Q&A: Making the EU’s electricity market fit for a climate-neutral future

Table of contents

- Why reform the electricity market now?

- How do electricity markets in the EU work?

- Why does the price of gas influence electricity prices?

- What can the EU's reform deliver?

- What has the European Commission proposed?

- How will the proposed instruments work?

- How have stakeholders reacted?

- What do EU member states want from the reform?

- Why is Germany also reforming its own electricity market?

- What are the next steps?

1 – Why reform the electricity market now?

Last year, European electricity prices spiked in the wake of Russia’s invasion of Ukraine and the curtailment of energy supply to the EU. The ensuing energy crisis, which saw consumers struggle to pay unsustainably high electricity bills and companies scramble to replace gas supply at higher costs, made apparent that accelerating the energy transition was both of environmental and strategic energy security importance for the bloc.

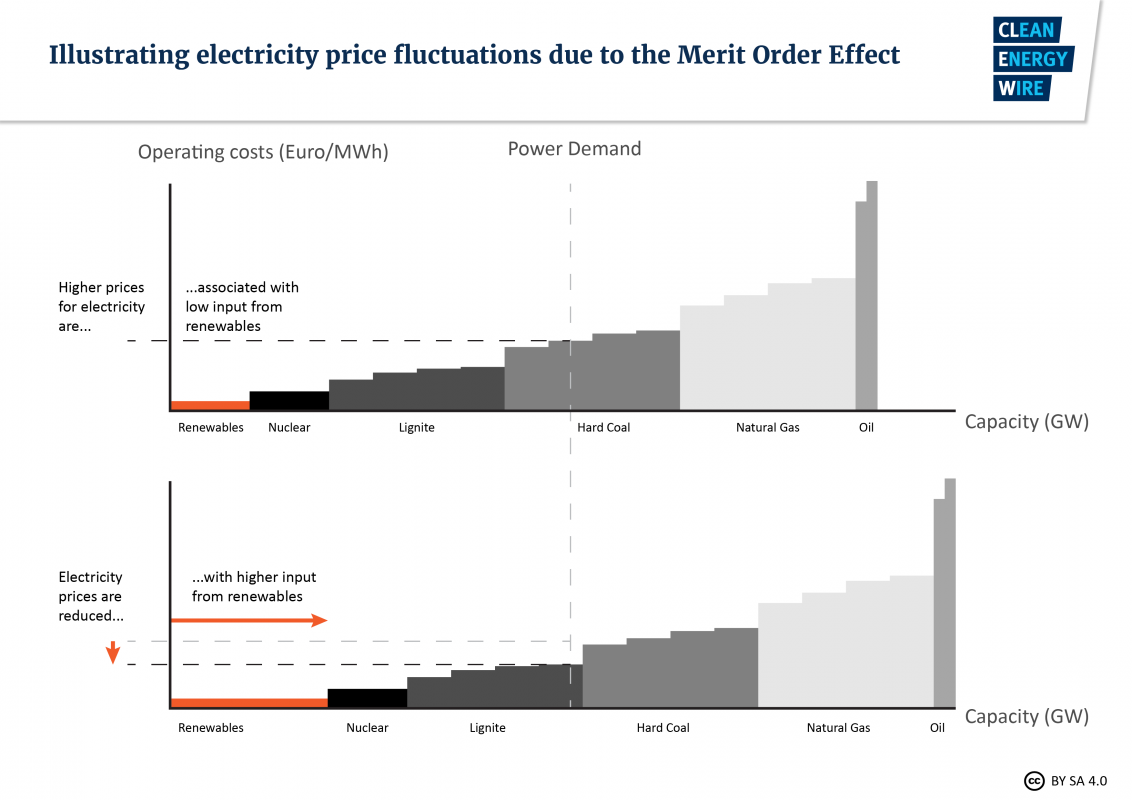

This brought the discussion about reforming the design of the EU’s electricity market to the top of the agenda, as sustained high electricity prices in the continent were primarily a consequence of very high gas prices (see merit order effect below). Protecting consumers from fossil fuel supply shocks became a priority for governments, and adjusting, reforming or even overhauling the electricity market part of the solution.

