Q&A: How can renewables enable Germany's energy independence push?

Contents

1. What are the current expansion goals for wind, solar and other renewables?

2. Will the planned expansion level allow an end to Russian imports and reach climate targets?

3. Are renewable power companies ready to deliver a fast expansion?

4. Which hurdles are obstructing a fast expansion? And how can they be overcome?

5. What about the parallel expansion of grids and storage capacity?

6. How can Germany’s renewables push be integrated in European climate neutrality plans?

1. What are the current expansion goals for wind, solar and other renewables?

Already before Russia's invasion, Germany’s government coalition of the Social Democrats (SPD), the Green Party and the Free Democrats (FDP) had aimed to achieve 80 percent renewables in electricity consumption by 2030. Shortly after the war’s outbreak on 24 February, it raised the ambition to 100 percent by 2035, meaning the expansion rate of renewables will have to multiply. In a policy package in April 2022 presented as the “biggest energy policy reform in decades,” the coalition proposed to lift the rollout of wind and solar power “to a completely new level.” Renewables already provided about 54 percent of electricity consumption in early 2022.

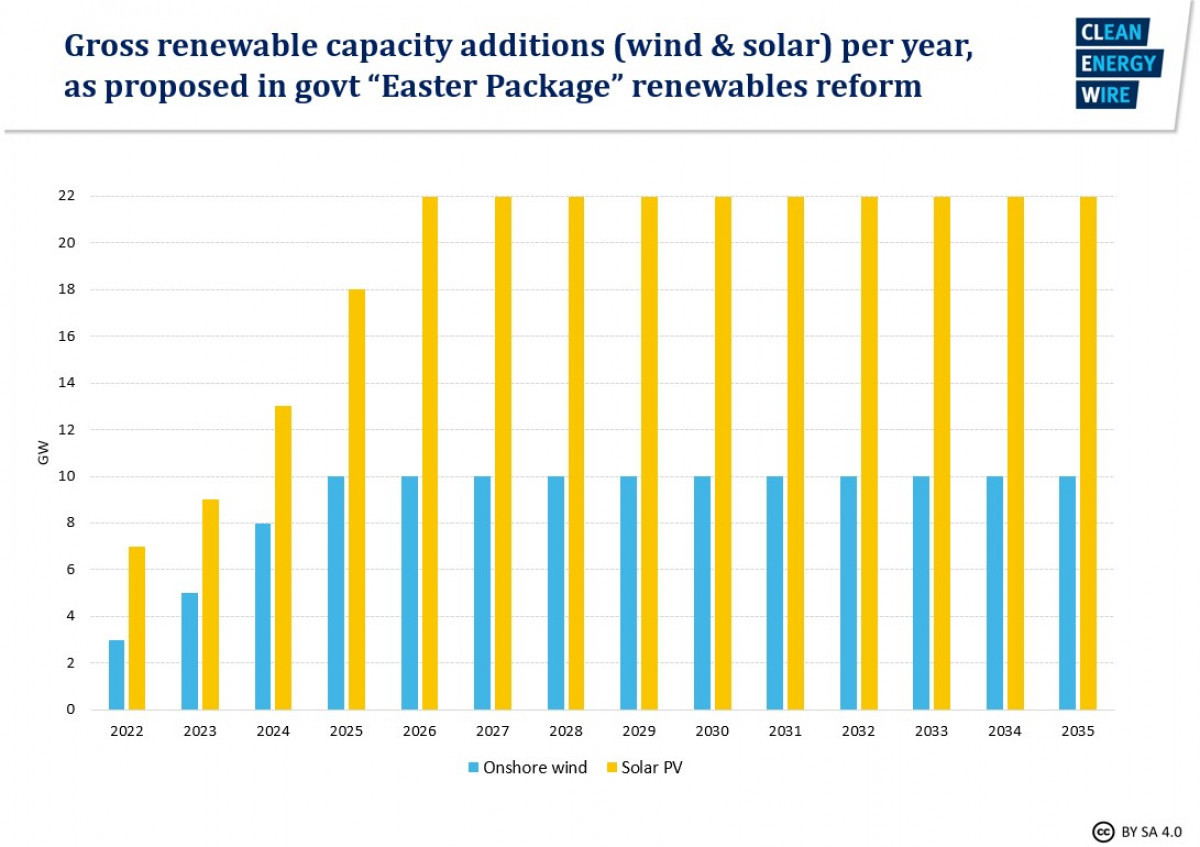

Installed onshore wind capacity should reach 115 gigawatts (GW), meaning annual capacity additions will have to reach 10 GW as of 2025. A total onshore turbine capacity of about 56 GW had been installed in the country by 2021. Solar PV installations will amount to 22 GW per year as of 2026 to achieve a total capacity of 215 GW by 2030, up from about 60 GW in 2021. Offshore wind additions are increased as well to reach a minimum of 30 GW by the end of the decade, 40 GW by 2035, and 70 GW by 2045. As ambitious as this sounds, much higher buildout rates are not without precedent in the country. In 2017, Germany installed 5 GW of wind power and solar capacity expansion peaked at around 8 GW before 2012.

The government said it will introduce a second package of legislative reforms by the summer. These will include draft reforms of the Renewable Energy Act (EEG), the offshore wind law, the energy industry law and legislation to speed up power transmission grid development. It will now be sent to parliament and could be adopted still in the first half of 2022, the economy ministry (BMWK) said.

