Industry bets on gas as last trump card in Energiewende

- Contents

- Heating an industrial nation

- A flexible partner for fluctuating renewables

- The case of Uniper

- Fierce battles ahead in heating

- Role of gas in transport set to grow

- Using the existing infrastructure

- Power-to-gas – the key to large-scale, long-term storage of renewable power

- Using PtG to decarbonise industry

- “We need a consensus for a future gas path”

“Greener than you think”

“CLIMATE CHANGE DOESN’T WAIT,” read a billboard picturing threatening clouds above Germany’s Bundestag and a stormy ocean lapping at its steps, which cruised Berlin’s government quarter on the back of a truck in 2016. Behind it on the flatbed trailer was a giant melting ice sculpture of the parliament building, underscoring the urgent need to defend against climate change – with an unlikely fossil-fuel hero – natural gas.

With campaigns like these, the German gas industry initiative Zukunft ERDGAS (Future Natural Gas) claims its fossil-fuel resource is “greener than you think” and positions it against the more CO₂-intensive oil and coal. The industry, whose product is currently responsible for more than a fifth of the country’s energy-related greenhouse gas emissions, says time is running out for climate protection.

“Gas will be a key element for Germany to reach its climate targets by 2030, because it is the most cost-efficient way to save CO₂ across all sectors,” says Harald Hecking, managing director of energy research and consultancy organisation ewi Energy Research & Scenarios.

Using the existing infrastructure, from gas pipelines and storage caverns to distribution grids and end-use applications, could save money and be a reliable bridge for volatile wind and solar energy, the industry says.

Still, betting too much on natural gas could create a path dependency expensive to abandon a decade or two later, when stricter climate targets take effect, Peter Ahmels, head of energy and climate protection at Environmental Action Germany (DUH), told the Clean Energy Wire. “What seems to make sense now – the quick reduction of CO₂ by using gas – will have a boomerang effect in the long run without a clear political road map.”

Ahmels says that after 2030 no heater or vehicle should be produced that depends on fossil energies. This would only make sense if natural gas were replaced by synthetic gas made from renewables – a process known as power-to-gas, or PtG. But Ahmels says chances are there will not be enough renewable synthetic gas at affordable prices to meet demand at that point. “A strategy fundamentally leading away from gas is much more robust in my opinion, and it can be applied globally,” he says.

Critics also fear that an increased focus on natural gas over the coming years will increase dependency on energy imports from countries such as Russia. Several of Germany’s neighbouring countries are strongly opposed to the gas pipeline project Nord Stream 2, which will directly connect Russia with the German market. They argue that it is not necessary for supply security and highlight political implications for current transit countries such as the Ukraine. In April 2018, German Chancellor Angela Merkel said that Nord Stream 2 is not only an economic project and political factors need to be taken into account. [Read more on Nord Stream 2 in this factsheet and about the Energiewende and its implications for international security in this CLEW dossier.]

Successful so far in expanding renewable power production while phasing out nuclear energy in its ambitious Energiewende, or energy transition project, Germany still lags behind its own targets for reducing CO₂ emissions in all sectors. The government is under pressure to take action with swift results. Chancellor Angela Merkel’s government has all but given up on its ambitious 2020 target of reducing greenhouse gas emissions by 40 percent, compared to 1990, now focussing on 2030 instead – a reduction of 55 percent.

For the natural gas industry, this is an ideal backdrop against which to promote its product as the climate-friendly alternative to oil and coal. Burning natural gas emits about 50 percent less CO2 than the dirtiest coal – lignite, which Germany has in abundant natural supply, and about 25 percent less than diesel fuel for each unit of energy output, depending on circumstances such as fuel quality.

“Gas will play a vital role in every transition,” as the world strives to meet targets for emissions cuts laid out in the Paris Agreement, Thorsten Herdan, Director-General in the German economy and energy ministry said at a recent G20 energy minister meeting in Argentina.

The advantage of natural gas is still hard to estimate in terms of climate change. It not only emits CO₂ when burned, but is mainly composed of methane, making it a climate-harmful greenhouse gas itself. Methane has a much higher global warming potential than carbon dioxide. The volume of methane leakages in gas production around the globe continues to be heatedly debated.

