Stricken solar sector sets out to regain leading Energiewende role

- Contents

- Introduction – a new dawn

- Every light has its shadow - solar power’s chequered history in Germany

- Solar industry seeks right policy mix for a comeback

- Radiant rooftops - solar industry bets on private power prosumers

- High noon on the energy market - prices, grids and demand-side management

- Where solar PV research could lead the Energiewende

Introduction – a new dawn

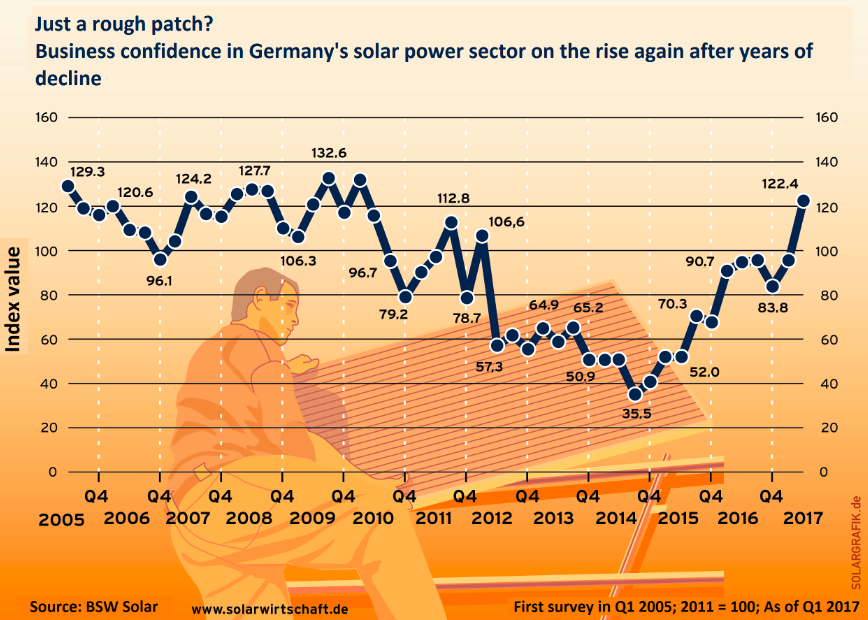

Against all odds, Germany’s solar power sector looks set for a comeback that could shape the future course of the country’s energy transition. The once-mighty German solar industry has repeatedly been declared a lost cause, no longer able to compete with cheaper competitors from abroad. But companies that successfully weathered the industry’s crisis thanks to offering sound quality, niche products or services are now taking advantage of cheaper prices and technological progress in a bid to regain their market shares as countries around the world shift towards renewable energies.