However, this doesn’t necessarily mean that the market failed. “A reform of the electricity market is something that was on the agenda anyway,” Aurora Energy Research associate, Nicolas Leicht told Clean Energy Wire. Power systems need to change in the next ten to 15 years to enable the full decarbonisation of the European economy by 2050, which fundamentally changes how the market functions, he said.

The European Commission pledged to reform the EU’s electricity market last year, but fast-tracked the discussion by launching a public consultation at the end of January and presented consolidated policy proposal on 14 March.

According to the Commission, the existing design of the European electricity market led to secure and affordable electricity supply to EU citizens for years. However, a threefold crisis in 2022 — Russia’s weaponization of energy against Europe as well as the low availability of nuclear and hydropower generation — exposed cracks in the market’s ability to react to short-term emergencies and extended periods of high fossil fuel prices.

In response, governments took on substantial financial burdens to alleviate high prices for consumers and EU member states utilised the bloc’s emergency regulations to partially finance these measures, for example taxing windfall profits from energy producers with low operation costs.

2 – How do electricity markets in the EU work?

With the aim of achieving a “fully interconnected internal market for electricity,” the EU sets common rules and regulations for the generation, transmission, distribution, storage and supply of electricity. Member states are then responsible for the implementation of these regulations, and there are differences among market mechanisms within the bloc.

For example, capacity mechanisms (paying operators to be ready to produce electricity when needed, not only for every kilowatt hour (kWh) they produce) can vary between member states. Countries like Germany and Sweden have a ‘strategic reserve’, where certain generation capacities are kept outside the electricity market for operation only in emergencies, while Italy and Poland have market-wide capacity mechanism, where power plants can obtain a payment for being available to generate electricity or to reduce their consumption when needed. However, the EU limits the support states can give to companies to encourage competition and avoid market distortions, therefore state support plans have to be approved first.

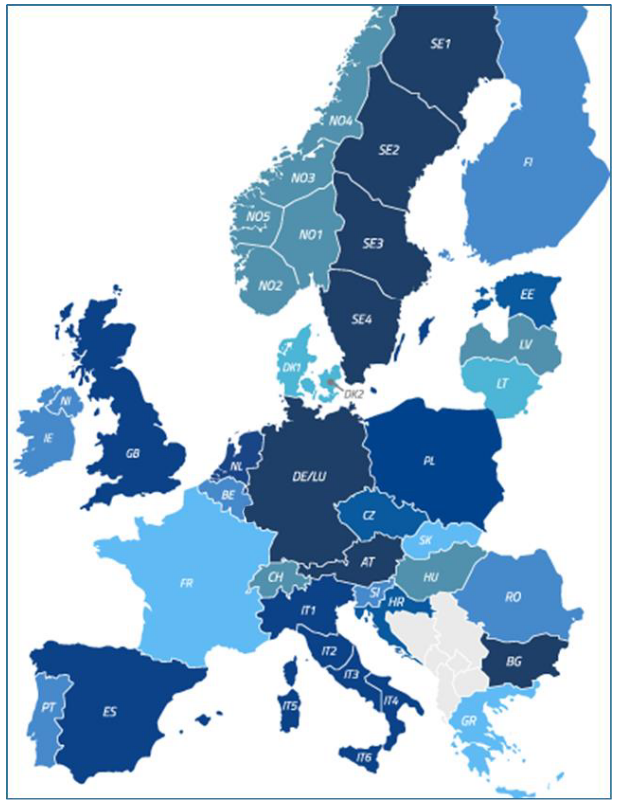

European wholesale electricity markets are split into different timeframes and regions. In the forward or futures markets, electricity is traded months or years in advance, while the spot markets see electricity traded hours or minutes ahead of delivery. Bidding zones, which generally overlap national borders, establish zonal wholesale prices for electricity.

The current market design focuses strongly on short-term markets. The so-called day-ahead market — where supply and demand are balanced to set the price for electricity for every hour if the following day —is Europe’s lead market for electricity. Every day, power exchanges across the EU publish wholesale electricity prices for the EU’s bidding zones.

However, national wholesale electricity markets have steadily increased their cross-border electricity flows, meaning if there is a surplus of electricity generation in one country it can be used in another where there might be a shortage. This has been achieved through advances in market coupling algorithms for trading as well as the expansion of physical transmission capacities. This integration of markets allows for “the most efficient use of infrastructure and resources available at European level,” writes ENTSO-E, an association for all European transmission system operators (TSOs). The Agency for the Cooperation of Energy Regulators (ACER) monitors these energy trades.