According to a 2018 study by the Federal Environment Agency (UBA), using natural gas in the energy sector is advantageous to hard coal and lignite, even if emissions along the value chain are taken into account. But in its World Energy Outlook 2017, the International Energy Agency (IEA) says “these emissions cannot be ignored and that they represent a clear risk to the environmental credentials of natural gas.”

Current German energy policy, which aims to make Germany carbon-neutral by mid-century, does not favour natural gas. It is practically slated for phase-out by 2050, when the only carbon dioxide, methane and nitrous oxide emissions will come from agriculture and process-related industry. Other countries plan to use carbon capture and storage/utilisation (CCS/CCU), allowing the continued burning of carbon-based fuels and capturing CO₂, instead of releasing it into the atmosphere. A significant use of CCS/CCU often hardly plays a role in future energy scenarios due to widespread public opposition and regulatory uncertainty in Germany. “The long-term fate of the gas industry depends on how climate-neutral it can become,” says ewi’s Hecking.

Looking ahead to a CO₂-neutral future, gas companies must develop “green” alternatives like biogas and synthetic fuels made from renewable electricity, PtG. PtG uses sun and wind power to produce gas, making it possible to store renewable energy on a large scale. This could be a valuable trump card for the gas industry in the future.

Heating an industrial nation

Germany has one of the most mature and best developed gas markets in world. It started more than 150 years ago with ‘coal gas’ made from coke, also called ‘town gas’, which was primarily used for lighting, later for cooking and heating. Today, gas has turned into a billion-euro market. Revenues from gas sales to final consumers alone amounted to about 33 billion euros in 2017, according to preliminary data by energy industry association BDEW.

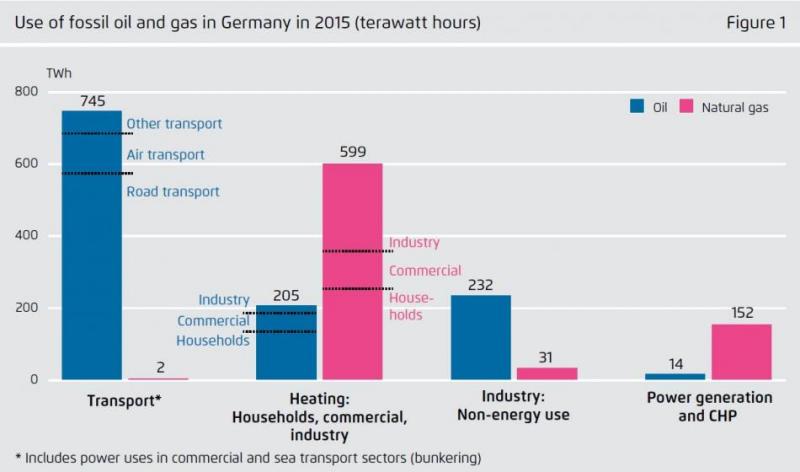

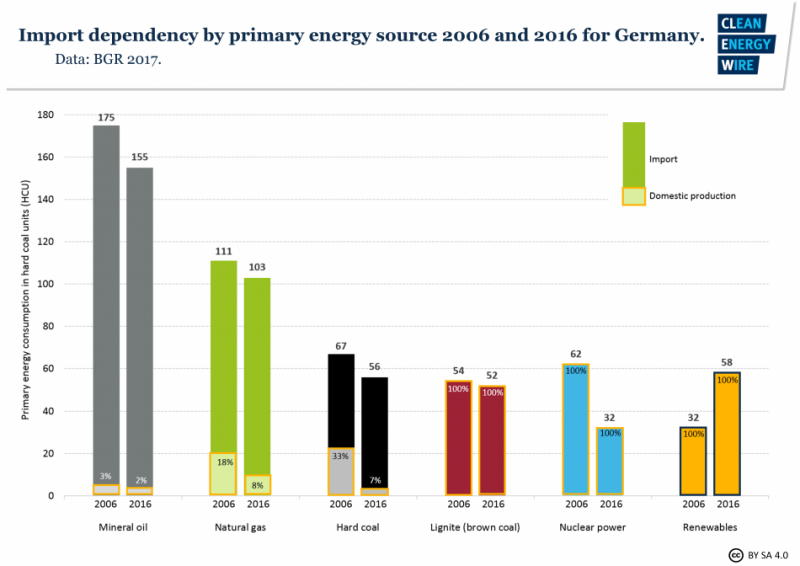

Natural gas currently covers almost a quarter of German primary energy consumption, second only to the country’s most important energy source, mineral oil. Most gas is used for heating and cooling in households and public buildings and for process heat in industry. Some is used to generate electricity and in combined heat-and-power facilities (CHP), and some for non-energetic use in industry. Current use in transport is marginal.

