Crucial EU electricity market integration collides with member states' worries of uneven benefits

What is the single European power market?

The idea behind the single European power market is to be able to have electricity flow freely across borders at all times, bringing individual national markets together to form the European internal electricity market. The aim is to create a unified, competitive and efficient electricity market where resources are used as best as possible.

The EU, alongside a handful of neighbouring countries, have worked on this vision for decades, connecting different power markets together, building cross-border grid capacity, jointly planning projects, and harmonising rules.

"Most trading occurs through market coupling, which ensures that – as long as there is enough transmission capacity – the electricity is produced where it is cheapest in Europe," said Leonhard Probst, a researcher at Fraunhofer ISE and co-lead at Energy Charts, a website with interactive graphs on the electricity market and energy production.

While there is already a single European power market, pursuing deeper integration is an ongoing project. There are transmission bottlenecks where grids are either still under development or do not yet exist, while regulations across countries could still be harmonised to use existing infrastructure more efficiently.

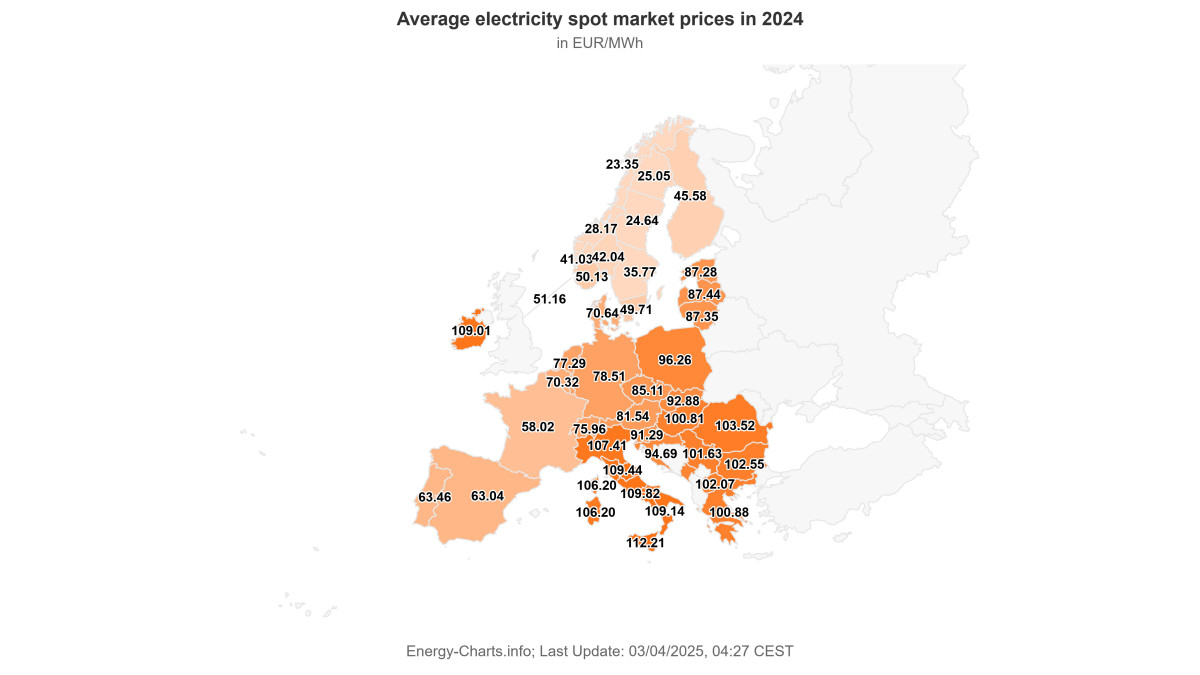

In the end, coupling markets should enable the wholesale electricity price (that in the power exchange, a platform where generators including gas power plants and solar farms sell their electricity to utilities and large companies, more below) to be almost uniform across the EU, leading to price convergence, as experts call it, and increasing the competitiveness of the bloc as a whole. End consumer prices (what appears on bills) might still differ across regions, as these include taxes, fees and other levies determined by each nation.

How does the single European power market work?

Understanding power trading zones (a region where electricity producers such as wind parks and nuclear plants freely trade electricity with utilities or businesses) is key to understand how the single EU electricity market works. Electricity within a trading zone, known as a bidding zone, has a uniform wholesale price (the cost of electricity on trading platforms known as power exchanges) and can thus flow freely within the geographical region. Bidding zones usually reflect a country's geography, although there are countries with multiple price zones, such as Denmark (2), Sweden (4), Norway (5) and Italy (5).