2. Will the planned renewables expansion allow an end to Russian imports and reach climate targets?

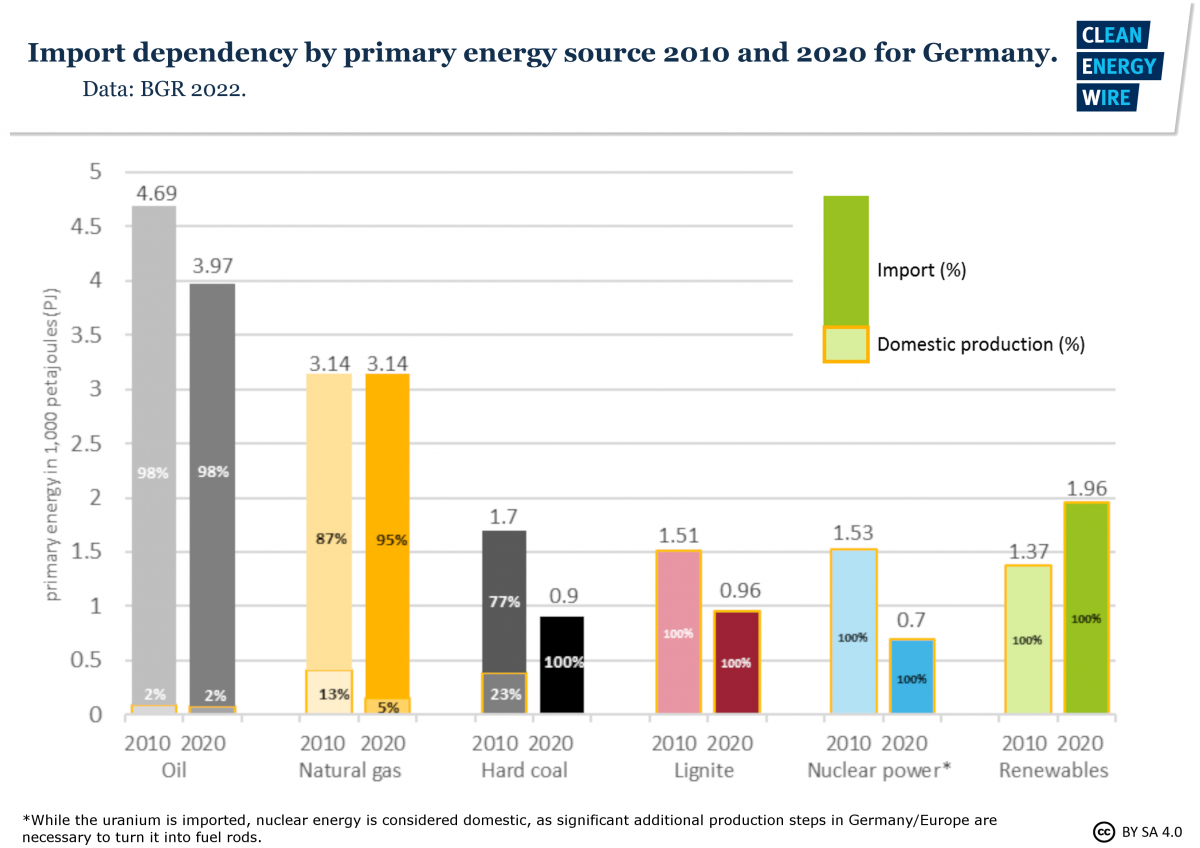

Full independence seems unlikely for Germany even with a fully decarbonised energy system due to continued raw material imports and the sheer power capacity needed to implement decarbonisation measures. However, the energy potential that can be exploited using renewables within the country is still significant. Renewables expansion provides the fundament for almost all energy transition activities Germany has planned to reach its goal of full climate neutrality by 2045. Together with increased efficiency to reduce the overall need for energy, the electrification of mobility, heating and other sectors is a cornerstone for ending the use of fossil fuels like petrol in cars or natural gas in heating systems – and renewables allow doing so without causing new CO2 emissions. However, electricity so far only covers a fraction of Germany's primary energy consumption, where the share of renewables in 2021 stood at a little over 16 percent.

Yet, renewables also provide the foundation for green hydrogen production, which will enable decarbonisation in sectors and applications where electricity so far offers no viable solutions. But building more renewables takes time and offers no quick way out of the current predicament. In its progress report on energy security from late March 2022, the government said the goal to significantly reduce imports from Russia by mid-2024 to 10 percent of gas use would require further diversification of fossil fuel sources, a more rapid ramp-up of hydrogen and the “massive expansion” of renewables. The Easter Package is aimed at becoming the “greatest accelerator since the year 2000,” when guaranteed remuneration was introduced with resounding success for the buildout of wind and solar power installations. Economy and climate minister Robert Habeck had urged that expansion should happen “at Tesla speed”, referring to the US carmaker’s quick construction of a gigafactory for e-cars near Berlin. However, he warned the country still lacks sufficient wiggle room in energy supply to end dependence on Russia swiftly.

