Disruption caused by energy transition is unstoppable - Amory Lovins

Clean Energy Wire: As a long-time advocate and observer of the global energy transition, how do you evaluate the current progress?

Amory Lovins: On the whole, the global energy transition is going very well and continues to accelerate. The course is not always smooth, but the direction is unstoppable because it’s now largely business-led and market-driven — it’s no longer a creature of policy, although of course policy plays an important role in many countries.

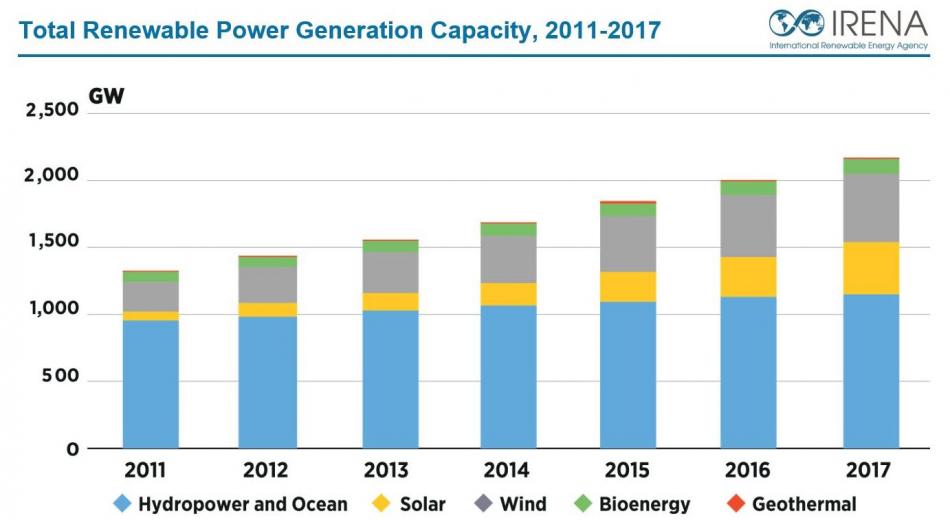

The pace of saving energy and decarbonising supply both accelerated sharply from about 2010. Modern renewables (those other than big hydro dams) last year provided 64 percent of the world’s net additions of electric generating capacity. Solar energy alone added more net capacity than all fossil fuel generation combined. Developing countries now dominate investments in a ratio of 1.7 to 1 against developed countries. This year, the solar and wind additions will be predominantly in developing countries as well, so they are leapfrogging over the old investment patterns. China and India have become renewable leaders.

But perhaps the most striking indicator for the energy transition’s progress is that a year ago, global modern renewable capacity reached a trillion watts—a terawatt of installed capacity. That took about 15 years but IRENA says that the next trillion watts will only take about four years—which would be about three years from now. When I mentioned that the business case is the most fundamental driver, it’s not simply that renewables are cheaper than fossil or nuclear power in most parts of the world—and they will be in all major regions within another year and a half or so—but also that modern renewables yield increasing returns to volume: As they get cheaper we buy more, and that makes them cheaper, so we buy still more, and so on in a virtuous circle.

The big surprise to many people—which I published 18 September 2018 in the paper “How big is the energy efficiency resource”—is that modern energy efficiency often has the same attribute. Not only renewables, but also efficiency can cost less as we buy more. That’s very good news for the climate.

You know Germany very well. What are your thoughts on the state of the German energy transition?

There is a commendable and exciting activity at the level of the federal states and many communities. However, the renewable transition in electric supply has seriously lost momentum in the past few years because the federal government has changed the rules to eliminate the democratisation goal that was so basic in the original Energiewende, and to favour the incumbents who were being seriously inconvenienced by having missed the train.

There have been enormous business failures and consolidation among the smaller players who cannot afford the scale requirements, transaction costs and complexities of the auction system that replaced feed-in tariffs, and other restrictions have deliberately throttled back the pace of renewable additions—presumably to accommodate the incumbents whose coal and nuclear investments cannot compete but are being protected. This is possibly set for improvement as the coal commission does its work—that’s been the main political roadblock—but it’s still very disappointing and a setback for Germany’s and the world’s energy progress.