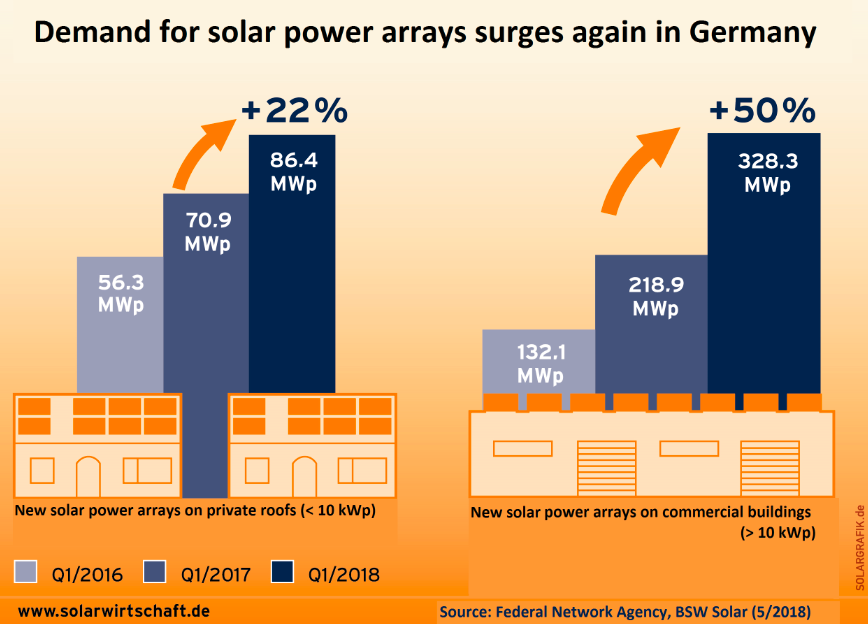

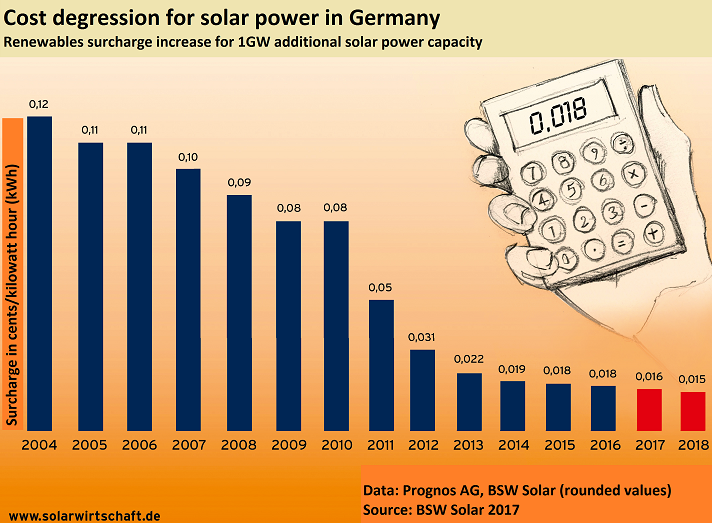

A significant increase in demand for solar power installations – especially from small-scale, private investors – have prompted a revival of solar energy in Germany which defies the narrative of an industry in decline. While state-mandated support rates have dropped substantially in recent years, a parallel drop in hardware prices has allowed even small investors to install solar arrays and operate them at a profit.

The new conditions that shape Germany’s solar power market also warrant new policy approaches that take into account falling prices for private investors and systemic changes brought by expanding storage capacities, say observers like Volker Quaschning, a researcher at the Berlin University of Applied Sciences. “There needs to be some sort of a new ‘masterplan’ for the Energiewende,” Germany’s dual transition from fossil and nuclear power generation towards an energy system based on renewables and efficiency, the researcher told Clean Energy Wire.

German companies have long-standing experience in developing and implementing solar power projects and still produce cutting-edge equipment. Moreover, the country has a vibrant solar power research sector that constantly seeks innovative solutions to open new pathways in the embattled but rapidly expanding global solar power market. As solar power expands again and the industry underlines its suitability for a leading role in Germany’s energy system, its effect on power prices, grid stability and the Energiewende itself is spurring policymakers to reconsider solar power’s role.

Every light has its shadow - solar power’s chequered history in Germany

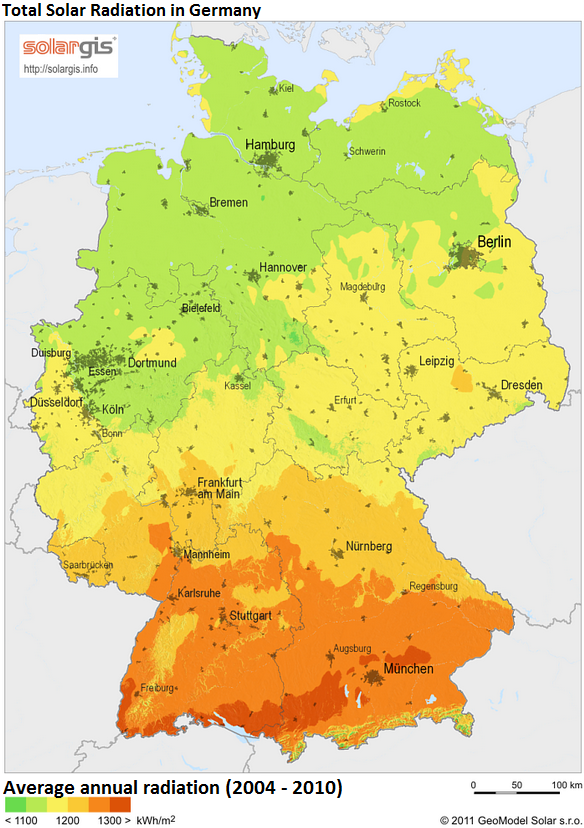

Germany is not exactly one of the world’s sunniest holiday destinations. In fact, the Central European country ranks among countries with the fewest hours of sunshine per year. And yet, despite these comparatively unfavourable conditions, Germany has become an unlikely global leader in solar power. Back in 2012, Jürgen Grossmann, former CEO of Germany’s biggest energy company RWE claimed that supporting solar power in Germany was as smart as “farming pineapples in Alaska.” Five years later, the country ranked first globally in solar power capacity installed per capita and hosted about ten percent of the technology’s worldwide capacity.

