Resources and recycling needs for Germany's wind turbines

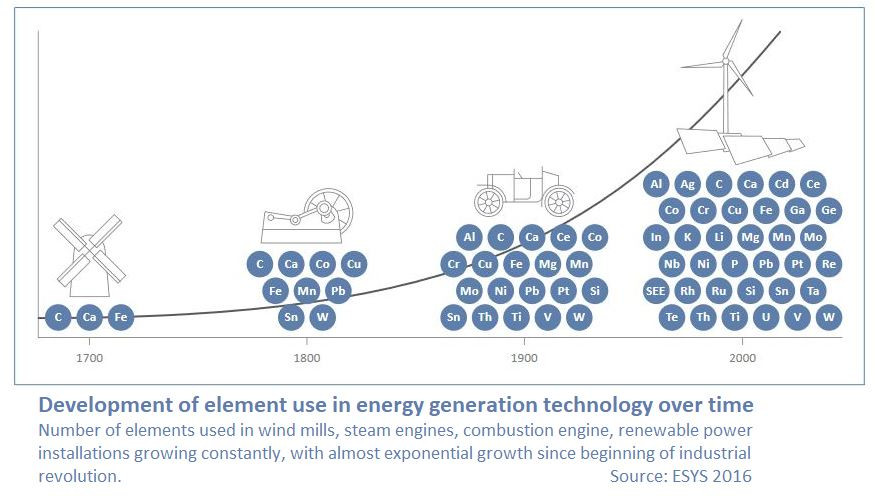

Wind turbines have become a standard landscape feature in many parts of the world and the number of new onshore and offshore wind farms is projected to grow even more rapidly over the next decades. As more and more countries adopt ambitious climate targets that are based on the fast-expanding availability of renewable power, the demand for a wide range of primary input materials to construct new turbines with thousands of gigawatts (GW) of capacity is set to multiply many times over. Critical resources for wind turbines, for example rare earth elements, are potential bottlenecks to expansion plans.

The share of wind power in the world's electricity generation mix needs to rise to at least 36 percent by 2050 in order to abide by the Paris Climate Agreement, according to the International Renewable Energy Agency (IRENA). Onshore wind power capacity therefore will have to grow from about 400 GW in 2018 to roughly 5,500 GW and offshore wind capacity from 12 GW to about 520 GW. In Germany alone, some 30,000 onshore and over 1,000 offshore turbines with a combined capacity of about 65 GW were in operation as of early 2020. By 2050, this figure has to grow to 260 GW for the country to fulfil its climate commitments and renewable power capacity goals, research institute Fraunhofer ISE says.

With the average turbine's service life ranging between 20 and 30 years, the impending expansion rush in the world's wind industry will simultaneously produce vast amounts of discarded raw materials in the next decades. A comprehensive approach to a sustainable energy system must therefore ensure responsible mining, maximise the use of "secondary resources" through recycling and continuously reduce material intensity, the Association of German Engineers (VDI) concluded in a 2020 report.

What's in a wind turbine?

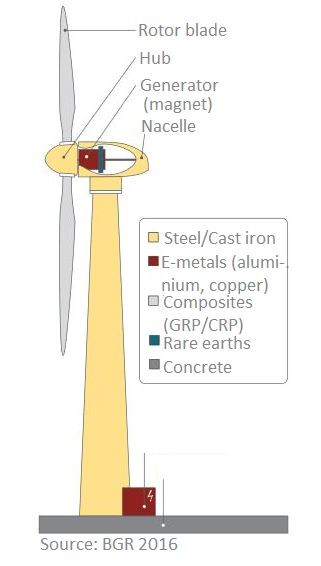

The typical wind turbine in Germany consists of a concrete base, a steel tower, the engine house (nacelle) containing the drive train and control units and, crucially, the rotor blades. Standard turbines are made of 60-65 percent concrete in the tower and foundation, according to figures released by the German Wind Energy Association (BWE). Steel makes up the second biggest share of the turbine's weight at 30-35 percent. For offshore turbines, steel even accounts for more than 80 percent of the materials used. Besides the tower, it is used in the nacelle that holds the rotors, the machine room with the rotor shaft and generator and in many turbines also a gear box. The turbine also contains electric cables and other components made from metals like copper or aluminium that are particularly valuable for recycling purposes. Moreover, operating fluids like lubricants and cooling agents are needed continuously during the turbine's lifetime.

