Resources and recycling needs for Germany's solar panels

Solar PV capacity in Germany has grown constantly over the past two decades and made the country the biggest solar power producer in Europe. The country has been at the forefront of rolling out the technology at a large scale and has boasted the greatest nominal solar power capacity in the world for more than 20 years. Millions of panels are already connected to the grid, but there is still enormous untapped potential for further expanding this key renewable energy technology and eventually solar PVs could be installed on every new building in the country.

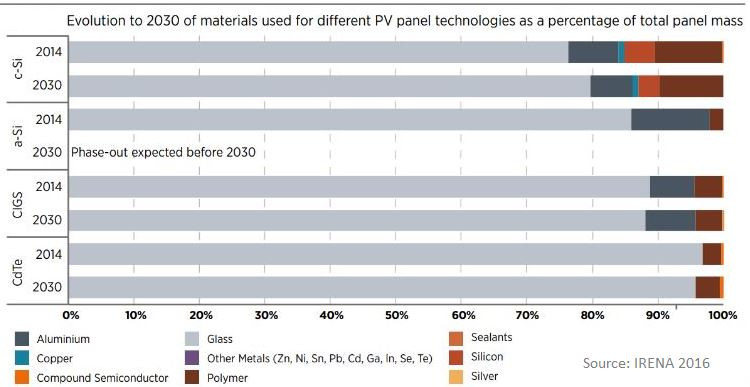

As more and more countries take advantage of falling solar power production prices, the vast scale of expansion ahead raises questions about the technology's raw material needs and the industry's recycling capacities. Solar cell development is an ongoing process and has seen fast advancements in recent years, illustrating how difficult it is to forecast resource requirements and conduct life cycle analyses. How various solar PV technologies develop and how market choices align with these will thus define demand for a wide range of materials.

What is clear, however, is that Germany, Europe and the rest of the world will need to build much more solar power arrays. Globally, nearly 600 gigawatts (GW) of capacity in the form of millions of solar panels had been installed by 2019. According to the International Renewable Energy Agency (IRENA), this figure must grow about 18-fold and reach more than 8,000 GW by 2050 to make the world's energy systems compatible with international climate targets.

Research institute Fraunhofer ISE says Germany's capacity has to multiply about eight times, from just over 50 GW in 2020 to about 415 GW by the middle of the century. In order to reach the 2030 target of a 65 percent renewables share in power consumption, the annual capacity expansion must reach at least 5 GW for both solar and wind power. This means the country will also be among the first to experience a large-scale return of used solar modules that will have to be dealt with in a clean and systematic way that minimises environmental impacts and maximises economic viability. Its experiences in establishing a clean and efficient sourcing and recycling mechanism could therefore hold valuable lessons for managing the growing volumes of PV waste that will accrue as the world transitions away from fossil power.

What are solar panels made of?

Solar PV modules consist of multiple solar cells that are protected by glass and plate covered by a waterproof and translucent layer usually made of plastic. The plate is encased in a metal frame, often aluminium. Glass, metal and plastic account for up to 90 percent of the module's weight. Most panels also contain copper and small amounts of silver in metallisation pastes. But the biggest difference in component materials is determined by the cell technology used.

As of 2017, 85 percent of all installed solar cells worldwide were crystalline silicon (CS) cells, according to World Bank figures. Germany's Federal Environment Agency (UBA) says with 95 percent the share in Germany is even higher. CS cells bundle the crystalline silicon in wafer plates that work as semiconductors. They often contain small amounts of lead and thin film made of cadmium, which is are considered a toxic material that requires careful treatment when decommissioning an installation.

The other key technology uses thin film cells, which are more flexible than CS cells and are made of more complex components like copper indium gallium selenide (CIGS), cadmium telluride (CdTe) or amorphous silicon-germanium cells. These might require fewer material volumes but can be more toxic and less abundant. In any case, these varieties illustrate the range of possible input materials for solar PV installations.

Resource supply secure but requires more efficient use

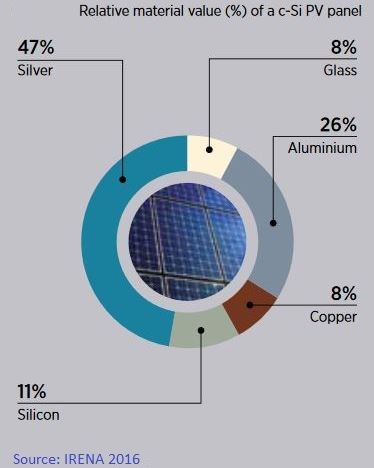

For the most material-intensive components in CS cells -- silicon and aluminium CS cells -- there is no shortage in sight. But for other materials that are only used in small amounts within the panels, the effects on supply levels can be significant given the projected expansion levels. Already in 2015, the world's PV industry used 1,400 tonnes of silver, about five percent of the global mining output that year, according to research institute Fraunhofer ISE.