[See the factsheet on Solar power in Germany for more benchmark data]

Propelled first by a few dispersed renewable energy aficionados in the early 1990s, solar power really took off after 2008 and for a while made the country the uncontested global leader in solar power expansion. Financial support under Germany’s Renewable Energy Act (EEG) allowed generation capacity to grow more than sixfold in only five years and firmly established the technology as a main pillar of the Energiewende.

But despite this growth streak, it has not been all sunshine and roses for German solar panel makers. Attracted by the EEG support, Chinese competitors in solar panel manufacturing began exporting vast quantities of solar panels made at much lower costs than those in Germany. German manufacturers complained that the cheaply produced panels were driving them out of a market they had just helped to create through their investment in developing the technology.

Solar panel prices dropped by about 80 percent in just five years and German manufacturing imploded, reducing the number of jobs in the industry from over 150,000 in 2011 to about 36,000 six years later.

As cheap products flooded the market, a government reform of the EEG in 2011 cut solar support rates to reduce the pace of expansion and allow for better grid integration. The policy delivered a finishing stroke to many solar panel manufacturers, who subsequently had to file for insolvency. “By losing their home market, the German manufacturers stood no chance of survival,” solar power researcher Quaschning said.

Now, however, a surge in new installations and the rising availability of home power storage appliances and innovative solar power generation concepts could help German companies and turn this dynamic sector upside down once again.

Solar industry seeks right policy mix for a comeback

In a bid to shield European manufacturers from their low-cost competitors, the European Union introduced trade barriers on Chinese solar module imports in 2012. But these largely failed to halt the industry’s decline and also slowed solar power expansion across the EU. The EU lifted the tariffs in 2018 – with reactions in Germany ranging from excitement to exasperation. Many panel producers fear that trade deregulation with China will wipe out what is left of German manufacturing, but panel importers and installers say lower prices will breathe new life into the sector and help Europe to achieve its climate targets.

But the good news of expansion also revived the policy debate – which policies will best allow domestic companies to benefit from a global surge in demand. Germany was on track to reach its annual expansion goal of 2.5 GW for the first time in five years in 2018. Solar industry lobby group BSW Solar subsequently lost no time and called on the government to reconsider its current 52 GW cap on support, which at current rates could be reached by 2020. And expansion rates could be boosted even further once the removal of import tariffs translates into a further drop in panel prices. British analyst firm IHS Markit estimates that Europe’s solar panel demand could rise by 40 percent in 2019. “Modules account for about 50 percent of the total cost of a solar power array,” Susanne Henkel of solar power hardware supplier SMA told Clean Energy Wire. “We expect the tariff removal to have a positive effect on the market,” she said, noting that new investments would become even more attractive.

Critics of the tariffs, like EEG co-author Hans-Josef Fell, say the German market’s expansion was limited by fencing off competitors just when financial hurdles started to crumble away. According to calculations by research institute Fraunhofer ISE, tariffs kept prices up to 20 percent higher than they otherwise would have been – while around 30 percent of the total solar power support paid so far in Germany ultimately went to East Asia. However, it estimates that the rebound effects of China’s own expansion will benefit Germany’s solar power sector. SMA’s Henkel confirms that surging demand abroad helped the company a great deal. “We were able to stem the decline in the German market by our international activities,” she said. Inverter modules, one of the company’s core products, will be needed regardless of where a solar array is produced. “This has helped to balance our business pretty well,” she said.