As I said in my acceptance speech for the award of Germany’s Officer’s Cross of the Order of Merit [Bundesverdienstkreuz 1. Klasse] in 2016: “Energy in the hands of citizens is power in the hands of citizens. That’s good for democracy and bad for those who can’t hold their ground in the competition. The 2016 legal changes have wrested the initiative from citizens and cooperatives, and helped restore some of the utilities’ power. The initially brave Energiewende that supported the new energy system instead of defending the old has lost some of its creative power.”

I think the more Germany tries to slow down renewables at the federal level—as Japan has also notably tried to do to protect the incumbents—the more it will become clear that this harms the national interest. We really need to not protect the old system, but enable the new. And this is exactly what Germany did at first after Fukushima. But then in the past few years this became too painful for the incumbents, they exercised their political power, as I interpret it, and the federal government obliged them.

Similar processes seem at work in the mobility sector. The German government recently blocked more ambitious proposals for limiting CO2 emissions from cars at the EU level to protect the German car industry.

That doesn’t protect the carmakers; instead, it actually increases their risk of being left behind. I’m very closely involved in the automotive and mobility revolutions, advising governments and automakers in China, India, and other places. If the technical skills that exist throughout the German car industry are not matched by equal strategic boldness, the German car industry will be in serious trouble. This transformation of the auto market cannot be held back. If Germany chooses to stall rather than lead, it will simply become less relevant.

Remember that this is not only about what kind of cars we make, but also how they are used. I sometimes say that autos are evolving from PIGS to SEALS: PIGS are Personal Internal-combustion Gasoline Steel-dominated vehicles, and SEALS are Shared, Electric, Autonomous, Lightweight Service vehicles (meaning mobility as a service). So that’s two changes in technology and three changes in business model, all simultaneous, and all mutually reinforcing.

At the same time, the redesign of many cities around the world around feet not tyres—meaning around people, not cars, no longer treating cars with favouritism, and making sure that drivers get what they pay for and pay for what they get—is a further strong evolutionary pressure on the car industry. In the US, we expect peak private car ownership in the next few years. This is obviously a big shock for the car and oil industries. But it will make cities more liveable, with greater access for more people, cleaner air, less oil-dependence, less climate change, and less cost.

When you have many electric cars, batteries become very cheap not only for cars, but also for everyone else. New types of batteries rapidly emerging, too, require no materials that are scarce, costly, toxic or flammable. Just as the cars will have no extra purchase price to be electric starting in the early 2020s, so the batteries will make your rooftop solar 24/7 at very little extra cost. Then it becomes much cheaper to do that than to get the costlier and less reliable power from the grid. So the grid itself is at risk of becoming a stranded asset like telephone-company copper wires. Bypassing the electric grid, much as wireless telephony displaced those copper wires, gives utility executives nightmares, but it gives venture capitalists sweet dreams.

You cannot think of the competitive crises of the electric and car industry separately. They are now intimately related; each drives the other.

In the past few weeks, several German carmakers have presented their vision of what the future of mobility will look like. Both Audi and Mercedes showcased heavy cars without prominent use of lightweight materials—basically SUVs powered by batteries—which is the opposite design of what you’re proposing in your efficiency paper.

There is a lot of inertia in these large and complex organisations. But as in the electricity business, markets can change very dramatically. I’ve been talking to all of these companies for many years and those conversations made me more worried about the future of the German car industry—except for the case of BMW, which applied real engineering genius to the i3, a remarkably good integrative design. In fact, I drive an i3, which pays for the lightweight carbon fibre in its passenger cell by needing fewer batteries to pull the weight around. And of course, fewer batteries also recharge faster. This design nicely demonstrates the increasing yield of efficiency. And the manufacturing in Leipzig reportedly needs one-third the usual capital and water, and half the usual energy, time, and space, making this 1,7–1,9 L-equivalent/100 km car profitable from the first unit.