Wholesale electricity prices are formed by matching electricity supply and demand at any given time on the power exchange, following the so-called merit order. This means that the supplier which offers the lowest price to produce electricity is given priority (these are usually renewable sources), followed by the next cheapest, and then the next, until demand is covered – the most expensive plant needed for this sets the price that all suppliers will get and all consumers will pay.

In theory, bidding zones reflect the physical constraints of the market, meaning that there is enough capacity (in the form of power grids) to transport the electricity within the geographic area (this is not always the case, more below under challenges). By joining together power markets, electricity can be bought and sold across borders, with demand in one bidding zone met with the cheapest electricity from other bidding zones, and then the next cheapest, until transmission capacity is fully exhausted.

If transmission capacity is limited, one area has to use additional, more expensive forms of electricity generation, and prices start to diverge.

Why connect European electricity markets?

Historically, connecting electricity systems followed the general principles of the European Union of having efficient internal markets, allowing goods and services to flow across borders. This is trickier with electricity, as it cannot easily be stored in large quantities and electricity grids which transport it need to have a stable frequency at all times.

Deeper integration is seen as playing a key role in bringing the bloc closer to its goal of a sustainable, secure and affordable electricity system. It brings together the huge variety of companies that organise the production, trading, transmission and supply of electricity across the EU, using resources as efficiently as possible.

You have to build a lot of other parts of system to accommodate renewables – including cross-border infrastructure, storage, back-up capacity and encourage demand flexibility – and that system development will in large part determine whether prices go down.

"Integrated EU energy markets can turn the diversity of European energy systems into an asset," the Agency for the Cooperation of Energy Regulators (ACER), a regulatory body which coordinates EU work on energy, said in a 2024 report assessing capacity for international electricity trade. An integrated market is part of the puzzle in making the EU more energy independent and support its transition away from fossil fuels. Moreover, an efficient power grid guarantees that affordable electricity flows from where it is produced to where it is needed.

Whether the cost of electricity for households and industry is lower than today will depend on how efficiently countries build their national electricity systems. "You have to build a lot of other parts of system to accommodate renewables – including cross-border infrastructure, storage, back-up capacity and encourage demand flexibility – and that system development will in large part determine whether prices go down," Conall Heussaff, a research analyst at European think tank Bruegel, explained.

"Focus now shifts to helping pave and navigate the way towards a clean, secure, and competitive energy system, tackling trade-offs as these emerge," ACER wrote in its 2025 electricity and gas monitoring report. "Going forward, strengthened cross-border cooperation is key to building political trust and aligning regional energy markets."

Europe is quite unique in this regard – significant electricity trading across borders is not very common around the world.

In depth: Security of supply

"One of the main reasons why countries chose to couple their electricity grids was not primarily to trade between countries but to have a more reliable electricity system," Fraunhofer ISE's Probst said. Unlike other goods and services, electricity cannot easily be stored in large quantities, and electricity grids which transport it need to remain stable at all times.

If there was an outage of a large power plant or important transmission line, neighbouring countries could step in and prevent power cuts.

"The benefits of the coupled electricity market will increase with renewables," Probst added, explaining that it is easier to balance out renewables in larger areas for the simple fact that they have different regional weather patterns. "Nowadays it becomes more and more important that, for example, fluctuations of wind power can be equalised between different regions in Europe."

The effects of climate change will also play a role. For example, as precipitation and glacial ice melt patterns change, countries relying on hydropower reservoirs – which are currently seen as reliable way to back up intermittent renewables – will face new challenges.

An integrated system is a more resilient system, able to handle short and long-term shocks as countries can rely on their neighbours to provide them with electricity during supply crises. This happened, for example, in 2022, when historical net electricity exporters France and Norway experienced a sharp drop in nuclear and hydro power output respectively, largely due to reactor maintenance, plant closures, and a severe drought.

Following Russia's invasion of Ukraine and the ensuing energy crisis, it also became clear that Europe's dependence on imported fossil fuels would only lead to skyrocketing energy prices and energy insecurity. Renewable sources were dubbed "freedom energies", with a speedy rollout seen as key to strengthening long-term security of supply and sovereignty.

The energy crisis also gave rise to calls for more national energy self-sufficiency and sovereignty (see more below under key challenges).

In depth: Sustainability

A solar panel in Spain holds greater potential than one in Finland, while North and Baltic Seas are ideal for offshore wind generation. Interconnection can bring this clean power to Europe's heavy industrial areas and large population centres, allowing for the integration of more weather-dependent renewables than it would otherwise be possible, increasing their deployment, and reducing their resource requirements.

