Q&A: How will Germany support the expansion of renewables in future?

Content

- What is Germany's trademark renewable support scheme?

- Is the current electricity system prepared to deal with a rising share of renewables?

- Why is support for renewable projects needed?

- Why does Germany need to change its support model for renewables?

- What role do European rules play in Germany's decision?

- How will Germany deal with renewables growth and negative power prices?

- How is Germany planning to support renewable expansion in future?

- What challenges remain?

- Is a future with no state support mechanism for renewables possible?

***Please note: This article is part of a series on how electricity markets are evolving to support the energy transition. Find the full deep dive here.***

What is Germany's trademark renewable support scheme?

Germany has supported the expansion of wind and solar power with its trademark renewables surcharge (the EEG in German): a guaranteed feed-in payment that producers of renewable electricity receive for every kilowatt-hour (KWh) they feed into the grid, usually during a 20-year period.

The EEG was first introduced to drive the ramp-up of renewables, which due to the electricity market structure, would have had a hard time competing with other power sources — such as coal — due to their high upfront costs.

The feed-in tariffs are credited with powering the country's renewables growth and reducing the price of renewable technologies, not only in Germany. Many experts say the energy transition would not have been possible without the EEG.

The government financed the EEG by adding a renewables levy to electricity bills. While this helped to spur the growth of wind and solar power capacity over the past two decades, the renewables levy was also criticised for contributing to Germany’s relatively high household electricity prices, among the highest in Europe.

The fee was scrapped in mid-2022 amid the energy crisis in a bid to protect consumers from skyrocketing power prices. Instead, the government planned to fund support for renewables with the proceeds from emissions trading and the state budget. For large renewable projects, the feed-in tariffs are determined through an auction system, where capacity is put to tender and the lowest bids get awarded contracts.

Is the current electricity system prepared to deal with a rising share of renewables?