While most turbines in the three-bladed horizontal axis design that has become the industry standard look quite similar from the outside, there are significant differences in the materials used within the nacelle. A decisive factor is whether the turbine is geared or direct-driven. Geared models use a generator that converts rotation speed into electricity through a gearbox and require large amounts of copper. Direct-driven models, on the other hand, use a generator with permanent magnets weighing several tonnes and apart from steel contain rare earth elements that keep its magnetic field strong for a long time. If no gearbox is used, the generator is usually built much bigger. Geared models are generally seen as the cheaper alternative but require more frequent maintenance. Direct-drive models are more expensive but built with fewer components and thus generally are less prone to malfunctioning.

Most installed turbines are geared models, with the World Bank citing estimates that the share of direct-drive models was about 30 percent in 2020. Offshore wind turbines mostly use direct-drive technology due to its lower maintenance requirements. A study conducted by researchers from Delft University found that both turbine types still have the potential to achieve or uphold market dominance, making the required material inputs and therefore also the market prices of the future more difficult to predict.

Another decisive technology choice with crucial implications for material sourcing and recycling is made with the rotor blade design. The turbine's long and relatively lightweight rotor blades, about 10 tonnes at a length of 50 metres on average, are typically made of epoxy resin strengthened either with glass fibre reinforced plastic (GRP) or carbon fibre reinforced plastic (CRP), materials also widely used in aeroplanes, trains or cars. GRP blades are used more often as they are cheaper to produce. Both blade models are coated with epoxide, polyurethane or a different plastic resin shell. The blade is further strengthened by a "sandwich" construction with layers of balsa wood or plastic foams. The BWE said these layers could also be made with recycled materials.

Source countries and recycling quotas of Germany's wind power resources

Aluminium: Russia, United Arab Emirates, Mozambique (UBA 2019), RQ approx. 50% (Alfa)

Cobalt: DR Congo (>80%), Russia, Canada (dera 2019), RQ approx. 95% (Öko-Institut)

Copper: Peru, Chile, Brazil (BGR 2019), RQ 45% (Copper Alliance)

Rare earth elements (neodymium, dysprosium): China (>85%) (BGR 2019), RQ n/a

Steel: Brazil, Canada, South Africa, RQ 45% (Alfa)

How does wind power affect import patterns of Germany's energy system?