The IRENA says the share could even be up to 15 percent if material losses in mining and production are factored in. But silver could to a large extent be substituted with other more abundantly available materials like copper in the future, as global solar power capacity moves into terawatt volumes. A substitution analysis conducted by environment agency UBA for critical raw materials found that solar power is among the future technologies where resource supply shortages could be avoided best through technological development, for example a greater use of thin film cells. This would not eliminate sourcing risks but at least greatly alleviate them, the UBA said.

For thin film cells, availability depends on the technology used. While raw material supply for silicon-based cells appears secure, estimates on the availability of tellurium and indium vary widely. The US Geological Survey said material use has exceeded annual production levels as more and more of these materials are used in the growing stock of electronic equipment. But making a much greater use of residual raw materials contained in discarded renewable power installations might greatly alleviate the risk of bottlenecks and reduce them to spikes in demand and lags in expanding production capacity, the German engineering association VDI said.

Production location impacts on panels' emissions balance

The production location of solar panels also plays a role in how resource- and emissions-intensive every kilowatt hour (kWh) they produce is. The energy recovery time, an indicator for when the module has produced as much power as it took to build and install it, for the average solar module in Germany stood at about two years in 2020. Fraunhofer ISE researchers say modern installations pay back at least ten times the amount of energy needed to produce them during their lifetime. And this figure is likely to go up in the coming years thanks to further energy efficiency gains. Wind power turbines have an even shorter recovery time in the country, needing only 2-7 months to return all the energy that was used for their construction, they add.

A comprehensive life cycle assessment that includes the emissions and recycling quotas during the panel's production process for Germany's total solar PV stock shows that the emissions factor, meaning how much is CO2 is released for production, installation and operation, stood at 67 grams of CO2 equivalent kWh as of 2020, the UBA said. As this is an average value that includes early installations, newer modules achieve much better ratios. It is in any case lower than the German power system's total emissions factor, which stood at 500 g CO2/kWh as of 2020.

In countries with an even higher reliance on coal-fired power generation, the footprint will automatically be greater than in countries with a higher share of low-carbon energy sources. Fraunhofer ISE estimates that roughly 80 percent of the solar panels installed across Germany in 2020 came from China. A study conducted by Northwestern University in the US found that modules made by world's biggest panel manufacturing country have about 30 percent lower energy efficiency in production and a carbon footprint about twice as high as modules produced in Europe or North America, meaning these installations would have to run significantly longer to draw even in their life cycle assessment. Finally, the distance over which products are transported for further processing or final use of course also has an impact on their carbon footprint, given average shipping, road and railway freight or aviation emissions.

Scrapped panel waste levels set to inflate in 2030s

As of 2016, the latest year for which environment agency UBA provided figures, about four million tonnes of PV modules had been installed across Germany, with the panels commissioned between 2017 and 2018 alone weighing about 300,000 tonnes. The average lifetime of an installation is around 25 years, but the bulk has been built under Germany's Renewable Energy Act (EEG) introduced in the year 2000, and these have started to lose support funding after two decades in 2021. A huge bulge of installations came into operation between 2010 and 2012, meaning their decommissioning looks set to seriously intensify in the second half of the 2030s. However, many operators, especially non-commercial ones, might choose to keep their installations running longer than that since they have already been written off but continue to feed electricity into the grid.