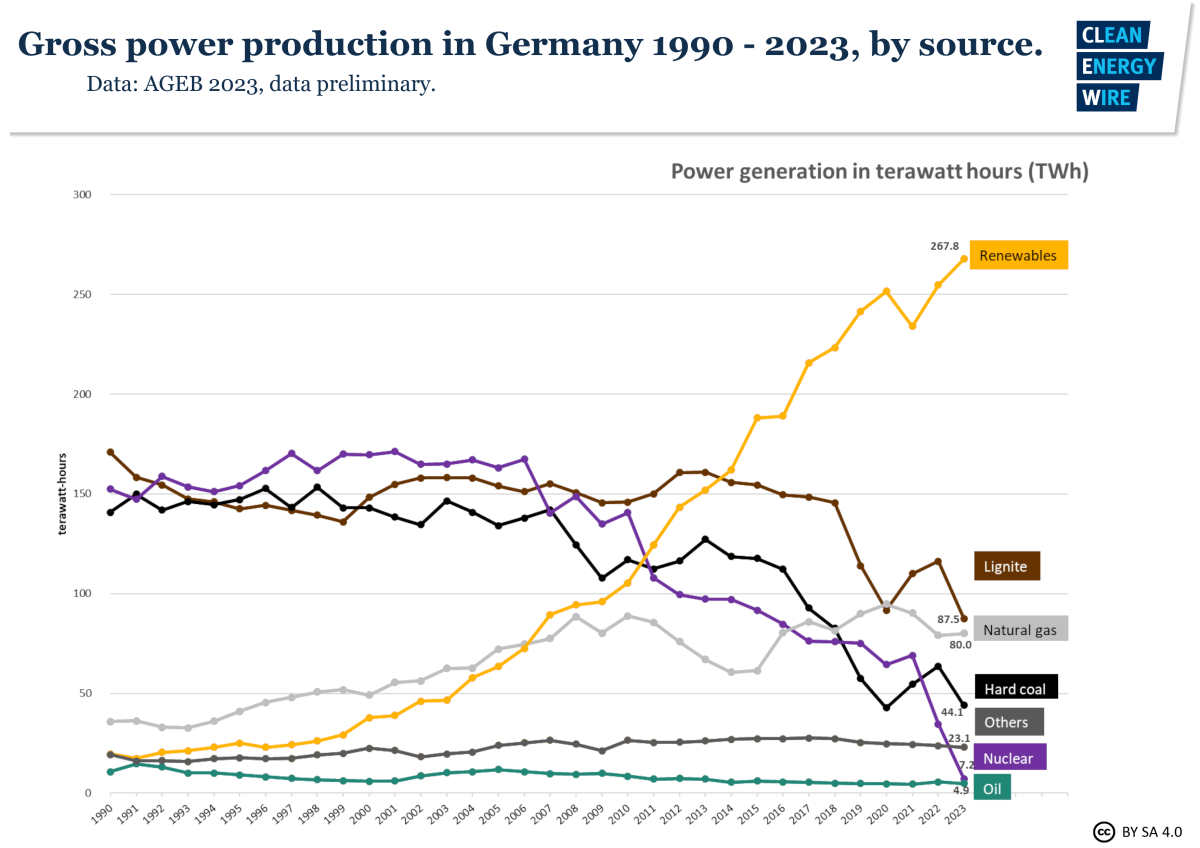

Wind power and solar photovoltaic (PV) systems will be the main sources of Germany's and Europe's energy supply in the future. The share of renewable electricity generation in Germany increased from 3.6 percent in 1990, when the very first feed-in law was introduced, to around 57 percent of the country's gross electricity consumption in the first half of 2024.

Thus far, electricity systems were guided by demand, with generation adapting accordingly. This worked well when controllable coal and gas power plants formed the backbone of the power mix. However, the aim is for renewables — which are cleaner and cheaper, but intermittent by nature — to dominate the power market. This implies that the whole power system will have to become more flexible to adapt. This includes making demand more flexible, and adding electricity storage systems.

Germany's priority before was to increase renewable capacity, but as more and more wind and solar projects come online the inflexible corset of the conventional power system is beginning to burst at the seams. For the new system based on renewables, the rigid way electricity is produced and consumed is outdated: there are few incentives for installations to produce at times when electricity is more valuable, for consumers to reduce demand when supply decreases, or for storage systems to respond accordingly.

Transmission infrastructure is also not yet up to the job of making full use of all the new renewable energy, while electricity generation now often exceeds the country's total power consumption for short time spans, especially around midday, when sunshine is at its most intense and solar power generation at its highest.

The costs of integrating more and more renewable capacity into the power system are stacking up: measures to stabilise the grid (so-called re-dispatch costs) reached 3.1 billion euros in 2023; Germany paid just under 13 billion euros in grid fees the same year to slow the increase of electricity bills through the required grid expansion; and low wholesale electricity prices caused a hefty increase in the federal funds required to pay the guaranteed feed-in tariffs to renewable operators. Projections estimate around 23 billion euros will be needed for the whole of 2024, more than twice the amount initially earmarked.

Why is support for renewable expansion needed?

Germany must find the best way to ensure enough investment in renewables in the future to meet legally-enshrined climate targets, such as covering 80 percent of power consumption with renewables, and to secure more cheap electricity.

Huge amounts of renewable capacity will be needed for Germany and Europe to power their economies in a climate-neutral way. Demand for electricity is set to rise sharply as industrial processes, mobility and heating switch from fossil fuels to electricity (from gas boilers to heat pumps or from combustion engines to EVs).

While renewables have become the cheapest source of electricity, project developers face high risks for future investments. Surplus renewable electricity — for example, more and more solar at midday — that is difficult to control in today's system significantly reduces wholesale electricity prices, meaning utilities hardly make any market revenues. While lower power prices benefit consumers and industry, uncertain or insufficient market revenues pose a risk for investors wanting to recover their capital costs.

Developments which would dampen this so-called cannibalisation effect during renewable power generation peaks and ensure more stable market prices, such as increased means to consume electricity flexibly, and higher storage capacity, as well as the increase in electricity demand through the rise in electric cars and heat pumps for example, are policy developments which investors in future renewable capacities have no direct control over.

"While we expect market revenues to likely sustain the build-out of renewable energy systems in the coming years, precise forecasts are difficult," Fabian Huneke, expert in the transition to a climate-neutral electricity system with think tank Agora Energiewende, told Clean Energy Wire. "To ensure projects are financed, planning certainty is important."

Why does Germany need to change its support model for renewables?

In future, Germany should promote the "market-efficient" use of renewable installations and allocate new capacity "in a way that benefits the system", according to a policy proposal paper from economy ministry (BMWK). This means that they are able to generate electricity at times when it is particularly valuable, which can be achieved with solar panels directed towards the morning or evening sun, wind turbines equipped with blades specialised for low wind speeds, or adding storage systems, for example.

Many renewable projects are reliant on subsidies and often do not react to price signals to reduce production when there is oversupply. These technologies, however, are slowly reaching a stage where they are ready to be integrated into the electricity markets fully, based on remuneration from market revenues only, without subsidies.