3. Are renewable power companies ready to deliver a fast expansion?

Ramping up the production and installation of wind turbines, solar panels and other renewable power installations was made a priority as soon as the new government entered into office at the end of 2021, meaning companies had some time to gear up for a renewed expansion boost. However, consultancy McKinsey said while achieving projected buildout volumes so far had no been a challenge, the ambitious new goals mean the country risks falling behind its own schedule. But solar power industry organisation BSW Solar is confident its companies can deliver on the increased targets, even arguing these represent the “lower boundary of what is necessary” to reach the country’s climate targets and substitute the coal-fired power plants slated for decommissioning. The industry group says expansion to up to 250 GW is possible by the end of the decade, given the political will. In the long-run, the country could install up to 500 GW, it added.

The wind power industry is more cautious regarding a fast scale-up. German Wind Power Association (BWE) said the current expansion plans already are “very ambitious”. Due to a near total collapse of turbine construction in Germany in the past few years, many companies had scaled down domestic production capacities to focus on markets abroad. The BWE said it expects manufacturers to recalibrate their focus back towards their home market given the perspective of a sustained boost to installations in Germany, an assumption that is backed by resurging interest in wind power auctions as of early 2022. “A forceful expansion will be imperative,” the group said. However, the lobby group said Germany could install up to 200 GW of onshore wind by 2040 if the country shed its "bureaucratic corset."