Germany is the world’s biggest natural gas importer, acquiring more than 90 percent of the gas it consumes from Russia, the Netherlands and Norway. The small amount of domestic natural gas production has been falling since 2004 and will likely cease altogether in the next decade. Unconventional fracking – which could open up new resources – has been virtually barred in Germany, due to environmental concerns. In 2017, Germany imported 22.6 billion euros worth of natural gas. [Find out more about Germany’s import dependency on fossil fuels in this factsheet.]

Natural gas plants produced 13 percent of Germany’s electricity in 2017. Because the fuel is more expensive than, for example, domestic lignite, producing electricity in gas-fired power plants is costly. This means the market favours electricity made with cheaper renewable, nuclear and coal power, and reduces demand from gas-fired plants so they rarely run at full capacity. [For more on this, read our factsheet on the Merit Order Effect]

Bruno Burger, professor at Fraunhofer Institute for Solar Energy Systems (ISE), told the Clean Energy Wire that preliminary 2017 data showed Germany’s gas plants produced about 30 percent of the electricity they could have generated had they run at full power all year. This presents a challenging business environment for German power plant operators and manufacturers.

One example is industry behemoth and gas turbine producer Siemens. Profits at its Power and Gas division plummeted as the world switched to renewables much faster than anticipated. The situation in its home market illustrates Siemens’ global challenges. Power and Gas is by revenue still the company’s largest business, and has long been a key contributor to profits. After international demand for its large gas turbines collapsed, Siemens announced job cuts in Germany and abroad. [For more on the energy transition’s effects on Siemens, read our factsheet]

A flexible partner for fluctuating renewables

Germany has only limited biomass potential – mostly energy crops and manure, biogenic waste, and wood – in the large volumes needed for fuel production. Thus, electricity generated from volatile wind and sun will progressively become Germany’s most important energy source, widely used in all sectors. With the continued electrification of transport, buildings and industry, there is a growing need for reliable backup generation at times of high power demand and when wind and sun are in short supply.

“Today, on a cold, dark winter day, the loads created in heating are about five to six times the peak loads of the power system,” says Timm Kehler, head of Zukunft ERDGAS.

Gas units can be ramped up and down comparatively quickly, meaning they could be a good partner for fluctuating renewables. Some see it as a “bridge technology” for the energy transition.

Battery storage technology can partly be used to balance out the “variations in power feed-in”, says Matthias Deutsch, senior associate at think tank Agora Energiewende, “but in the end this is a job that will be done by gas power plants to a high degree, in particular when it comes to seasonal storage.”

Operators in the future could be paid not so much for the kilowatt hour, but rather for their capability to provide it at the right moment, says ewi’s Hecking. Consequently, it is unlikely that total power production from natural gas will change significantly by 2030. “The number of kilowatt hours lost due to the nuclear and coal exits will largely be compensated through the use of renewables,” says Hecking. Germany’s last nuclear power plant is set to go offline in 2022, and the debate about a gradual exit from coal-fired power generation is in full swing. Together, they produced about half of the country’s electricity in 2017.

Additional gas capacity will be necessary to guarantee supply security, says Hecking. Just how much depends on developments like growth in e-mobility and electric heating, and political decisions such as the extent to which Germany wants to rely on electricity imports. The German Energy Agency (dena) study "Integrated Energy Transition" sees a doubling of gas capacities by 2030 in certain scenarios, while Agora Energiewende proposes the increased construction of smaller, more flexible gas motors, rather than few individual, less flexible gas plants powered by large turbines.

The case of Uniper

For years, utilities like Uniper, German energy giant E.ON’s fossil spin-off, have demanded “adequate compensation” for keeping gas plants at the ready. The company, which owns about ten percent of German gas power generation capacity, again said recently it wants to close two gas power units for lack of commercial viability. Due to their relevance for the power system’s stability, the Federal Network Agency (BNetzA) so far has not permitted the shut-down of Uniper’s Irsching units. They are part of the network reserve and used only when needed to maintain grid stability. According to Uniper, this service is provided at prices that do not cover costs.