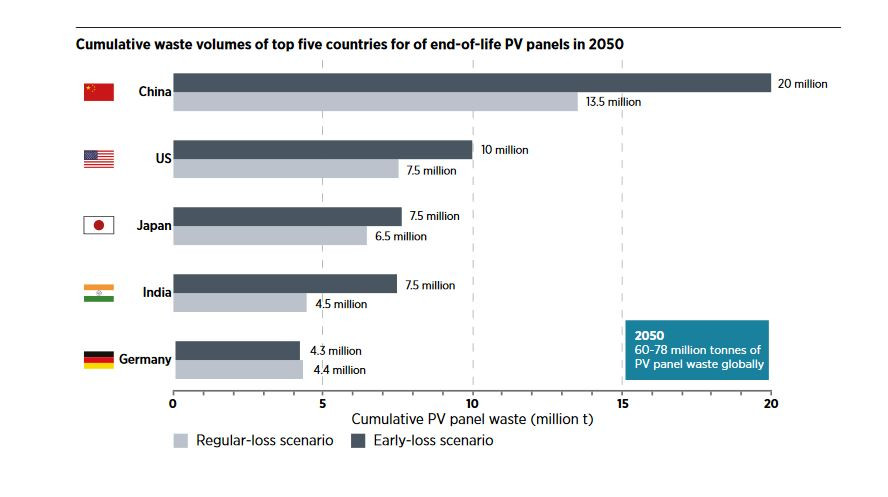

Waste volumes therefore depend on a range of factors, including expansion levels, operational lifetime and the specific weight of materials used in decommissioned panels. According to Germany's largest waste management company Remondis, nearly all modules put into the waste collection system as of 2020 had been disposed of due to damage or malfunctioning and not due to reaching the end of their service life. In 2018, just under 8,000 tonnes of solar PV waste were collected and processed in Germany. Estimates used by the UBA say the figure could grow to 22,000 tonnes per year by 2025 and waste volume could total almost three million tonnes by 2035 and nearly 10 million tonnes by 2050.

Globally, the IRENA estimates that waste volumes will reach nearly 80 million tonnes by the middle of the century, much more than the roughly 50 million tonnes of total e-waste generated in 2019, which covers all electronic equipment. It stresses that a sizeable share of these materials could be recovered if institutional groundwork is laid early on. A thorough management of retrieved input materials from solar cells could redirect nearly 80 million tonnes of glass, metals and other components back into the economic cycle, saving resources worth more than 15 billion dollars by 2050.

What happens to Germany's panels at the end of their lifetime?

A collection scheme for decommissioned PV installations is included in Germany's Electrical and Electronic Equipment Act, derived from the European WEEE directive introduced in 2014. It obliges producers or distributors to collect and recycle at least 85 percent of the modules’ volume and stipulates that old panels are treated separately from other residual waste. One of currently 20 certified facilities collects them and determines whether the installation can be reused. Otherwise, a first sorting of its material is carried out, during which liquid and toxic components are disposed of safely.

The environment agency says that further greenhouse gas emissions or other environmentally damaging effects are not to be expected if established procedures are heeded. According to Germany's statistical office, of the 7.9 tonnes of PV waste registered in 2018, 0.9 tonnes were deemed fit for reuse, six tonnes were recycled and one tonne was disposed of or "used otherwise."

Already in 2007, a mechanism dubbed PV Cycle was launched by European producers to collect and resell or recycle old panels. PV Cycle said it had processed over 35,000 tonnes of scrapped panels as of 2019 – with over 11,000 tonnes accruing in that year alone. It expects the volume of potential solar waste to increase fivefold by 2030.

Most panels can still be used even when operators decide to decommission them. So long as they are undamaged, they still produce power and can for example be exported. Especially "half-faulty" panels that no longer produce their maximum electricity output and therefore become unfit to operate in large, commercial solar farms are often sold abroad to continue serving as energy providers in Africa or Asia, the UBA said.

Recovery of valuable materials still widely lacking

About 90 percent of the waste volume can be recycled, meaning that the legal minimum recycling share quotas are met. But this is mainly because well-established procedures exist for aluminium and glass, which together account for most of the modules' weight, the UBA said. The remainder is usually combusted or used as filling material for road building or other construction works.

Aluminium and silver are among the most valuable components that can be retrieved to date, while an economically viable recycling procedure for glass has proven more difficult to establish as costs for collection and reprocessing are high. According to the research institute Fraunhofer IBP, improving the recycling quota especially of glass will be crucial for making the panels more environmentally-friendly over their entire life cycle. Recycling one tonne of CS modules thus could save up to 1.2 tonnes of CO2 equivalent.

Waste management company Remondis said that economically viable recovery is difficult for many of the valuable components used in a panel, including silicon, tellurium or indium. The amounts in which these materials occur in each panel would be too small to make extraction and reuse viable, it said. The environment agency said the recovery rate for strategic resources in standard treatment procedures would be practically zero, even though recycling trials had shown that rates for indium and other metals could be brought up to 70 or even 90 percent, thereby greatly reducing each module's environmental impact. However, at current rates this would still be more expensive than using primary resources. But the IRENA still expects Germany to be the first solar power market that reaches profitability in recycling procedures, as rising amounts allow economies of scale to set in and boost the learning curve.