Connected markets can also take advantage of different supply and demand patterns across regions and time frames: sunny hours are not necessarily windy hours, and overproduction in one region can be transported to somewhere with less wind or sunshine.

By 2030, an additional 88 gigawatts (GW) of cross-border capacity (around two thirds of current international transmission capacity) and 56 GW of storage capacity could avoid 19 million tonnes of carbon emissions and reduce the curtailment of 30 terawatt hours (TWh) of renewable energy per year (nearly Ireland's net electricity production in 2022), compared to a hypothetical future where Europe stops investing in its cross-border grid after the end of the decade, according to European Transmission System Operator (TSO) association ENTSO-E's 2024 Ten-Year Network Development Plan (TYNDP).

In depth: Affordability

Deeper integration, more cross-border infrastructure and more harmonisation of investments across borders will lower prices on average for European consumers, according to multiple reports, including ACER's 2024 EU grids monitoring report and Bruegel's 2024 electricity market integration policy brief.

Market coupling leads to more competitive power prices, as more consumers are connected with more producers, making better use of the cheapest electricity generation. When conditions for wind and solar – but also hydro or nuclear power – are not great locally, countries can benefit from relatively cheaper electricity produced elsewhere in Europe, resulting in less short-term price volatility.

At the same time, they can benefit from their neighbours' resources by importing electricity to meet peak demand, instead of firing up expensive 'peaker' power plants (which are controllable but generally run on fossil fuels). "You use the available resources at a European level in a more efficient way, and ultimately this leads to lower prices," said Bruegel's Heussaff.

Interconnectors – the power lines connecting the transmission grids of two countries – also reduce the national electricity system investment needs, as individual countries do not necessarily need to be able to cover electricity demand every hour with domestic capacities.

Investments in cross-border capacities of 6 billion euros per year between 2025 and 2040 would deliver a yearly increase in socio-economic welfare of 13 billion euros for the EU, ENTSO-E calculated in its TYNDP 2024.

How far can integration go?

As Europe moves away from fossil fuels, electricity is set to replace oil, coal and gas. Clean electricity will form the backbone of future economies, powering industry, mobility and heating. Therefore, electricity systems increasingly become more critical for energy supply securities, and national priorities might take precedence over the free operation of the market.

"To achieve a full, deeply integrated system that has a completely smooth flow of electricity across borders in all hours, based on sensible price signals, countries would need to give up some control," Bruegel's Heussaff told CLEW. "This is why we have not gone all the way."

"Achieving the benefits of integration will require a vision on what degree of integration is feasible and desirable, and how to properly implement and govern it," stated a 2024 report by his think tank on why the EU needs more integrated electricity markets.

The electricity system requires a fundamental transformation to accommodate renewables: from building up storage units and backup capacity, to adding measures that encourage demand flexibility and cross-border infrastructure. Therefore, developing the European electricity market needs a balanced approach and integrated view, Alexander Esser, an energy economist who heads the Nordics team at consultancy Aurora Energy Research, said. "Theoretically, you could build so many cables that you have one big market zone, but is that the most cost-optimal scenario? Probably not."

The EU has set a target for member states to ensure that at least 15 percent of their country’s installed electricity production capacity can be transmitted to neighbouring countries by 2030. The bloc currently has 126 gigawatts (GW) of available cross-border electricity transmission capacity, but this would need to roughly double by 2040 (on top of expected capacity increases by 2030) to achieve climate targets, according to ENTSO-E.

Moreover, the existing infrastructure is not used efficiently. The European Union has set Europe's transmission system operators (TSOs) the obligation to make 70 percent of their transmission capacity available for trading between bidding zones by the end of 2025. However, ACER found that significant effort is still needed to fulfil this requirement.

To achieve deeper integration, European countries need to expand their cross-border infrastructure. So far, these needs are often not matched by concrete projects: planned investments fall short of the 32 GW of missing capacity across all borders by 2030, according to ACER's 2024 EU grids monitoring report. For reference, Italy currently has an exchange capacity of around 16 GW between its five bidding zones.

Integration is so deep in the electricity sector that it was agreed to have a system which could be less optimal for an individual country for a certain amount of time, but the optimisation is really for the welfare of all of Europe.

Who benefits from interconnection?

"Integration is so deep in the electricity sector that it was agreed to have a system which could be less optimal for an individual country for a certain amount of time, but the optimisation is really for the welfare of all of Europe," Fraunhofer ISE's Probst said. He refers to the EUPHEMIA algorithm (which stands for EU Pan-European Hybrid Electricity Market Integration Algorithm), the tool that matches electricity supply and demand across Europe and calculates wholesale prices for the so-called day-ahead market, the EU's most important electricity market. "The algorithm is designed to provide the highest welfare possible for the whole market area."