Because of Europe’s goal of a harmonised and even more strongly interconnected market, national support systems for power generation, capacity mechanism and flexibility need to be coordinated between member states, said Georg Zachmann, senior fellow at think tank Bruegel. While each country is primarily responsible for managing its own electricity supply, “the focus of EU regulation is to counter any cross-border effects that could undermine market functioning and drive up electricity bills,” writes the European Parliament.

Ultimately, the price on electricity bills (retail price) varies between member states and sometimes regions (and amongst other by procurement strategies of retailers) based a combination of the price of electricity, grid fees, and taxes and levies.

3 – Why does the price of gas influence electricity prices?

Currently, the EU’s electricity market follows the merit order system, which closely ties electricity prices to the cost of fossil fuels. Electricity generated by wind turbines or gas-fired power plants is sold at the same price on the spot market, even if what it costs to produce this electricity is different for each generator. The merit order system establishes that the most expensive power plant in operation needed to meet demand sets the price for all electricity sold.

This means that gas-fired power plants used for electricity production — which saw their production costs increase through high gas prices over the past year — drove the price for electricity up whenever they were needed to meet demand.

The current design focuses strongly on short-term markets, which means the price of electricity is most often determined by fossil fuel prices. However, short-term markets are essential for the integration of renewable sources in the electricity system to ensure the cheapest form of electricity is used at all times and that there is a smooth flow of electricity between EU member states.

4 – What can the EU's reform deliver?

The Commission’s aim in reforming the electricity market is to better protect consumers from fossil fuel price spikes while securing European energy sovereignty and achieving climate neutrality.

Fundamentally, adjustments to the electricity market should address three key areas:

- Protect consumers against high electricity prices

- Ensure secure supply

- Promote the expansion of renewable power generation to drive the decarbonisation of the electricity sector

How this is achieved, however, depends on which mechanisms can be deployed in the short-term and which options can affect long-term change. “In the short-term, prices stand at the forefront,” Aurora’s Leicht said. “But in the medium and long-term, one should think about prices, security of supply and decarbonisation not as three separate goals but together — which is easier said than done — and figure out where one can lead to advances in the other.”

Addressing prices in the short term, not through state intervention, but through changes to the market requires tools that can be easily deployed and implemented to offer protection against fossil fuel insecurity, especially ahead of the winter of 2023/24 (for more see section 5). However, “it is crucial that the EU ensures that such immediate measures are consistent with maintaining a well-functioning market,” Christian Redl, European energy expert at think tank Agora Energiewende told Clean Energy Wire.

“The short-term reform is a chance to implement open electricity market provisions from the 2019 clean energy package in all member states. This concerns, for example, cross-border, intraday auctions, 15-minute products in the day-ahead market, time-varying grid tariffs and accelerating the rollout of smart meters,” Redl said.

“One clear goal of the reform in the mid and long-term should be to create stronger regularity security to improve investment conditions,” Aurora’s Leicht said. “It’s important to anticipate future crises, and there are instruments that can provide hedging and would make revenue caps superfluous.”

Many unexpected state interventions generated a lot of uncertainty for investors and other market players over the past few months, he explained. This is highlighted by the fact that despite unexpectedly large profit margins, investments in new wind farms and new wind turbine orders were down in 2022, according to industry association WindEurope.

Future situations where electricity producers with low operation costs (such as wind and solar parks) make unexpectedly high profits while at the same time receiving state aid – as was sometimes the case during the energy crisis – should be avoided, according to the Commission.

In the medium term, the market design requires a broader reform to help enable a fully decarbonised power system, Agora Energiewende’s Redl said, adding that “the public discussion has evolved; there is growing consensus among member states that addressing the issue of high fossil fuel prices in the short term is possible without overhauling the entire system.”

5 –What has the European Commission proposed?

The European Commission’s proposal is far from the “deep and comprehensive reform” promised by president Ursula von der Leyen at the height of the energy crisis in September 2022. Instead, the proposals focus on incentivising longer-term contracts with an aim of making electricity bills more independent from short-term market prices.