Panel producers, on the other hand, are less optimistic about the new trade regime. Lobby group EU ProSun, which is closely linked to German companies, argued that solar energy is already the cheapest source of power in Europe today. “Dropping the current anti-dumping measures will not make it any cheaper,” the group said, arguing that Europe would squander technological leadership with its eyes wide open. The group’s concerns are mirrored in the analyses of research institutions such as French institute Ceatech Liten. Its CEO, Florence Lambert, said earlier this year that, “we won’t keep our leadership by only integrating renewable energy technology,” as this could easily be taken over by Asian competitors too. Instead, she said, Europe must be self-sufficient in solar power expansion and make sure it retains control over “core technology” to build on.

“If producers in Germany are terrified, they are probably right to be,” Dominik Martel, consultant for renewable energy investors at PwC, told Clean Energy Wire. Martel said he expects that the EU Commission’s decision to lift tariffs will let module prices fall further – “and deal a heavy blow to remaining solar power producers in Germany.” He argued that despite their reputation for better quality and efficiency, German solar panels simply could not compete against low prices without making major innovations.

In order to strengthen the domestic solar power sector and to meet expansion levels necessary to comply with the emissions reduction levels related to the Paris Climate Agreement, as well as to meet the envisaged renewables expansion targets for 2030, installation numbers must rise, regardless of the panels’ origin, said researcher Quaschning. “If the government said it is ready to back a far more ambitious expansion path, this could bring big investors like Bosch or Siemens back and change the prospects significantly.” Besides encouraging large-scale investments, Germany also needs to unleash the potential of private citizens who are often discouraged by the bureaucracy involved in setting up a solar array at home. Too much red tape in construction prevents lower prices from fully translating into capacity expansion, he argued.

"The feed-in tariff is basically an obstacle for our storage business"

Radiant rooftops - solar industry bets on private power prosumers

The German energy transition historically has been driven by keen citizens willing to invest time and money in finding and funding cleaner technology. By 2018, private investors owned about a third of the country’s renewable power capacity, while another quarter belonged to farmers, businesses and other land owners. While the bulk of Germany’s solar power capacity consists of larger arrays built on open fields or big roofs that feed into the public grid, there are now also nearly a million smaller installations, with a capacity of up to 10 kilowatts, suitable for supplying power to individual households or small businesses.

As support rates decline and power prices go up, self-consumption of solar energy is becoming an increasingly important factor for new investors. And what is true for private households applies even more to companies with high power consumption, for example for cooling in warehouses, which is needed most when sunshine is abundant and solar power output spikes. To fully exploit the benefits of a module for self-consumption, owners can install storage devices that allow them access to solar power long after sunset. In Germany, demand for solar storage systems is growing rapidly and achieved the milestone of 100,000installed home batteries in mid-2018.

For companies that are banking on this trend, like PV module and storage system maker Solarwatt from Dresden, guaranteed renewables support can sometimes even be a hindrance, CEO Detlef Neuhaus said. The bureaucratic hurdles for registering home solar arrays in order to feed a relatively modest amount of power into the public grid puts off many potential buyers, he said. In addition, they face expenses such as retrofitting wall sockets for a reversal flow of electricity from plugged-in solar power devices, or the “sun tax” for installations over 10 kilowatts. This tax compensates for lost state earnings because self-suppliers do not pay the renewables levy that applies to regular power customers. “Solarwatt is active in the residential and small commercial segments only. So, the feed-in tariff is basically an obstacle for our storage business,” Neuhaus told Clean Energy Wire.

He said the feed-in tariffs incentivise solar panel construction that is most profitable, but not necessarily most beneficial to transforming the energy system. “I’m not against projects yielding high returns, but it simply doesn’t always make sense,” Neuhaus said. A look at the distribution of solar power installations reveals that especially inner cities are underdeveloped when it comes to exploiting the technology’s benefits. This is partly because larger open field installations in rural and sunny areas, such as in Bavaria and Baden-Wurttemberg in southern Germany, are much more lucrative than putting solar panels on city buildings, even though that is where most of the electricity is consumed. “Bringing the energy transition into cities offers huge potential in theory, but I have yet to see someone who can clear the related legal hurdles in practice,” he said.

Legislative initiatives aimed at making this easier for private citizens, such as Germany’s tenant electricity act, so far haven’t sparked the technology’s spread in densely populated areas, which irks policymakers in cities. Berlin’s economy senator Ramona Pop was among the authors of a draft bill issued in summer 2018in the Bundesrat, the legislature representing Germany’s federal states, which aimed to cut red tape to better include urban areas in the energy transition. She said “absurd” federal laws were holding back tenant power schemes and other solar expansion concepts, both in heating and electricity generation.