When photovoltaics were only five percent or less of German electricity production, the business model and over half the market capitalisation of the ten biggest utilities in Europe disappeared, starting with E.ON and RWE. If you look back at economic history, it is indeed common that the value of old businesses deflates very rapidly, while the output of the old technology stagnates and starts to fall, even when the replacement technology is only at the few percent level. That is most strikingly illustrated by some archival photographs that Tony Seba found. If you look down New York’s Fifth Avenue in the Easter Parade in 1900, you must look hard for the first car.

Just 13 years later, you must look even harder for the last horse. The US market for non-farm horses actually peaked in 1910, when cars were only three percent as numerous as horses.

The fraction of American households owning a car went from 8 to roughly 80 percent in just over a decade (to 1928) as Henry Ford cut the price of the Model T by 62 percent and General Motors and Dupont invented a financial innovation called car loans, which financed three-fourths of those purchases. Of course, in our own time, solar panels have become 80 percent cheaper in five years, not 62 percent in 13 years. Most of our rooftop solar is innovatively financed with no money down. Basically, Edison’s electricity industry and Ford’s and Benz’s car industry are rapidly coming together to eat Rockefeller’s oil industry.

All of this shows that both customers and investors can see these big shifts coming and start to adopt them rapidly if it makes sense and makes money. Capital markets in particular keenly sniff out disruption, and if they catch its scent—if they think that an old industry is already in or headed for the toaster—they don’t wait for the toast to get done before they decapitalise the old and invest in the new.

The car industry and to some degree the traditional building industry on the efficiency side show that there are many inertias in business models, legacy assets, and culture, but the pace of these transformations is not set by the incumbents and constrained by their inertia. It is set by the insurgents and propelled by their ambition. And the insurgents are not inhibited by the business models, legacy assets, and culture of the incumbents. They have nothing to hold them back. So in the German Mittelstand, we see greater agility and ambition that can help to either save or replace any larger enterprises that move more slowly.

In your latest paper you already mentioned, you argue that efficiency is much cheaper and has much greater potential than most economic models assume. But in the building sector, Germany is nowhere near the rate of renovations needed to achieve climate targets. Why is efficiency so often neglected? How can we realise its full potential?

The energy you don’t use is invisible, whereas renewables are highly visible on the rooftop or the skyline. This might help explain why in the US since 1975, energy savings have been 30 times as big cumulatively as the increase in the same period from the cumulative output of the doubled renewable supply. And yet the ratio of headlines is the opposite. In Germany, there is quite a lot of variations between the Länder and between different towns and cities in the degree of policy attention and industrial focus that efficiency receives.

The Passive House Institute in Darmstadt has certified about 1.8 million passive buildings, and interestingly, about two thirds are reportedly retrofits rather than new buildings. There is now ample evidence that the total cost of ownership is much less with deep retrofits and passive house-level new buildings than just continuing to run and fix buildings incrementally.

At the same time, the Dutch innovation Energiesprong, which is spreading across Europe and abroad, substitutes industrialisation for much of the craft labour, by effectively putting a tea cosy around your house. Instead of fixing each element of your house separately, they install an industrially prefabricated super-insulated shell, including of course photovoltaics integrated into the roof, and a new utility core with a very efficient heat pump for hot water. The building goes to zero net energy, and they’re rapidly getting the costs down to the point where it can be financed entirely from the energy savings without subsidy. They’ve even demonstrated the ability to install this whole retrofit in a single day while you’re off at work. So you come back from your job that day, and suddenly you have no energy bill.

I’m hoping that my new paper, which is being translated into German, will help efficiency providers, investors, and policy makers to realise that the same attractive economics demonstrated by these 1.8 million passive buildings apply also to integrative design in industry and in vehicles. I think this is a new proposition.

It’s heartening to see that you have remained an optimist…

I’m not an optimist, and I’m not a pessimist. Both are different forms of fatalism, in which you treat the future as fate not choice and you don’t take responsibility for creating the future you want. So I prefer to live in the spirit of applied hope.