As the federal government in 2015 rejected proposals to introduce a full-fledged capacity market, Uniper needs higher prices per kilowatt hour of electricity and is looking abroad for solutions. In a capacity market, operators of fossil-fuelled power plants are paid for electricity produced, as well as for maintaining generation capacity during times of scarcity to ensure grid stability. “The UK is a good example, where we have carbon price floor that pushes out coal and helps gas power plants,” Andreas Schröder, senior analyst at Uniper, told the Clean Energy Wire.

The debate over a national carbon price in Germany recently flared up again after environment minister Svenja Schulze signalled support. According to Uniper’s Schröder, the EU-wide ETS price alone would not help in Germany. “It has increased recently, but is still not enough to invert the ranking of coal and gas in the merit order,” he said.

Yet, in the long term the company is clearly steering towards gas in power generation. “If we were to build a new power plant in the future, it would not be powered by coal,” says spokesman Leif Erichsen. In places where power plants are reaching the end of their life span, Uniper would rather consider new gas-fired units. “This tells you how our portfolio will change in the long term,” he said.

This is not always a clear-cut decision, as the case of the coal-fired cogeneration plant Kraftwerk Nord in Munich shows. In a referendum, citizens voted for an early shut-down by 2022, forcing the utility and local government to think about gas as an alternative. The block was originally slated for shut-down between 2027 and 2029, to be replaced by renewable geothermal energy – which will not be available before that time. Critics of the gas alternative, however, say a gas plant would cement the continued use of fossil power for another 30 years. In addition, building a new gas unit might simply not be possible in the short time frame.