Concrete proposals include:

- Introducing measures to boost the uptake of Power Purchase Agreements (PPAs).

- Requiring member states to provide public support for new investments in low-carbon electricity generation only in the form of two-way Contracts for Difference (CfDs).

- Improving consumer protection by allowing consumers to have several contracts, for example to cover their domestic consumption on a long-term, fixed-price contract but charge their electric vehicle or use heat pumps on a dynamic pricing contract.

- Requiring member states to assess their needs for power system flexibility from non-fossil fuel sources, such as demand response and storage, and establish objectives to deliver on these needs.

- Bringing trading deadlines closer to real time to allow for a more efficient trade of renewables and balancing.

The EU electricity market should have a lesser focus on short-term markets, as currently many member states hardly have any forward instruments covering more than three years, commissioner for energy Kadri Simson said. Greater access to long-term contracts such as PPAs and CfDs should enhance the stability and predictability of electricity costs across the EU, she explained.

However, the market fundamentals will remain untouched, as the current design remains the most efficient way to ensure the cheapest generation technology is used at all times and encourages trade between member states in times of scarcity, Simson said. She pointed out that the key for the success of the reform will rely on its implementation.

6 – How will the proposed instruments work?

A faster deployment of renewables is the most sustainable way of addressing the energy crisis, reducing demand for fossil fuels used for electricity generation and increasing energy independence, according to the Commission. Due of their low operational costs, renewables can positively impact electricity prices across the EU, reduce the impact of gas prices on electricity bills by reducing consumption, and support the energy transition.

“While the proposed measures do not affect the price formation in the short-term markets, the reform changes the way infra-marginal generators are remunerated,” the Commission explained. This would boost investment by providing renewable energy suppliers with predictable revenues and lowering their financial risk and capital costs.

Power Purchase Agreements (PPAs)

Renewable Power Purchase Agreements (PPAs) are direct contracts between consumers and electricity suppliers. They ensure that electricity is sold on a long-term basis (typically between 5-15 years) at an agreed price.

- For consumers, they can provide cost-competitive electricity and hedge against electricity price volatility.

- For renewable projects developers, they are a source of stable long-term income.

- For governments, they are an alternative avenue to the deployment of renewables without the need for public funding.

Under the Commission’s proposals, member states will be required to provide instruments to reduce the financial risks for companies struggling to enter the PPA market, including guarantee schemes at market prices.

PPAs are already central to electricity markets in European countries such as Spain and Sweden, but they are currently mostly limited to large customers such as energy intensive businesses.

“We need enabling frameworks for PPAs,” Agora’s Redl said. “This would mean, for example, that governments provide platforms for bundling PPAs so that smaller market parties could join forces or indemnify against risks such as counterparty bankruptcy.”

By providing increased predictability for future investment decisions, PPAs could increase the share of renewables in electricity generation.

Two-way Contracts for Difference (CfDs)

Two-way Contracts for Difference are agreements between an electricity generator and a public body (in this case the state), where a price of electricity (one that makes economic sense for a generator) is pre-arranged – usually by a competitive tender. If the price of the electricity sold on the market is lower than the pre-arranged price of the contract, the state pays the difference to the generator (thus ensuring a stable revenue). However, if the market price of electricity is higher than the pre-arranged price, the generator has to pay those profits back to the state.

In short, CfDs are a two-way payment process that ensures generators receive a certain level of remuneration for the electricity produced while preventing disproportionate revenues.

- For investors and consumers, two-sided CfDs would ensure greater certainty.

- For governments, they cater for situations where public support is required.

One big reason why Europe didn’t see a wave of investment in new renewable generation capacity during the energy crisis, despite the fact generators made unexpectedly high profits, was insecurity in the long-term price development of electricity. The Commission wants to address this and secure long-term investment security with two-way CfDs.

Under the Commission’s proposals, member states will be required to use two-way CfDs when new solar, wind, geothermal, hydropower and nuclear energy projects require state investment. When there is market-based investment, CfDs will not be an obligation for private investors. Additionally, existing market players would not need to enter a two-way CfDs if already receiving state aid.

The proposal also specifies that the revenues from these contracts should be passed on to consumers via their electricity bills, proportionate to a share of their overall consumption.