According to European TSO association ENTSO-E's 2024 Ten-Year Network Development Plan (TYNDP), cross-border grids can reduce overall system costs; help avoid the curtailment of renewable energy; reduce dependence on gas for electricity generation; avoid carbon emissions; decrease electricity generation costs; increase security of supply; lower power prices on average across Europe, bringing wholesale prices closer together; and create jobs as well as increase GDP.

In fact, compared to a scenario with no cross-border trade, the benefits of cross-border electricity trading amounted to around 34 billion euros in 2021, according to a 2022 report by regulator ACER. Further integration could increase these benefits to around 40 billion euros per year by 2030, the International Monetary Fund calculated.

More tangibly, however, electricity flowing across borders means consumers in importing countries benefit from lower prices, while producers in exporting countries can sell their surplus renewable energy. "The grid operators earn quite a bit of money with the price differential between countries, and utilities with generation assets benefit from increased electricity prices," Aurora's Esser pointed.

What challenges need to be addressed?

The main challenges as Europe works to connect its market further boil down to two issues: who bears the cost, and can the market be trusted to deliver when it matters. Huge investments are needed to transform the electricity system, and potential spill-over effects need to be managed (more below under international coordination) while national interests might get in the way. This means that strong coordination between EU countries is key to develop generation, transmission and storage capacity efficiently and expand the integration goal.

"We currently have challenges with political backlash against integration, especially in countries with low power prices that export a lot, such as Norway and Sweden," Aurora's Esser said. While in general deeper interconnection reduces costs, it is also likely that power prices end up higher in certain bidding zones, he explained (more below on equitable sharing of costs and benefits). "The challenge is how to integrate markets better without hurting end consumers."

Berit Tennbakk, a partner at Norway's energy transition consultancy THEMA, agrees. "The main thing you need to demonstrate is that interconnection is beneficial for everyone," she told CLEW. "Without this, it could still be successful, but you have to be prepared to compensate those who do not benefit."

It is a big challenge for policymakers in national countries to fully accept that their energy security is, in some sense, dependent on the behaviour of system operators in a neighbouring country that is outside their jurisdiction.

It is clear, experts agree, that not everyone will benefit equally from deeper market integration, and that in fact, some consumers or producers in some areas for a certain amount of time would experience others in different areas profiting from their increased prices or lower revenues. Therefore, the EU needs to find ways to ensure the equitable sharing of costs and benefits.

At the same time, increasing trust in the market, stepping up international coordination, and ensuring price signals reflect the real capacity to transport electricity are also key topics to address in the pursuit of a stronger single EU electricity market (see below for closer look into each challenge).

"While the benefits are there, you still have to find a way to compensate the losers to an extent," Bruegel's Heussaff said. "Clearly we do not have efficient mechanisms for doing that because it is causing problems and blocking new projects from getting built.

"It is not a question of 'if', but a question of 'how much more' integration we will achieve," he added. "Europe is in a particularly vulnerable moment, and there are people looking for bold ideas and bold solutions. If we crack that, we should be able to get more key projects built and get closer to this fully integrated market."

In depth: Redistribution of revenues and an equitable sharing of costs and benefits

In areas with excess electricity production, consumers tend to favour fewer exports as this means lower prices for their own consumption, while TSOs and utilities make a bigger profit by being able to sell and transport electricity to more customers. Conversely, when countries import electricity, end users tend to enjoy lower prices, but local utilities can be out-competed by those abroad.

"Higher interconnector capacity can mean that the imbalance between interest groups grows," Fraunhofer ISE's Probst explained. "It's really important to find political incentives which try to counteract this imbalance between producers and consumers, because society as a whole profits from the additional transmission capacity."

The risk of rising wholesale electricity prices already led to Sweden cancelling the Hansa PowerBridge cross-border interconnector project with Germany. "Electricity costs for consumers have come up a lot since the energy crisis, hurting household budgets and the competitiveness of industry," Aurora’s Esser said. Especially in the Nordics, which have a high deployment of electric vehicles and heat pumps, and where many users have dynamic electricity tariffs, these price increases are felt particularly strongly.

One way to better share the benefits of European electricity interconnection would be to redistribute profits from producers and transmission operators and hand them back to consumers. However, finding a way to do this properly is no easy feat, experts say. "The challenge is in identifying exactly who the winners and losers are over time, and that depends on so many factors in the system," Bruegel's Heussaff explained.