Fierce battles ahead in heating

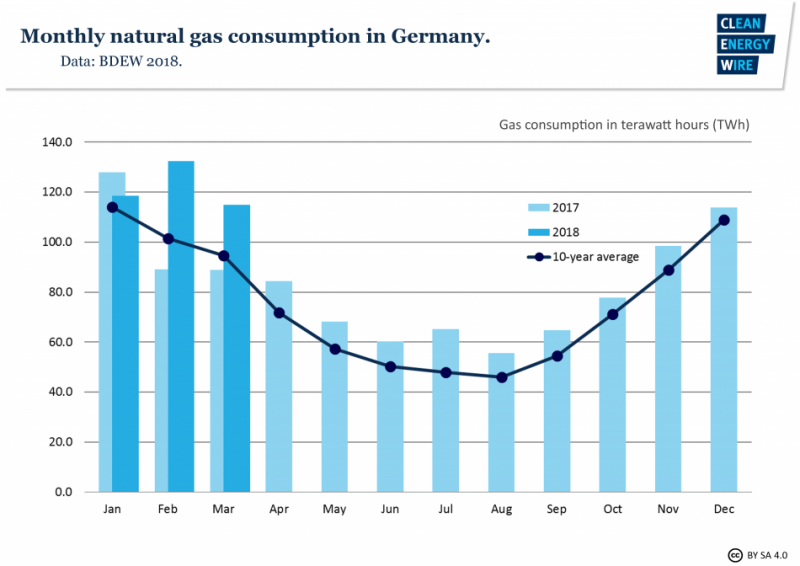

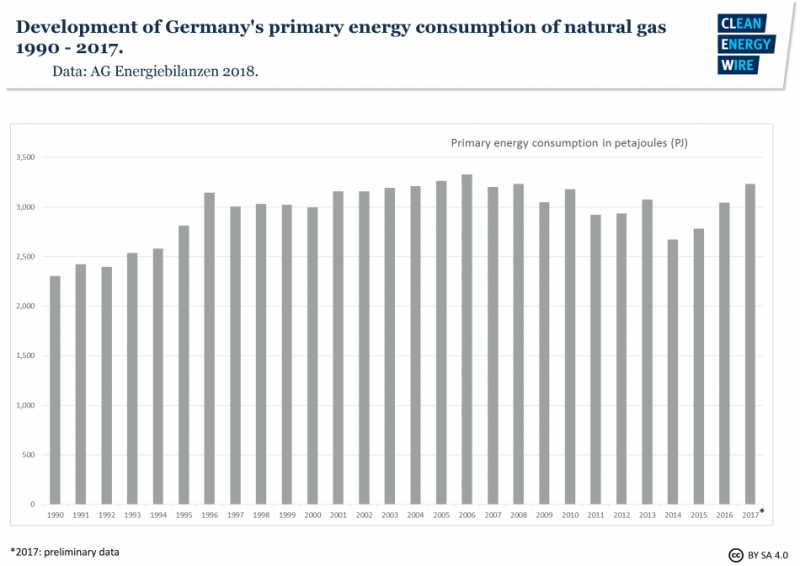

German gas consumption has been on the rise in recent years, supplied in large part by record imports from Russia’s Gazprom in 2016, 2017 and early 2018. Due to icy temperatures at the beginning of the year, gas use soared almost 20 percent year-on-year in the first quarter of 2018, according to preliminary data by energy research group AG Energiebilanzen (AGEB). This reflected the central role of gas in heating.

Uniper, which is heavily invested in the import, storage and supply of natural gas to industrial and municipal utility customers, expects gas consumption to continue rising. “According to our own forecasts – which match many external ones – gas consumption will slightly increase in Europe – and in global markets,” says analyst Schröder. The company’s total worldwide gas sales amounted to about 2,000 TWh in 2017, more than twice as much as Germans used that year.

As about three quarters of gas in Germany is used for heating and warm water in buildings and for process heat in industry, changes in consumption over the coming years depend highly on factors like economic and demographic developments, temperatures in winter and efficiency gains. It also depends on policy – such as the statement by Merkel’s new government in 2018 to want to “definitely” reach the 2030 greenhouse gas reduction target.

Some of the fiercest battles with other energy sources will be fought over building heating systems. Currently, half of Germany’s 41.5 million apartments are heated with gas boilers, a quarter with oil, 14 percent with district heating, and two percent with electric heat pumps.

Electric heat pumps are the most energy-efficient systems, using ambient heat to supply a building. In 2017, 27 percent of installations in new apartments were heat pumps (40 percent gas, 25 percent district heating). They are, however, a comparatively expensive technology, because their use requires extensive energy-efficient modernisation of the house.

Zukunft ERDGAS’s Kehler says gas is the cheapest way to protect the climate right now. “Each replacement of an old oil heating system with a modern gas boiler can halve CO₂ emissions from 10 to around 5 tonnes of CO₂ per year,” says Kehler. “If we want to have a significant impact on millions of households, we must choose the most cost-efficient measures.”

But that ignores the long life cycle and high costs for gases produced with renewable electricity in the future, DUH’s Ahmels warns: “If house owners trust in low-carbon gas today and decide against energy efficiency measures, reality will catch up with them when they buy their next heater.” Starting around 2030, he says, new gas heaters should not be installed, as their life cycle can stretch beyond 2050, well into the net-zero carbon world. To avoid stranded investments, only carbon-free technologies such as the heat pump should be installed, says Ahmels.

Role of gas in transport set to grow

Gas plays virtually no role in transport today. In Germany, the birthplace of the automobile, three iconic carmakers, BMW, Daimler, and VW, have all initiated major electrification initiatives for passenger cars. Like heat pumps, electric drives are the most energy efficient use of renewable power, but issues like range and charging times make alternatives necessary in certain cases.

“Our strategic focus must, of course, be on electric traction, and our resources are distributed accordingly,” Stephen Neumann, Volkswagen Group Officer for Natural Gas Mobility, told the Clean Energy Wire. Still, the car giant launched an initiative in 2017 with gas infrastructure companies to push compressed natural gas (CNG) mobility aiming for a million cars on the roads by 2025. In the medium term, the companies see gas mobility as a technology to help reduce carbon emissions, and it is already available today.

“In the long term, battery electric engines will be replaced by fuel cell engines, where you will have electric traction with a fuel cell powered by hydrogen produced from renewable energy,” says Neumann. [Read the full interview here.]

In contrast to passenger cars, e-mobility for heavy-duty road transport, aviation and shipping is scarce, because today’s battery performance is insufficient. Liquefied natural gas (LNG) can already be a cost competitive alternative for trucks, and German cruise company Aida has announced that it will be able to operate its new generation of ships entirely with LNG.

Using the existing infrastructure

One of the strongest arguments for the continued use of gas is the pre-existing, well-developed infrastructure from production and import to end use. For gas transport alone, it is a tried and tested system of more than 530,000 kilometres of pipelines, adequate to supply many cities, big industries and power plants with high security.