“Contracts for Difference could provide more security for developers as the state stands on the other side of the agreement, which means that there is no risk of insolvency,” Leicht explained. “This is an instrument that is mostly driven by the state, where the state decides through auction volumes how much capacity it wants to bring into the market.”

Flexibility

The flexibility of electricity systems should be prioritised through storage and demand response measures. Under the proposal:

- Member states will have to invest in the development of technologies that allow for demand side management, such as smart meters, as this is seen as key to cutting peak consumption.

- Member states can also design or redesign capacity mechanisms in order to promote flexibility solutions.

- The possibility for member states to introduce new support schemes specifically for non-fossil flexibility solutions should also be opened.

7 – How have stakeholders reacted?

Reforming the EU’s electricity market is no silver bullet in solving the energy crisis, Jean-Michel Glachant, president of the International Association for Energy Economics, wrote in a December op-ed in Euractiv. “A reform of electricity markets can only help if the root causes of the crisis are also addressed and if the objectives for such reform are made clear upfront,” he wrote, adding that “market design changes alone won’t cut our dependence on fossil fuels, solve nuclear reactor issues or prevent droughts hitting hydropower generation.”

Many energy companies and associations agree that a market reform is needed, but warn against deep market interventions, taxing windfall profits or forcing mandatory CfDs on existing power plants, as all this could deter much-needed investment in renewable and low-carbon electricity.

Emergency measures adopted to counteract very high or very low prices should not be confused with a structural market reform, an alliance of major European energy companies, including Vattenfall, EnBW, E.ON, RWE and Uniper, said. Long-term contracts (such as PPAs and CfDs) could protect customers against price volatility, but these mechanisms have to remain voluntary and be well designed to maintain competition and deliver the right long-term investment signals, they added.

Vattenfall’s head of energy trading, Frank van Doorn, said that while CfDs could initially be good for hedging new power generation deals, one should think twice about how much of a role states should play. “One has to think carefully whether the state’s intervention in the market is really necessary, because, among other things, it can cost taxpayers and above all customers a lot of money,” van Doorn told Wirtschafts Woche. Moreover, it was important that the reform ensures predictability and investment, he said. “When we decide on a wind park, we need to know the rules.”

Germany’s renewable industry association BEE has criticised key elements of the EU proposal to reform the design of the bloc’s electricity market. The lobby group said strict rules about the shape of future subsidies for new low-carbon electricity generation facilities were not the best route forward for Germany’s renewables industry. It says the reforms could have similar effects as a mechanism that skimmed revenues from producers during the energy crisis, which led to high costs for them, as well as “market distortions”. Other German reactions were less critical, with industry association BDI and energy industry lobby group BDEW welcoming the fact that no drastic changes to the system were proposed. [Read the full article with reactions here.]

8 – What do EU member states want from the reform?

Germany wants to see the reform happen in two seps, where price stability and European market integration “come without delay”. Yet, a comprehensive reform takes more time and is developed based on accurate analyses, state secretary Sven Giegold said ahead of an informal meeting of EU energy ministers at the end of February.

“The deeper structural electricity market reforms can bring much benefit, but can also cause great damage if they are done wrong,” Giegold warned, adding that “Any fundamental structural reform must improve incentives for investment in renewables, energy efficiency and storage.”

A well-functioning electricity market is a prerequisite to achieving the EU’s long-term climate and energy targets while guaranteeing security of supply and affordable prices, as Germany, Denmark, Estonia, Finland, Luxemburg, Latvia and the Netherlands warned in a joint letter. Thus, any reform going beyond targeted adjustments should be “underpinned by an in-depth impact assessment” and “should not be adopted in crisis mode.”

“It is crucial that attempts to address the challenge of affordable electricity prices and security of supply do not endanger the decarbonisation efforts and well-functioning of the electricity market,” the letter reads.

Spain on the other hand supports substantial changes and hopes to see the reform agreed before European Parliament elections in mid-2024. Teresa Ribera, the Spanish minister for the ecological transition, called for a different remuneration model that considers upfront investment costs and the availability of technologies that can respond on-demand.