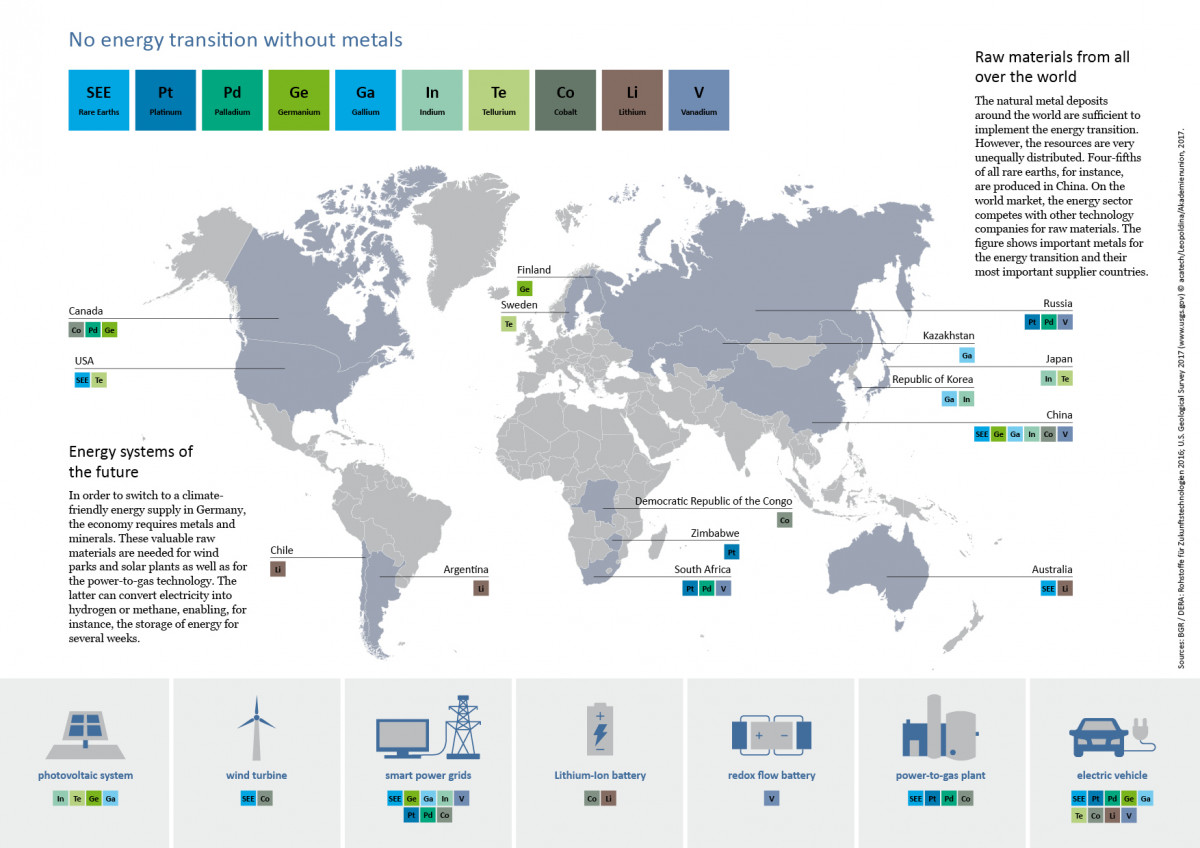

Germany currently imports about two-thirds of its fossil energy needs. But the envisaged phase-out of domestic lignite as a power source is set to increase dependence on international supply chains at least temporarily. The planned transition to 100 percent renewable power supply by 2050 is set to drastically alter the structure of resource demand and Germany's dependence on raw material imports will not end with its projected total phase-out of fossil fuels.

In fact, the need for a variety of imported minerals and thus the reliance on reliable suppliers is set to increase as renewables, smart grids and storage systems are rolled out at an increasingly large scale, the Energy Systems for the Future (ESYS) research consortium said. Improving recycling rates, expanding mining in Europe and the deep sea and strategic investments in raw material projects could improve supply security in "often highly opaque" markets that are poised to see stiff competition, the researchers said.

Mineral demand increases are expected across the board to implement the renewable energy objectives, with demand for key wind turbine ingredients like copper or rare earths growing at double or triple digit rates, the Federal Evironment Agency (UBA) said. While part of the demand could be covered by recycling raw materials and re-use them as "secondary resources," Germany's import dependence on these will be "almost 100 percent," according to the metals industry association WV Metalle.

Many input materials for wind turbines, especially rare earths used in permanent magnets, are deemed "critical" in terms of their secured availability, with criticality denoting the relation between proven reserves and annual consumption, the research consortium ESYS explained. While reserves can be expanded through new mining projects, criticality and thus a supply bottleneck can still arise due to short-term spikes in demand and a lag in mining or other production capacities.

While prices for rare earths, for example, climbed steeply around 2010, supply, meanwhile, has exceeded demand and prices collapsed. This triggered a search for alternatives among wind turbine manufacturers if prices were to spike again, for example due to rising demand by carmakers using rare earths for magnets in their planned mass rollout of electric vehicles. Several research projects on substitutes, recycling procedures and reuse of magnets, for example by research institute Fraunhofer IMWS or by Siemens and RWTH Aachen University, seek to reduce import dependence.