“The infrastructure is an economic value that should be used to implement the energy transition, rather than dismantling the pipelines,” says ewi’s Hecking.

The largest of Germany’s 16 gas transmission grid operators, Open Grid Europe (OGE), manages 12,000 kilometres of pipelines, equal to the length of the country’s infamous Autobahn system. More than half of the 4 billion euros in investments foreseen in the current gas grid development plan by the Federal Network Agency (BNetzA) will be shouldered by OGE.

Germany is currently undergoing an enormous infrastructure investment project in the country’s gas supply – the switch from low calorific gas (L-gas) to high calorific gas (H-Gas). Domestic production and imports of L-Gas from the Netherlands have declined steeply, making a retrofit of the infrastructure in large parts of western Germany necessary.

“In addition there will be changes in the supply routes and sources, like increasing amounts of LNG imported to the EU,” says Jürgen Fuhlrott, Head of Business Development at OGE. [Read the full interview here.]

Because of its central location in Europe, the German gas infrastructure was also built for inter-European transit. Its cross-border flows supply western and southern neighbours. Developments, especially in the transmission infrastructure, always depend on what happens in other countries. Imports from the west are set to decline as Europe’s biggest gas field Groningen in the Netherlands is scaling back production after several earthquakes. With decreasing domestic production, Europe’s overall import needs will grow.

The European Commission's top internal energy market official, Klaus-Dieter Borchardt, recently called for “a new narrative for a future role of gas” and said the energy system will continue to rely on the gas infrastructure of pipelines and storages for a sustainable, secure and affordable supply in Europe. Borchardt called 2019 a “crucial year”, as the Commission will work on the legal proposal on the future European gas market.

In the longer term, a “sensible integration” of the existing electricity and gas infrastructures is absolutely necessary to make Germany’s energy transition a success, says Fuhlrott. This speaks for power-to-gas technology. If the country continues to use the existing gas grid, for example to transport synthetic gas made from renewables, this would drive the need to expand the electricity grid by even more than already planned, he says. OGE has recently launched an initiative together with power transmission grid operator Amprion to test PtG facilities on an industrial scale.

Power-to-gas – the key to large-scale, long-term storage of renewable power

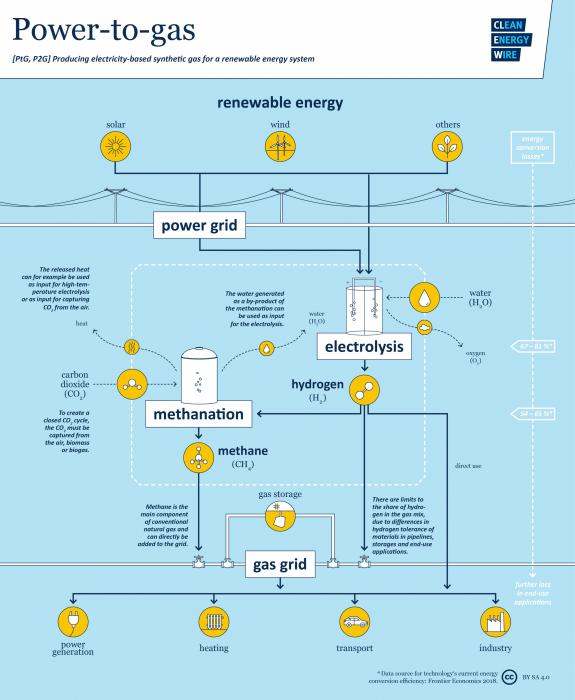

PtG means that gas has the potential to become “green” itself in the long-term. As biomass potential is limited, synthetic fuels made from renewable electricity using techniques such as electrolysis and methanation – PtG – will be key to this development. [For details on the technologies, read the CLEW factsheet Power-to-gas: Fix for all problems or simply too expensive?]

Natural gas producers such as Gazprom and Norway’s Equinor have everything to lose in a decarbonised world. For German infrastructure companies, “it doesn’t matter if the gas they transport and store is fossil or climate-neutral in the end,” says ewi’s Hecking.

Progressively adding more biomethane and synthetic gases to the existing pipeline mix – eventually hitting 100 percent – would help future-proof the sector and ring in “the next big energy transition for the gas industry”, says Zukunft ERDGAS’s Kehler.