For the German Renewable Energy Federation (BEE), the industry’s umbrella organisation, the current targets do not yet reflect the situation resulting from the war in Ukraine and the new focus on supply security. It expects the government to pull more levers to ensure that renewable power can replace fossil fuels, as power demand in general is set to grow to at least 750 terawatt hours (TWh) by 2030. The BEE stressed that bioenergy could play a central role in the push away from Russian fossil power by simultaneously providing alternatives for the power sector, heating and mobility. However, this would require a massive roll-out of electrolysers for biogas plants. Biogas could “immediately” replace 5 percent of Germany’s Russian gas imports, according to the European Biogas Association.

4. Which hurdles are obstructing a fast expansion? And how can they be overcome?

Expansion progress in recent years has been below target values for a wide range of reasons, including cost pressure, low investor confidence and difficulties with project licensing and lawsuits against new installations, particularly regarding onshore wind turbines. The following hurdles are the most important to overcome for the renewables expansion to become faster:

Licensing

Easing regulation on new renewable power projects and speeding up licensing procedures is one of the most urgent measures to achieve short-term gains in expansion. Many projects already have been planned but are still held up due to unresolved approval issues and lengthy licensing procedures for new wind farms have been plaguing the industry for years. These usually involve questions like minimum distances to residential areas and construction permits in ecologically sensitive areas. Wind power companies said procedures have to be streamlined and conflicts with nature conservation resolved through standard practices. The government in early 2022 presented changes to species protection requirements that include uniform legal standards in all states. The changes could halve the average licensing time from currently six to three years. Moreover, new distance rules between wind turbines and radar installations or rotating radio beacons could free up some 5 gigawatts of onshore wind capacity can be freed up, allowing for around 1,200 new wind turbines to be built within a short time. One of the fastest and most reliable ways to quickly increase output would be to retrofit existing wind power production locations with new and more productive turbines, so-called repowering, the BWE said. However, the number of new turbine licenses issued in early 2022 was still lower than one year before.

Solar power projects on average are much easier to implement than wind farms. But homeowners and businesses willing to install solar power panels on their roofs are often left alone when applying for necessary licenses and support frameworks. The BSW Solar said district management concepts that bundle installations could improve local usage of solar power and quickly equip whole neighbourhoods with renewable power in a coherent way. In early 2022, the government also agreed on opening up more agricultural spaces as well as moorland to solar PV installations.

A growing number of regulatory hurdles and more expensive licensing procedures have also hampered investor activity for bioenergy plants, industry group Fachverband Biogas said. “Completely overblown” construction restraints would make projects unprofitable and some of the often small- and medium-sized suppliers would even struggle to find their way through the required paperwork.

Acceptance

Protests by local interest groups against renewable power installations have held up implementation of many projects in recent years, often coming from neighbouring residents who reject energy infrastructure near their homes. Wind power group BWE said the Ukraine war could now tip the balance in many key areas currently hindering a faster expansion, as administrations, businesses and ordinary citizens reconsider the contribution wind power makes to energy security. “Independent supply can only be achieved with renewables. We expect this to become conventional wisdom,” the BWE said. The important hurdle of minimum distances for new turbines therefore is coming under increasing pressure to be justified. In its Easter Package, the government establishes the principle that the use of renewable energies is of overriding public interest and will be given priority over other concerns until greenhouse gas neutrality is achieved. Incentives for achieving higher acceptance agreed include exemptions for citizen energy initiatives from having to participate in auctions and better access for local communities to benefit financially from wind parks and ground-mounted solar PV nearby.

Solar power is generally more accepted by neighbouring residents, since even larger installations are less visible and attract less attention than the tall wind power turbines. In fact, many citizens not only tolerate but also want to take part in solar power expansion, as more and more homeowners mull installing panels on their roofs, often together with solar-powered batteries in their cellars. As of late 2021, one in three households had considered an installation either for power generation or heating, with the main drivers being greater energy autonomy and rising prices, according to the Renewable Energy Agency (AEE). BSW Solar said this trend had only been amplified since the Russian invasion started and some states have also begun to make solar panels mandatory on new homes.

