult to achieve in the short-run.

The full-scale military invasion of Ukraine has now raised the specter of a protracted military standoff that could let energy trading between Europe and Russia dry up. While Germany’s government quickly reassured that the conflict will not lead to instant supply shortages, a reassessment of its longer-term energy transition blueprint appears inevitable. “We will change course,” chancellor Olaf Scholz reassured in a speech in parliament on 27 February, and added that the country has to overcome its energy dependence on individual suppliers. Scholz’s speech was considered “historic” for a wide range of reasons, as it threw multiple axioms of German-Russian relations grown since the end of World War 2 over board, from the delivery of weapons to fight Russian soldiers to a reinvigoration of Germany’s defense budget. On energy, Scholz instantly swept away a long lasting debate over liquefied natural gas (LNG) infrastructure, announcing the construction not of one but two terminals to allow direct LNG deliveries to Germany.

Already before the chancellor’s speech, economy and climate minister Robert Habeck of the Green Party had set the tone for the shifting view on the current energy transition architecture, acknowledging that energy policy would always “also mean security policy and must be assessed on geopolitical terms.” The German government’s long-standing argument that Nord Stream 2 would be a merely “economic” project would thus have been an “illusion,” the vice chancellor said, whose party has been critical of the project for years. In a first strategic revamp, Habeck announced the country would build up gas and coal reserves to prepare for possible supply shocks.

Regardless of a novel coal reserve, plans to shutter further coal capacity also this year have so far not been affected by the crisis. However, ministers from two coal producing German states quickly warned that current plans for a fast coal exit and for ending nuclear power in 2022 should be revisited. Social Democrat (SPD) Dietmar Woidke from Brandenburg questioned whether the new government’s aim to close the last plant in 2030 “is still realistic,” arguing that a final decision on the schedule would be needed still this year. His Conservative (CDU) state premier colleague, Michael Kretschmer from Saxony, said the plans for both coal and nuclear power would have to be revisited, arguing that Germany had “forgotten” the need for autonomy regarding critical infrastructure. The current crisis would mean “it is time to correct the political deficits of the past.” Kretschmer has been a vocal critic of a faster coal phase-out, encouraging citizens to protest against it, and argued for a postponement of the nuclear exit well before Putin decided to wage war on Russia’s smaller neighbour.

"No taboos" for supply security - but technical and financial constraints remain

Finance minister Christian Lindner from the Free Democrats (FDP) said “there’s a law for the nuclear phase-out,” meaning this decision could not be brushed aside by the government. Moreover, prolonging the runtime of plants scheduled for closure at the end of the year would not change the current situation, he argued. Economy minister Habeck said he ordered an evaluation of whether both coal and nuclear plants could be given an extension of their running time, arguing that there should be "no taboos" in considering potential solutions to a supply crisis.

For the head of Germany‘s most important industry federation BDI, Siegfried Russwurm, the Russian attack had “fundamentally changed the framework conditions for the aspect of supply security within just 24 hours.” The question how Germany can balance times of little wind and sunshine would now become more urgent than ever, also suggesting that current exit plans need to be reconsidered, Russwurm told Handelsblatt.

However, irrespective of the political will, extending the running time of the last remaining plants might well fail due to technological and logistic constraints, nuclear plant operator PreussenElektra told Clean Energy Wire. Extending operating time or even reviving decommissioned reactors would no longer be possible ten years after Germany decided to exit the technology. The plants lack fuel elements as well as trained staff able to operate reactors. Nuclear plants provided about 12 percent to the country’s power mix in 2021, before ten gigawatts of capacity were taken offline at the end of the year.

EU policy think tank Bruegel calculated that about ten percent of gas plants could switch to using coal instead to deliver some relief in the European electricity sector by lowering gas demand by around 90 terawatt hours (TWh). Reviving coal plants taken offline since 2019 would unlock more than twice as much capacity -- 200 TWh -- Europe-wide – “assuming the plants are still there.” Even though this would likely let their price skyrocket, enough allowances should be available to remain within the limits of the European emissions trading system (ETS), the think tank said. The “technically and politically difficult” option of delaying the shutdown of nuclear plants could offer another 120 TWh, it added.