The industry presents PtG as a kind of all-purpose tool for the challenges of a future decarbonised system. It can be used in the existing infrastructure and makes extensive modernisation of power plants and appliances unnecessary, thus saving a lot of money. In many respects, this means the world could essentially stay the same, ensuring continued business for the sector.

Some of the major benefits of PtG energy are that it can be used to create high temperatures, store energy over long periods, and is easily transported. However, synthetic fuels are very inefficient. A lot of energy is lost during electrolysis and methanation, so it takes a great deal of renewable energy to produce them. Thus, they will always be more costly than direct electricity use.

Agora Energiewende’s Deutsch cautions that synthetic gases should be used only when there is no better alternative – “like a joker in a game” – as the direct use of renewable energy is far more efficient. “We can do almost everything with these jokers, but at the same time they are valuable and rare. We should only use PtG when we have no other trump card,” says Deutsch, for example for long-term storage. “For seasonal storage needs, there is nothing that could replace the gaseous system at the moment or in the foreseeable future,” says Deutsch.

Already today, many see PtG as a way to make use of power that cannot be transported because the electricity grid has not yet been sufficiently expanded. However, only some 30 small research and pilot projects exist in Germany and these are far from making a profit. Ahmels of the DUH says the government must create the regulatory framework and incentives now to scale PtG up to market maturity. “It would be responsible to set binding milestones on how much renewable gas must be produced by what year,” he says. In any case, synthetic gases will definitely be needed in the future. “It’s a no-regret measure,” says Ahmels.

But there is a catch - the value of the infrastructure for the energy transition likely also depends on the future role of hydrogen. Looking toward mid-century when synthetic fuels are expected to replace natural gas, OGE does not see methane as the prevailing synthetic gas. “In our view, this will mainly be hydrogen, because it’s the first step of the power-to-gas process,” says Jürgen Fuhlrott. This makes it a more efficient and cheaper alternative. The second step of methanation would likely be needed “for a transition period”, but discontinued in the long term.

The problem is that today’s existing natural gas infrastructure is not suited to transport and use gas with a high share of hydrogen. The hydrogen tolerance of materials used in pipelines, storage and end-use applications varies widely.

“The gas industry points to the high value of the infrastructure in its studies, but what is its value if extensive modernisation and replacement is necessary for a switch to hydrogen?” asks Agora Energiewende’s Deutsch.

Using PtG to decarbonise industry

The long-term decarbonisation of the industry sector will be one of the most difficult tasks for Germany, and power-to-gas could be a key means. In 2017, energy and process-related emissions in industry were responsible for more than a fifth of total greenhouse gas emissions.

Germany’s most important industry association BDI published its climate path study at the beginning of 2018, concluding that for a 95-percent-scenario a “fully renewable gas supply of biogas and power-to-gas” will be needed in 2050 to avoid emissions in necessary industrial burning processes.

There are ways to use electricity directly to create high temperatures – for example to produce steel. However, the industry has employed burning processes for decades and would need to make significant and expensive changes, while keeping production running. PtG might turn out to be the cheaper solution in some cases, says Agora Energiewende’s Deutsch. Hydrogen – today produced mostly from fossil fuels and used to make ammonia and in the direct reduction of iron ore – can also be made using power-to-gas. As could the carbon needed in the chemical industry, which today mostly comes from oil.

In their study on the future costs of synthetic fuels, Agora Energiewende and Agora Verkehrswende say Germany will likely have to import significant amounts of synthetic gas in the future. Production conditions might be better and cheaper in sun-rich countries in North Africa or the Middle East. Still, higher initial costs and security risks abroad could make synthetic gas produced with North Sea offshore wind competitive, says Deutsch.

“We need a consensus for a future gas path”

The need for natural gas as a flexible partner for fluctuating wind and solar power, combined with the opportunities provided by power-to-gas may well ensure that the gas industry remains a major player in the German energy system for some time – even as new efficient renewables-based technologies enter the market.

“From the energy transition in the power sector we learned that you can try as hard as you will to push good, new technologies into the system, but this won’t really work if the old players don’t let go,” says Deutsch.

Agora Energiewende calls for a societal phase out plan for natural gas. “We need to sit all stakeholders down at a table to find a consensus for a future gas path, just like we did for nuclear power,” says Deutsch. “Realistically, this won’t happen before we have found a consensus on coal.”