Governments could also reduce grid fees or other levies to lower prices, as these are added to form the final electricity bill, experts suggested. While wholesale power prices depend on the market, policymakers have a say on the other components making up the final price.

Figuring out who will pay for international grid projects is another challenge. Huge investments are needed, so setting up cost-sharing mechanisms for cross-border infrastructure – in line with the benefits delivered – could increase acceptance. Another idea would be to set up EU auctions where contracts are given to projects that provide the most value to the EU system as a whole.

In depth: Ensuring price signals reflect market conditions

Bidding zones, in theory, reflect a region's physical capacity to transport electricity. Where this is not the case, TSOs within a bidding zone have to carry out expensive redispatch measures, where they pay costlier generators in the area of high demand to increase their electricity production and power plants (for example offshore wind farms) in the area with too much supply to reduce it – distorting prices.

Experts often cite Germany as a prime example of where this happens, as the country has high renewable generation capacity in the north and high industrial demand in the south – and insufficient transmission grid connections between the two. Electricity, which is traded freely in the single power price zone, then has to travel across the country, but cannot do so because of grid bottlenecks. This has led to economists, researchers and EU partners calling on Germany to split its price zone – a move that the country's industry, especially in the south, rejects.

The political discussion is not limited to national circles; it has become a symbolic question for Germany's northern neighbours too. "Denmark, the south of Norway and south of Sweden don't feel like the trade is fair, because they exchange at the 'wrong prices'," THEMA's Tennbakk said.

The Nordic countries would expect lower prices when there is high offshore wind generation in northern Germany, but that is not always the case. If Germany did split its single bidding zone, it would send different price signals for cross-border trade, as prices in the north are likely to drop significantly.

In depth: Guaranteeing market reliability and stepping up international coordination

The electricity system faces a fundamental change as fossil fuels are phased out. With the rise of solar and wind power, electricity generation becomes more volatile and comes from many smaller units instead of centralised power plants.

While local flexibility can help manage short "Dunkelflaute" episodes, longer times of little wind and no sunshine may require energy imports, regulator ACER said in its 2025 energy market monitoring report. Politically, this means a system is needed that guarantees that neighbours will be able to send electricity during those critical hours or days, and will always be available to do so.

"There is the concern: when you do need electricity imports, will you be able to get them from a system that is now less reliable, based on wind and solar power that is weather dependent," THEMA's Tennbakk said.

"Business opportunities created by price signals and fear of high costs are powerful incentives for market actors. But politicians, companies and consumers keep holding back and are reluctant to trust the market."

Bruegel's Heussaff agrees: "It is a big challenge for policymakers in national countries to fully accept that their energy security is, in some sense, dependent on the behaviour of system operators in a neighbouring country that is outside their jurisdiction."

At the same time, deeper international coordination over national policies is also needed. Ultimately, national investment decisions for the electricity system development – from new renewable capacity, progress on grid expansion or the implementation of capacity markets – affect neighbouring markets.

"There are a lot of spill-over effects between countries that need to be figured out," Heussaff said, explaining that low-cost exports from a country rich in resources could, for example, affect the business case of storage assets in the importing country. Investors need to have a long-term perspective and mange risks, so stronger coordination between investments across countries could help bring down costs and have a more efficiently integrated system.

What would happen if Europe stopped pursuing further interconnection?

There are strong economic reasons for deeper electricity system integration, and in general, researchers, policymakers and businesses realise the importance of deeper system integration for more energy security, lower prices and greater sustainability. However, political discussions and the financing and planning gap for infrastructure projects highlight the challenges in further integrating markets.

If countries decided not to continue to pursue further interconnection, "system costs would increase a lot and markets would be more volatile," THEMA's Tennbakk said. Some areas would experience more situations with very high wholesale prices, she added. "I don't think this is viable in the long term. We would have to think about rationing and I don't see how that would work well."

Persisting with the status quo would slow down the energy transition and make electricity more costly for European consumers than it would otherwise be, while eroding trust in the European internal market.

"It is a very big advantage nowadays that Europe is so well interconnected," Fraunhofer ISE's Probst said. Backtracking "would mean a very big loss of economic welfare for all of Europe."

A purely national perspective risks overbuilding the system, as countries would need more redundancy and additional reserve capacities to balance out renewables. "In the end, that is a more expensive journey to the energy transition," said Aurora's Esser.

However, required grid investments are an energy transition cost driver, meaning that alternatives besides grid expansion should be considered too. "The other thing that needs to happen is to access the flexibility of demand, with consumers acting smarter on the power market without them feeling any difference," he added.