Investment

Faltering investor confidence has long been a major impediment for Germany’s renewables industry, with tender volumes especially for wind power seldomly being fully used up in recent years due to uncertainties about expected profits. Binding commitments regarding buildout volumes and the required renewable power capacity could now offer a clear perspective for producers and grid operators to deliver the required hardware and provide corresponding logistics, wind power group BWE said. Surging interest in renewable power companies’ stocks in the wake of Russia’s attack appear to back up this assumption and the government has said it will halt support degression until 2024 to sustain this trend. Offshore wind auctions will be re-designed to include Contract for Difference (CfD) schemes.

Solar power industry group BSW Solar said more changes to the support scheme under the Renewable Energy Act are still needed to ensure a steady buildout despite already surging interest. Support rates for roof-mounted panels have to be adapted to higher expansion targets and attract investors irrespective of whether they primarily plan to market their power or use it for their own consumption. The government agreed to split auctioned volumes equally between rooftops and open spaces and granting higher remuneration to small rooftop installations outside the tender scheme, including a halt to remuneration degression until the beginning of 2024. Installations on agricultural land or moorland receive a bonus payment to become competitive.

Bioenergy association Fachverband Biogas said changes to the support regime are also necessary, since auctioned volumes had never been fully used up since tenders replaced guaranteed remuneration rates set by the state in 2017. This is despite the fact that the technology could contribute much more to a system based on 100 percent renewables, as it allows the storage of renewable energy and is scattered all over the country, making supply more flexible, the lobby group argued. The government in its renewable power law reform said it will focus subsidies on highly flexible bioenergy power stations and increase tender volumes for biomethane, which allows for more flexible use.

Workers

A lack of skilled workers is widespread in Germany’s construction and manufacturing sectors, posing a challenge to renewable power companies’ ambitions. Heating industry association ZSVKH said the goal of installing up to 6 million heat pumps across the country could become unattainable due to a shortage of skilled labour. About 60,000 workers would be lacking, ZSVKH head Michael Hilpert said at a conference in early 2022. The decarbonisation goals in the sector “cannot be achieved with the existing potential” of workers, he argued.

Solar power panels have a high degree of automatization in production, meaning that hardware production can be scaled up fast with corresponding investments in machinery. But labour could become scarce for installation of the panels, which requires manual work on the ground. While some solar power installations and especially larger ones are made by internationally active teams, producers could benefit from a short-term influx of skilled domestic labour if only a fraction of the huge workforce in electrical trading is retrained to put their abilities to use for the energy transition, BSW Solar said. For this to happen, policymakers would have to ensure the expansion level boom will not be short-lived but offers business opportunities in the long run.

Wind turbines are generally produced with a greater degree of manual labour and mounting them requires both skilled workers and specialized equipment like cranes and lorries for oversized transports. The BWE started an initiative to recruit more people for wind turbine planning, production, installation and operation in 2022. The industry group said the federal employment agency estimates up to 40 percent of all labour needs for climate neutrality would fall into categories in which finding skilled workers already is a challenge. In the offshore wind industry alone, about 3,000 jobs have been lost since 2018 as expansion collapsed, industry group WAB said. The 2045 goal of 70 GW offshore wind could only be achieved if corresponding investments in production facilities, workers and port infrastructure is made now, it said.

Raw materials / Supply chains

The coronavirus pandemic delivered a blow to the smooth functioning supply chains in many industries around the world, including producers of renewable power installations. Although renewable power installation producers for the most part do not depend on direct raw material imports from Russia or Ukraine, supply problems have been exacerbated by the war and the ensuing rise in commodity prices. The BWE said solutions could only be found together with the government. Raw material cost hikes and have already led to concerns that these might greatly inflate German energy transition’s bill and about a possible phenomenon dubbed "greenflation," whereby cost increases in low-carbon technology outruns that in other sectors.