"We should keep the bigger picture in mind: renewable energies are key for climate neutrality in 2045. Looking forward, they require a safety net. Expensive support payments are a thing of the past," Huneke explained. "This means we need a dynamic system, which on the one hand maximises market-driven expansion, but on the other hand is backed up by an investment framework to ensure stability in critical phases and security for long-term planning."

What role do European rules play in Germany's decision?

Following a power market reform earlier this year, the European Union requires that, from 1 January 2027, new state-backed support mechanisms to promote wind, solar, geothermal, hydro and nuclear power need to include a repayment clause to avoid possible over-funding.

At times when expensive fossil power plants make it into the wholesale electricity market, they set the price for all producers (following the merit order principle). This means operators with low running costs (i.e. renewables) can make huge unexpected revenues, also referred to as "windfall profits".

A clawback clause would set a ceiling on the amount of money new renewable installations can make if they receive state support, and any profits beyond this ceiling have to be returned to the state. New contracts following Germany's Renewable Energy Act (EEG) support model, which include only a guaranteed feed-in tariff but have no cap, will no longer be allowed.

The EU made this a requirement in the wake of the energy crisis sparked by Russia's war against Ukraine.

To promote the market integration of renewable energies, the new EU rules also state that direct support payments should not have a negative effect on electricity markets (day ahead, intra-day, balancing and ancillary power markets). Member states, therefore, need to implement additional regulations to reduce the effects that guaranteed support payments (that operators receive for the green electricity they feed into the grid) could have on renewable power plants' decisions to generate electricity or not.

How will Germany deal with renewables growth and negative power prices?

