German gas demand set to rapidly decline by 2030, new investments questionable – consultancy

Clean Energy Wire

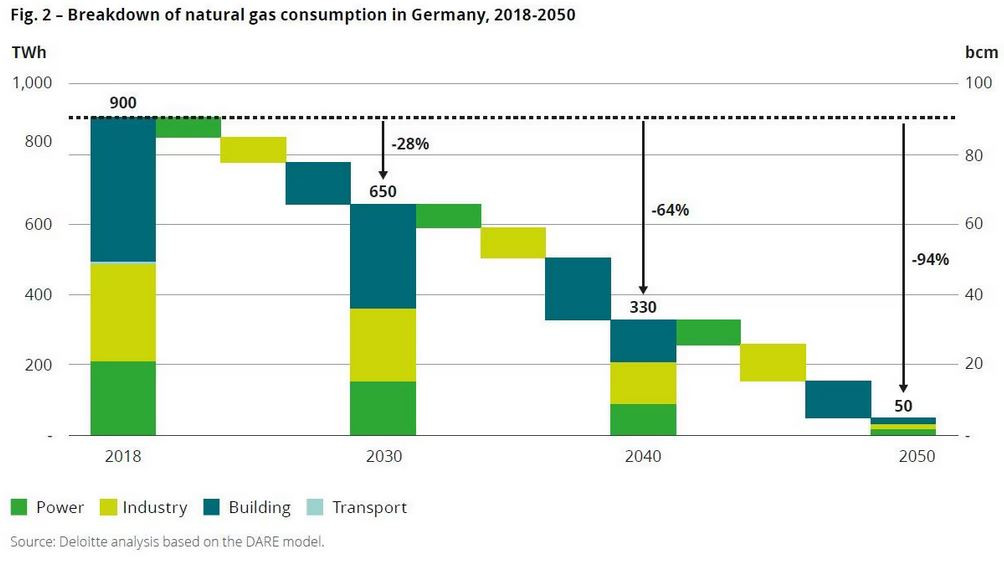

Propelled by a rapid transformation in the heating sector, Germany’s demand for natural gas looks set to plummet by one third by 2030 and by another third in the following decade, consultancy Deloitte has found in an analysis of demand patterns for the fossil fuel until 2050. The buildings sector and the change of heating systems towards heat pumps, solar thermal energy and other non-fossil solutions is going to drive the decline in demand and account for about half of the drop in demand by 2030, followed by the energy sector and then industry, the consultancy said in the outlook it compiled together with the Institute for Applied Ecology (Öko-Institut). By the middle of the century, demand for natural gas in the energy sector will have dropped by 95 percent compared to 2021, leaving an annual consumption of merely 50 terawatt hours (TWh), provided that Germany and other EU states achieve their climate targets. According to Deloitte, gas will account for only 1 percent of the primary energy supply in 2050, compared to 25 percent in 2021. Fast-dwindling demand puts a question mark behind current investments in the fossil fuel’s infrastructure, said Bernhard Lorentz, head of sustainability and climate at Deloitte. “There’s a risk that projects will fail due to this development if global climate obligations are being adhered to,” Lorentz said. Moreover, a high degree of market dominance by just a handful of countries - Russia, Algeria and Norway for pipeline gas and the USA, Qatar and Australia for liquefied natural gas (LNG) - mean that Germany cannot attain a much greater diversification of supply by expanding import infrastructure, he added.

The analysis assumed that hydrogen will play a role in replacing gas in the electricity and industry sectors. By 2030, the consultancy expects an accelerating trend in the industry to apply hydrogen-based production solutions, meaning gas demand there will drop by 20 percent within this decade and by another 60 percent by 2040. The government therefore ought to be wary about long-term contracts with individual suppliers and couple investments into gas infrastructure with detailed concepts for a later conversion into hydrogen-based operations “to avoid lock-in effects,” researcher Felix Matthes from the Öko-Institut said.

The future of Germany’s gas grid infrastructure has been debated intensively since the end of Russian pipeline gas deliveries in the wake of the invasion of Ukraine and Germany’s subsequent entry into ship-based LNG supplies. Moreover, a controversial law to spur the transition in the heating sector by the government coalition looks set to greatly accelerate the uptake of heat pumps, district heating and other low-carbon solutions, even though restrictions on the use of gas boilers have been relaxed compared to initial plans.