Energy researcher Bruno Burger of the Fraunhofer Institute said new studies on overall emissions of hard coal plants suggested these could replace gas capacity without additional strain on the climate. The high methane emissions in gas production would mean the fossil fuel could contribute significantly more to global warming than its relatively low CO2 footprint when burned suggests. “For the climate it’s almost irrelevant whether we burn hard coal or gas,” Burger told the Frankfurter Allgemeine Zeitung.

Economy and climate minister Habeck said “true independence” in energy affairs could only be achieved with renewables, hinting that the government’s already ambitious plans to jolt renewable power could now receive an additional booster on grounds of national security. Finance minister Lindner even re-branded wind and solar power as “freedom energies,” arguing that the government should not “seek solutions from the past but on the contrary march towards the future ever more determined.

Yet, free-spending on renewables expansion could still run into difficulties, as Lindner already faced criticism over the constitutionality of his move to carve out a first tranche of 60 billion euros for climate projects from funds earmarked for pandemic recovery. Given chancellor Scholz’s commitment to inflate military spending to over 100 billion euros in through so-called “special assets” and the government’s determination to keep a lid on skyrocketing energy prices, conflicts over budget priorities loom large, especially against the backdrop of a possible global recession triggered by Putin’s war. Similarly, industry companies already warned that a shortage of skilled workers could become anohter major stumbling block for its renewables expansion ambitions.

Researchers say coal a "temporary fill-in" but only renewables offer permanent strategic advantage

Several German researchers looking at the impact of Russia’s aggression on the country’s energy transition said coal could well serve as a “temporary fill-in” but ruled out that the fossil fuel’s decline in the country’s power mix would be halted by the crisis. For economist Manfred Fischedick, head of the Wuppertal Institute for Climate, Environment and Energy, the outbreak of war in eastern Europe showed the need for “a general risk-assessment regarding central energy transition and climate action paths,” in particular with respect to supply security, industry provisions and adequate access to resources needed for low-carbon technologies. “Should there be any gaps in power supply due to gas shortages, the utilisation of coal plants would go up automatically,” Fischedick said. However, industry and heating would not directly benefit from it.

Lamia Messari-Becker, building technology researcher and advisor to the government’s expert council on environmental policy, said the slow expansion of renewables based on flawed priorities would now backfire. “An ill-guided focus on electricity and the lack of a transition in the heating sector are taking their toll,” the researcher said, pointing out that with almost half of all supplies, the prevalence of natural gas is particularly strong in the heating sector. By contrast, the share of gas in the German power sector stood at only 15 percent in 2021. Messari-Becker said the government should quickly hold an energy summit to quickly agree on a comprehensive strategy. Stronger European cooperation and partnerships with African countries would offer a long-term perspective to move away from Russia.

Energy grid and storage researcher Michael Sterner from the University of Regensburg said that halting gas deliveries from Russia would also hit industrial companies that cannot easily switch production systems which rely on the fossil fuel. “We can and must overcome this massive dependence with the help of the energy transition,” he said, arguing that wind and solar power ultimately would also reduce total costs. “Everyone who bet on wind and solar power in the past years is not severely affected by rising energy prices: house owners, businesses and industrial companies.” Switching to heat pumps and making solar panels a standard on every roof should no longer be delayed, Sterner said, adding that a general relabeling of the role of renewables in Germany is overdue. “We’re a wind country, we can cover a large part of our demand. Renewables are crucial for maintaining our prosperity and supply security,” he argued, adding that “unnecessary and scientifically unfounded minimum distances” between wind turbines based on fears have to be scrapped, as protests and legal action against new projects are delaying the construction of thousands of turbines.

Renewable power industry lobby group BEE warned against reopening the debate about exiting coal and nuclear power, arguing that this would be no remedy to energy dependency in the long run. Studies have shown that enough renewable power can be provided over the next years to follow through with decommissioning plans, BEE head Simone Peter said. “Supply security and affordability would be a given at any time and Germany could remain a power exporter,” Peter said. She said backup capacity for intermittent renewables production would have to be provided by biogas and hydropower installations, storage facilities, combined heat and power systems as well as a “steep scaling-up” of green hydrogen production. The capacity of biogas could quickly be more than doubled to over 230 TWh without using additional farming land for energy crops and could even reach 450 TWh if all potential sources are used. “Sun and wind don’t belong to anyone, in contrast to gas and coal. We must use his strategic advantage now,” Peter said.