Despite the bureaucratic difficulties for small-scale systems, Germany’s Federal Network Agency (BNetzA) forecasts that the mass of solar power expansion in the next years will consist of smaller projects implemented outside the renewables auctions scheme, which instead receive a fixed and declining support rate. After the EU lifted anti-dumping measures for Chinese panel imports, the German government reduced its fixed support rate for smaller roof installations, arguing that lower prices for hardware would mean “excessive support” for roof-mounted solar arrays with a capacity of at least 60 kilowatts. 3

Industry lobby group BSW solar said the cut will affect about half of the annual added solar capacity and damage “an important driver of the Energiewende” by curtailing incentives for homeowners and businesses. The growth was the only reason Germany met its own solar capacity expansion goal in 2018, the group’s head Carsten Körnig said. “We must support this welcome development and not strangle it,” he argued. However, tenant electricity marketer Solarimo said that while a better differentiation of installation sizes would help optimise area use, the support cut is justified, as it will avoid large gains for investors at the public’s expense. “Power should be consumed where it’s generated. You don’t need guaranteed support from the government for that,” said company co-founder Daniel Fürstenwerth.

Likewise, grid agency BNetzA estimates that many existing solar power arrays will be used for self-consumption once they lose their guaranteed support payments after 20 years. Since expansion in Germany was especially high between 2009 and 2013, huge quantities of up to 30 GW will drop out of the support scheme by 2030, “possibly resulting in a net capacity reduction,” the agency warns. Consultancy PwC analysed possible developments once the first installations start dropping out of the scheme by 2021. Like the BNetzA, it says that many will move on to self-consumption due to the low operational costs. This trend could even be strengthened by a parallel fall in prices for storage systems, both for private households and businesses.

“Quite a few companies, especially smaller ones, have been holding back investments in self-supply as they don’t see module prices under tariffs paying off quickly enough. But with the tariffs gone, they might decide to make these investments now,” said PwC’s Dominik Martel. He said the energy demand in cities currently is not high enough during the peak solar output times to justify a massive capacity increase in urban centres, but breakthroughs in storage technology could change the situation. E-car batteries, which act as power storage systems, could be one way to put excess solar power to use in inner cities. “Sector coupling could alter the demand pattern and greatly impact solar power development. If for example more and more households own e-cars, a ‘gas station at home’ could become attractive to many people.”

High noon on the energy market - prices, grids and demand-side management

A large-scale shift towards self-supply through combined solar storage systems would significantly impact Germany’s energy providers and calls policymakers to action, PwC says. Energy companies will lose more and more power consumption to solar panel owners, which should lead them to consider providing platforms for decentralised energy trading of small prosumers instead of retailing their own power output, the consultancy says. And if more and more partly self-reliant prosumers deduct grid fees, power customers still depending on larger providers will end up paying more to cover unchanged infrastructure costs, PwC warns. “Those responsible in parliament and at grid operators better start to figure out what to do soon,” said PwC energy economy director Norbert Schwieters.

Although solar power provided less than seven percent of Germany’s total power consumption in 2017, it has already significantly impacted the power system structure. The rapid increase in capacity between 2009 and 2013 has made available huge quantities of electricity in the middle of the day, when both sunshine intensity and power demand usually are highest – with profound effects on the balance of supply and, by implication, on traditional business models of electricity trading. At peak output times, up to 40 percent of the Germany power mix can come from solar panels. According to research institute Fraunhofer ISE, the output profile of solar arrays and the usual pattern of power demand match so well that older coal plants, which are too inflexible to respond to short-term fluctuations, have become economically unviable. In fact coal plants may no longer operate at a profit at all once solar capacity has reached a certain threshold, solar energy researcher Quaschning says.

Given solar power’s low generation costs, this trend is set to continue and will add further pressure on operators of inert fossil power plants, who now see profits dwindling around noon, the time of day that used to guarantee the highest margins. As solar capacity expands, power price curves in the middle of the day increasingly resemble lows previously only occurring at night.