What's the impact of wind turbine waste?

Wind turbines in Germany generally have a very fast energy amortisation, meaning they recuperate the energy used to produce them relatively quickly. Depending on the exact location and other factors like nominal capacity or height, a typical turbine takes somewhere between three and seven months to recover the energy consumed during manufacturing, installation and also its eventual demolition, according to the German parliament's scientific research service. This is much faster than for solar cells, for which energy amortisation may take somewhere between three and five years in the not overly sunshine-endowed European country. Power plants relying on a constant supply of fossil or nuclear fuels to operate, on the other hand, can never fully achieve energy amortisation since they don't work without putting in new resources.

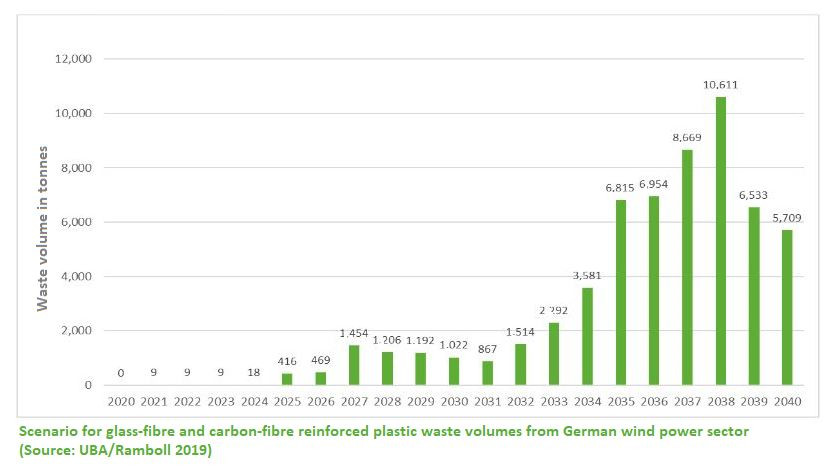

A study published by the UBA assumes that the average lifetime of turbines corresponds to the 20-year support period guaranteed in Germany's Renewable Energy Act (EEG), even though most installations are technically capable of continuing operation well beyond that time. As operators find them outdated and charged off financially, a first bulge in turbine decommissioning is expected around the early 2020s and another one in the mid-2030s, in accordance with installation volumes 20 years earlier.

The environment agency's assumption translates into an estimated 5.5 million tonnes of residual concrete, one million tonnes of used steel and 70,000 tonnes of rotor blade waste per year in the 2030s, with volumes starting to spike from 2024 onwards. However, the UBA and the BWE both stress that finding ways to extend the lifespan of each turbine by subsequent contracts to the EEG would directly decrease the volume of waste materials accumulating every year.

What happens to turbines at the end of their lifetime?

Germany and other countries with a high share of wind power are faced with the need to dismantle large quantities of wind turbines over the next decades and will have to come up with disposal and recycling systems and solutions at a large scale. For most of the turbines' input materials, fairly well-established recycling procedures already exist. According to wind industry lobby group BWE, about 90 percent of an installation's total weight could easily be fed into cycles for steel, metals and concrete. But while a collection scheme exists for solar PV installations in the framework of Germany's Electrical and Electronic Equipment Act, turbine deconstruction still requires tailormade concepts for each location due to a more diverse range of installations and removal concepts.

Blanket removal schemes for turbines that stand more than 150 metres tall are difficult to implement also due to physical constraints, according to blade recycler Neocomp. For example, construction cranes capable of lifting heavy machinery this high up can be in short supply, creating one of many real-life bottlenecks that make a theoretical rate of turbine disposal difficult to predict. There is a range of projects co-funded by the government aimed at improving and streamlining deconstruction and recycling procedures, for example by mechanically cutting down concrete towers in one rather than in eight weeks' time.