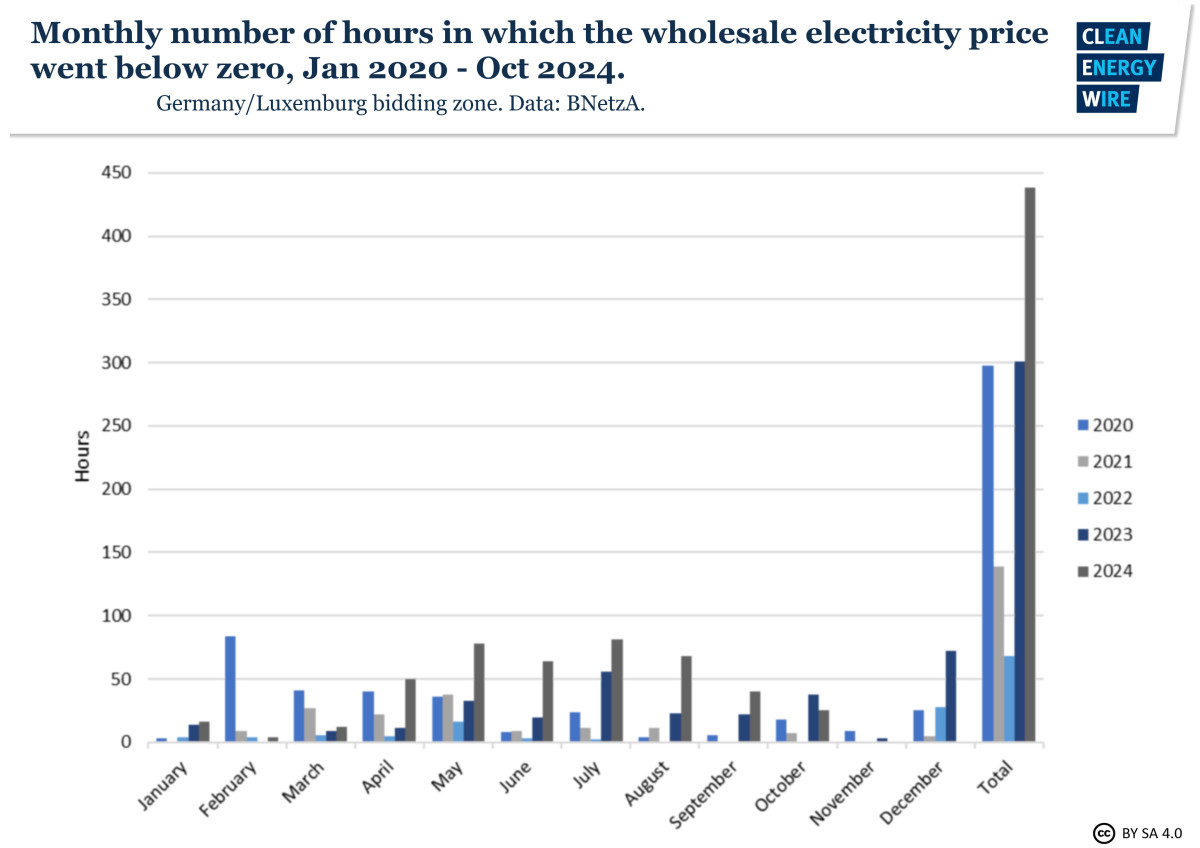

Renewable energy covered over half of Germany's gross electricity consumption in 2023. The same year, installed renewable power capacity increased by about 17 gigawatts (GW) to a total of 166 GW. All the while, the number of hours with negative power prices is also on the rise at times of oversupply due to favourable conditions for wind and solar. When this happens, power plant operators pay consumers to use electricity, instead of getting paid to produce it. Between January and October 2024, Germany saw over 430 hours with negative wholesale electricity prices.

The higher the share of renewables in the electricity system, the more frequent the hours become in which wind farms and solar parks feed in electricity simultaneously. In combination with low consumption — and crucially, a lack of flexibility — wholesale prices tumble.

However, because renewable producers receive feed-in premiums for every kilowatt hour they feed into the grid, they have so far largely not been incentivised to react to negative prices by producing less.

According to a current cabinet proposal, from January 2025 onwards, feed-in tariffs should generally be suspended for new photovoltaic (PV) systems or wind farms at times of negative power prices (with the exception of small systems). Support currently stops at times when the spot market price is negative for three or more consecutive hours.

"In the long term, the market should be able to stabilise itself without the need for permanent subsidies," Philipp Schröder, CEO at energy management start-up 1KOMMA5°, told Clean Energy Wire. "Above all, this means getting out of the EEG hammock and funding that is more strongly aligned with market economy principles."

Flexible electricity demand and more storage should also help stabilise wholesale power prices.

How is Germany planning to support renewable expansion in future?

In a paper published in September 2024, the economy ministry proposed four options to support the expansion of renewables in the future, all different types of so-called two-sided Contracts for Difference (CfDs).

Installations with these contracts would, in essence, receive money when wholesale power prices are low, and have to give some profits back if power prices are high.

Renewables should stop receiving subsidies "as soon as the electricity market is sufficiently flexible and sufficient storage facilities are available", according to the government's 2024 "growth initiative".

"Currently, a major point of contention is whether we should have a system where revenue guarantees are linked to the general capability of the wind farm or solar park to produce electricity – irrespective of the exact operation of the plant," Agora's Huneke explained. "Or, by contrast, a production-based system, i.e. a mechanism that links revenue guarantees to actual production."

Another open question is how Germany plans to combine state support mechanisms with a market-driven expansion. "A combination of a high share of market driven-expansion and a public framework which de-risks investments can back sufficient renewables growth, benefit the state budget and reduce the overall cost of a renewables-based power system," Huneke added.

What challenges remain?

To drive down costs and make the most of the rising share of clean and cheap electricity, Germany must find a way to ensure that future renewable installations benefit the overall electricity system, while also making it more flexible and able to cope with more renewables.

"Renewable energy project developers in Germany have had limited incentives to invest in system-friendly installations," DIW researchers wrote in 2017 already. This could mean, for example, setting up solar panels facing east or west, to generate electricity earlier in the morning or later in the afternoon. While these systems would generate less electricity overall compared to south-facing panels, they would feed in power when it is usually most needed.

"We are currently still a long way from 100 percent renewables.” Philipp Schröder, CEO at energy management start-up 1KOMMA5°, told Clean Energy Wire. "If we do not manage to decouple the system from subsidies as much as possible, adapt the grid and infrastructure to the challenges, and avoid high costs for the general public, then neither scaling up renewables nor a 100 percent renewable-powered electricity system will come to pass."

Is a future with no state support mechanism for renewables possible?

Technologies such as offshore wind and some big solar parks have, in the past year, shown that it is possible to expand without any support scheme. However, there will be phases in which build-out slows because electricity prices are low or capital costs high (for example steel prices for wind turbines rising, or projects becoming more expensive the further away they go from the shore).

"From today's perspective, experts generally believe that electricity market revenues alone will not be enough to provide sufficient security to refinance all the investments in renewable energy plants required to modernise the electricity system," the economy ministry wrote in its proposals paper.

While renewables networks expand and electricity demand significantly increases, a framework is needed to ensure the continuous build-out of new capacity. But the closer we get to climate neutrality, the more we can rely on a market driven build-out, according to Agora's Huneke.