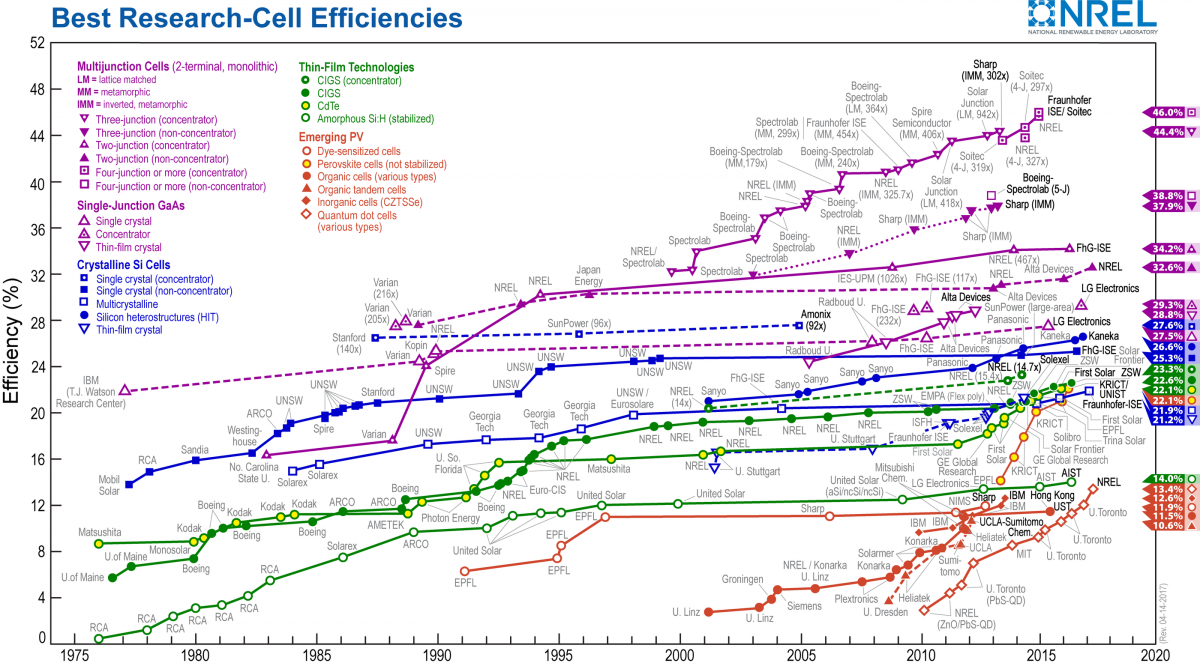

Economic research institute ifo says that the expansion of solar power has been underestimated in recent years due to overly reserved expectations of price and efficiency developments. According to ifo, prices for solar power on average decrease by 22.5 percent every time the installed capacity is doubled, making the technology’s “learning rate” much higher than other power sources. “This warrants a re-evaluation of the potential” and of future expansion rates, the institute says. Think tank Agora Energiewende also found that recent and anticipated cost developments indicate that solar photovoltaics’ role in a cost-optimal power system should be seen as similar to wind onshore, which plays a much more prominent role in grid development scenarios.

While German energy providers are today better prepared to cope with falling prices, frequently acting as service providers for smaller investors and investing in solar power themselves, challenges remain for the power grid. It must respond to volatile wind and solar power output, and plan the connection or blocking of production capacity to adjust not only for demand but also for weather forecasts. Research institute Fraunhofer ISE argues that instead of throttling down, a “precedence for volatile producers” like wind and solar will be necessary in the future to keep excess power production and production costs in check. It also opposes the idea of letting wind and solar power compete in joint auctions as this would prevent the exploitation of their complementary features. Due to Germany’s climatic conditions, their output is often inversely correlated, meaning that it is often windy when it is not sunny and vice versa. Making them rivals in tenders runs contrary to the aim of establishing a constant and secure power supply with renewables, Fraunhofer ISE argues.

Every additional solar array in the grid sharpens the technology’s feed-in profile, but aside from regulatory measures, technical solutions can also help ease its integration into the grid. Power storage is the most obvious and also already growing quickly. Charging storages at peak production times around the middle of the day can “straighten out” supply. This would not only reduce grid expansion costs by ensuring a more levelled feed-in but also allow prices to rise slightly at noon and reduce them in the evening, consultancy Prognos says. Several German companies, ranging from small start-ups like sonnen GmbH and industrial heavyweights like Siemens, are working on solutions to better control and smoothen power flows. The success of such projects and the speed of storage capacity and e-car development will shape both the power market and the required grid structure.