“The current crisis has shown how vulnerable the current design of the electricity market is to stress situations, as well as the tremendous consequences for domestic consumers,” she wrote in an opinion piece for Euractiv. According to the article “the current pricing system, based on operational costs, does not provide the incentives necessary to drive new renewable energy projects, as well as investments in storage and backup technologies.”

Alongside with Spain, France wants a deep reform and called frameworks to enable more long-term fixed-price contracts with low-carbon power plants. Their proposals focus heavily on CfDs for renewables, nuclear and hydropower. It would additionally see the introduction of a capacity market for flexible options such as combined gas-cycle gas plants and energy storage.

Poland would like the reform to do more to support investments in nuclear energy as they typically require high upfront investment. “We must ensure a positive regulatory environment for investing in all zero- and low emission technologies,” the country said in a paper shared with EU policymakers, adding that countries should have an “unrestricted right” to implement capacity markets to subsidise such flexible power plants.

In July last year, Greece presented its own proposal, which sought to bifurcate electricity markets, with renewables, nuclear and flow hydro on the one side, and fossil fuel generation and stored hydro in a separate market. However, this proposal is hotly contested.

9 – Why is Germany also reforming its own electricity market?

Germany has a target of covering 80 percent of its electricity demand with renewables by 2030. To achieve this, the government launched its ‘Climate Neutral Electricity System’ dialogue platform to prepare the country’s comprehensive electricity market reform. [Read the full article here.]

While a reform would have to comply with the European framework, it could go further and account for the country’s power mix and future targets. For example, the introduction of a new market mechanism for security of supply, which was not mentioned in the EU consultation, could play a major role in the German debate.

As the country is phasing out its nuclear and coal power plants, reserve capacities that don’t run all the time are of particular importance, economy minister Robert Habeck said, especially in light of the expected increase in demand through the electrification of the mobility and heating sectors. Habeck said that Germany will use auctions to ensure that about 25 gigawatts of new gas power plants are built.

The German reform should look at how to ensure favourable electricity prices, how to set the right investment signals for renewable energy and gas-fired hydrogen-ready power plants, and how to make the system flexible, Habeck said. The market should also encourage grid expansion, regional control of generation and loads (such as electrolysers near offshore areas), and ensure renewable electricity can be used onsite instead of being curtailed due to grid bottlenecks.

The economy ministry aims to present the first essential findings of the platform in a summer report by the end of June. It plans to follow this with a winter report before the end of the year. In Germany, electricity prices for consumers are among the highest in Europe due to a range of taxes and levies that make up a big portion of the price.

What have stakeholders called for?

“Currently, there are too few incentives for the expansion of renewable energy and the integration of smart energy and load management systems, flexible demand or storage options,” energy economist Claudia Kemfert of the German Institute for Economic Research (DIW) added. Security of supply could be ensured by means of intelligent energy and load management, she said.

The head of energy company Leag, Germany’s second biggest electricity producer, said the investment conditions aren’t there yet to invest in power plants only needed for peak demand. “No one is going to invest 500 to 600 million euros in a hydrogen-ready gas-fired power plant if they only get money for it in backup times,” Thorsten Kramer told newspaper Frankfurter Allgemeine.

He called for the introduction of capacity markets, arguing that the longer the reform takes, the longer expansion plans would be delayed. Moreover, without specific infrastructure plans such as gas and hydrogen pipelines to the Lusatia region, where Leag operates, flexible power plants won’t be built by 2030, he warned.

Solar association BSW called for market barriers to the necessary construction of millions of new solar plants must be “torn down quickly”. Targeted incentives, smart market rules and smart energy management are needed to make solar power available in sufficient quantities around the clock and throughout the year, the lobby group said, adding that this could be mixed with other renewable energy, storage and hydrogen.

German municipal utilities association VKU called for a high degree of reliability, so that necessary investments in renewable technologies, grids and guaranteed capacities are actually made. “There must be no repetition of sins such as the questioning of avoided grid utilisation fees or the skimming of revenues from renewables,” VKU head Ingbert Liebing said.

10 – What are the next steps?

The European Commission presented its policy proposals on 14 March. The file on the revision of the EU’s electricity market design will now be debated in the European Parliament and among member states in the Council, before the two institutions enter final negotiations. While EU negotiations often take more than a year, the Swedish presidency “hopes to see it adopted as soon as possible”.