According to the BWE, proper disposal of its installations is a "core interest" for the industry, as the turbines are subject to close public scrutiny and a bad handling of their leftovers could tarnish the technology's reputation. The industry pledges to have set aside sufficient funds to ensure that turbine dismantling is adequately taken care of but UBA calculations have cast doubt on the industry's readiness to fully fund deconstruction and disposal due to price volatility in waste management and the long lead time of 20 years that might confound calculations.

The tower can be torn down in several pieces or be made to fall with a targeted detonation. The foundation is then carved out of the ground, whereas pile foundations are left in place, since removing them would cause unnecessary damage to the soil structure, the association said. Removed concrete is used for road construction, but reuse in other applications is often still difficult due to the concrete's diminishing quality. Blades are removed separately and are mostly cut apart on the spot. Provisions must be made to ensure the fibre-enforced plastic particles are not blown into the environment.

Steel and other metals like copper or aluminium are regularly molten down and can be reused for turbine construction or other applications without significant quality losses. Research institute Fraunhofer UMSICHT states that recycling of metal components is crucial for ensuring supply security, which cannot be fully covered by primary resources and requires much less energy than mining and production.

The composite materials in rotor blades, however, are much more difficult to dispose of properly. Blades can also be dismounted and replaced, while the rest of the turbine stays in operation for repair or to increase the installation's output. GRP blades often end up in landfill sites, are burned in waste incinerators or used as additives in concrete production. The construction material's CO2 footprint can be reduced by up to 30 percent per tonne if blade remnants are added, according to US turbine manufacturer GE. In Germany, disposal company Neocomp is currently the only one offering GRP blade conversion to concrete but says it could quickly increase its current volume of 30,000 tonnes of material to 85,000 tonnes in case waste quantities pile up further.

More modern CRP blades can to a certain extent be recycled for reuse in new rotor blades. However, in a 2018 statement the government said that challenges in waste disposal would remain for both materials. The BWE said these installations so far operate below their full capacity and buy rotor blades from abroad, adding that processing capacity could easily be increased after 2021.

According to the wind industry, decommissioned turbines so far have often been sold abroad to continue producing power in another country, often outside the EU. But transporting the large installations and re-erecting them at a new location often poses significant challenges and might lead to the turbine not being able to perform as planned anymore. These are then disassembled in the new country, often with laxer regulations for special waste disposal, which is why the environment agency says a proper removal within Germany is the better option.

What could be done better?

Relatively few turbines have so far been dismantled, as the first installations erected under Germany's EEG only reached the end of their 20-year guaranteed support period in 2021. Many of the turbines already taken down in the country have been given a second lease on life abroad. Recycling procedures are therefore not fully developed yet, the BWE said.

Turbine manufacturers so far are not obliged to list the input materials of their blades, which would greatly help making recycling measures more efficient. In order to optimise the recycled value of decommissioned turbines, obliging manufacturers and suppliers along the entire turbine production chain to classify components could be a major step forward, according to industry group BWE, as this would allow their full integration in waste treatment guidelines.

The BWE has urged amending waste material regulation to better handle the composite materials and to strive for establishing standards globally or at least across Europe due to the German industry's high export share. It called for more investments in recycling research to better establish procedures like pyrolysis, in which rotor components are taken apart by heating, to give the shredded blades a second use. In order to counter widespread rejection of secondary resources for industry use, a broad information campaign would be needed to unlock new use cases for recycled materials, it said.

According to the environment agency, a lack of coordinated guidelines for deconstruction and waste collection among Germany's states further aggravates a systematic handling of turbine leftovers. Moreover, the UBA calls for extending manufacturer responsibility by obliging industry to design and use more durable or more easily reusable components in the first place and includes a quota for using recycled materials. At the same time, it warns against establishing too detailed national standards as long as a concerted European approach has not been put into place.