But even with highly decentralised power output from a large number of dispersed solar arrays connected to storage facilities, Germany cannot avoid significant grid expansion. “The new power lines we are talking about now are necessary for us to be able to use the renewable power we already have,” said Jochen Kreusel, head of Market Innovation in the Power Grids Division at grid management software provider ABB. And renewables are set to grow further in any case.

Where solar PV research could lead the Energiewende

Despite the commercial solar industry’s rocky history, Germany still boasts a highly dynamic research sector, and its material suppliers, engine manufacturers, PV producers, research and scientific institutions still set standards. Although it has become more difficult to find domestic partners to bring scientific findings to market, German research labs continue to improve current technology and to innovate with the potential to contribute to other countries’ efforts to create a more sustainable energy system.

Researcher Volker Quaschning warns that Germany needs to consider how its policies and research efforts will affect its competitive edge. The Chinese solar industry, for example, has shown its ability to quickly adopt new ideas, and the Chinese state its willingness to back industry with generous state assistance. “Stereotypical German strengths like reliability and sound product quality, plus decades of experience in Germany, could help to maintain some ground,” he said, adding that developing abilities in fields like battery cells and sector coupling through e-mobility and power-to-heat concepts are key. “But things like that happen much faster in China and we really have to make an effort if we don’t want to fall behind.”

With existing solar power technology and especially the dominant silicon models, China has coupled huge production volumes with significant research progress, making competition in a market that operates on low margins very difficult for German firms. Researchers therefore are seeking other materials that could reshuffle the whole sector, although technologic path dependency makes this an arduous task. “It’s a bit like replacing combustion engines in cars, if you will,” says Quaschning. Promising fields of research like perovskite technology, which have the potential to make a major impact on the sector, have already passed the lab stage and are receiving government funding to scale up production.

Others, like the butterfly wing project by the Karlsruhe Institute of Technology (KIT) are still in a fledgling stage and have yet to prove their applicability for industry. This also includes promising ideas like the power-producing cement DysCrete from Kassel University or transparent solar cells developed at the University of Leipzig that can be evaporated directly on a window one day could turn entire building facades into generation capacity. Regardless of whether these developments will eventually make it into everyday use, the trend towards more versatile and multi-purpose applications is evident in solar cell research.

Apart from hardware, solar power research also includes technology that optimises power generation management, like the MetPVNet project by Fraunhofer ISE and partners, which aims to improve weather forecasts and can help minimise systemic costs associated with re-dispatch measures to stabilise the grid. Similarly, bifacial solar panels like those tested by the Berlin-based start-up Next2Sun can help stretch the output curve of solar installations while reducing land consumption, an important issue as renewables grow and become more visible across Germany’s countryside. This could give solar power an edge over wind.

Sustainability aspects like land use or cleaner production processes could become an asset for producers as solar power generation surges around the world. In the long-run, falling production costs for solar modules mean that financial and environmental costs as well as shipping time gain in relative importance, which could favour innovative products and concepts and improve the competitiveness of local manufacturers. Lobby groups have already tried to raise status of sustainability and environmental standards in expansion scenarios. In early 2018, a group of over 30 solar power companies and research institutions addressed this in an open letter to the German government. “The largest portion of solar power expertise and internationally relevant patents comes from Germany,” the group said. “The economic survival of this technology of the future is in grave danger” in the country, they added, noting that “giving this up would be careless.” The group called for a greater consideration of sustainability criteria in solar power support and auctions, arguing that procedures to ensure European quality standards and compliance with environmental and social requirements already exist in France.

Solar power researcher Quaschning said that products from Germany and Europe indeed have an advantage in terms of sustainability vis-à-vis competing products from Asia. But “even if European products are a bit cleaner, the difference is not enough to justify a complete change of suppliers,” he said. As long as a large part of Germany’s power supply comes from carbon-intensive energy sources, it will be difficult to label products made with this power mix as environmentally friendly. “Things could look different if carbon emissions in production would cost industrial manufacturers across the board in Germany and Europe - and not just solar panel producers.”