Solar power group BSW Solar said it is confident that the disruptions can be overcome by 2023. However, in a survey in early 2022, more than half of the solar power companies asked said they currently struggle to implement projects due to supply chain troubles. The case for improving Europe’s self-reliance with critical resources by exploiting domestic reserves is therefore likely to become stronger among producers who are wary that frictionless trade could be thwarted by systemic shocks and also tighter regulation on supply chain transparency.

5. What about the parallel expansion of grids and storage capacity?

A power system based on 100 percent renewables needs a variety of storage technologies to become flexible enough for servicing an entire country. These include battery storages, either small ones at home or industrial-scale batteries in factories and pumped-hydro storage, biogas and hydrogen made with renewable power for other large users. Sector-coupling approaches like power-to-heat also allow the direct integration of renewables into the heating sector. In its coalition agreement, the government said that as of 2025, every new heating system had to be operated with 65 percent renewable energy, such as green hydrogen. But the electrolysers needed to turn electricity into hydrogen also require long licensing procedures. Solar PV could also play a significant role in substituting heating gas, lobby group BSW Solar said, arguing that a lack of adequate policy instruments is what keeps solar from being “unleashed” in the sector. Retrofitting existing oil and gas heating systems with additional solar thermal installations could reduce fossil power use significantly and renewables could also play a greater role in district heating, both with solar and geothermal power.

More storage options also mean that less power has to be fed into the grid. But the power grid is still in need of considerable investments to make it ready for the end of fossil and nuclear power. Grid expansion and modernisation that allows the integration of added capacity of renewables and replaces fossil power plants will be just as important as constructing more wind turbines and solar panels. The large planned transmission lines that are needed to connect windy northern Germany with industry centres in the south are said to be “years behind schedule." Furthermore, local distribution grids have to be upgraded to become more flexible to allow for feed-in by prosumers with solar panels on their homes.

The many decentralised and intermittent renewable power installations require that electricity surplus flows can be redirected through distribution grids during peak input times, such as periods of heavy winds or sunny days around noon. Storage options and load management are one way to provide flexibility, but retrofitting grids to allow for bi-directional power flows will be required too, industry group BEE said. Renewable power association LEE Niedersachsen said bioenergy plants could quickly ramp up their output if load management was improved. In times of high wind power output, too many biogas plants would still be turned off too often to shed load, which also cuts off heat generation with biogas. A better integration of heat and power supply management could offer quick relief, the LEE said.

6. How can Germany’s renewables push be integrated in European climate neutrality plans?

Germany’s central position in Europe makes the integration into a broader European energy transition framework an obvious aim. Renewable power industry group BEE said EU coordination still has considerable room for improvement, given the new urgency posed by the looming standstill of energy trading with Russia. The European Comission’s REPowerEU package has to be integrated into national law quickly in order to make headway regarding a pan-European renewable power system.

Even if rising energy prices are causing concerns over the EU Green Deal’s planned comprehensive carbon pricing system, a better coordination of energy transition efforts offers numerous no-regret investment opportunities for the bloc that helps to make its energy supply both more resilient and more sustainable. The EU Commission said its "Repower EU" plan scheduled for spring 2022 could include higher renewable power goals to take into account the aim of freeing Europe from its dependence on Russian supplies.

According to an analysis by Finnish energy company Wärtsilä, Europe as a whole could halve gas consumption by 2030 by doubling its renewable power capacity. Adding about 80 GW of renewable power capacity per year, roughly twice the current level, would allow it to bring the renewables share in production from roughly 33 percent in 2022 to more than 60 percent at the end of the decade -- a “sizeable but realistic” task for European governments, the company said. If the envisaged buildout is achieved, all of Europe could not only massively reduce fossil fuel imports but also have a net-zero energy system by 2040, 10 years earlier than planned.