What's new in Germany's Renewable Energy Act 2021

After two big reforms of Germany’s Renewable Energy Act (EEG), the latest amendments came into effect on 1 January 2021. The EEG 2021, as it has been named by the Ministry for Economic Affairs and Energy (BMWi) that is in charge of the bill, was approved by the federal parliament (Bundestag) in December 2020 after introducing some last minute changes. This factsheet gives an overview of the most important provisions in the new law.

Germany’s renewables legislation, which was launched 20 years ago, is responsible for the significant growth in onshore wind, solar PV, and biogas by establishing grid priority for these power sources and guaranteeing them generous feed-in tariffs. Together with offshore wind and hydro power, these renewable sources now cover half of the country’s electricity consumption. Subject to various changes in the past, the EEG’s next overhaul is staying true to the act's latest principles of making renewable power producers more market-ready by sticking to renewable tenders while incorporating new developments such as the 2020 national hydrogen strategy and electricity pricing for e-car charging. By 2027, the government wants to propose how, and by when, renewables funding via the EEG could be stopped entirely – provided a market-driven renewables expansion is to be expected.

2050 greenhouse-gas neutrality in the power sector becomes part of the law

Germany’s goal to become greenhouse gas neutral by the middle of the century is officially made the guiding principle of the EEG 2021. "The aim of this law is also to ensure that before 2050 all electricity generated or consumed in the territory of the Federal Republic of Germany [...] is generated in a greenhouse gas-neutral manner", the latest draft reads. Both the electricity generated in Germany and the power imported to the country will have to meet this requirement, which implies the European Union is expected to stay on track to its corresponding 2050 neutrality target as well.

Alignment with more ambitious EU climate target pending

EU member states have decided to increase the bloc’s 2030 climate target. For Germany this likely means adjusting its national emission reduction goals. The tighter target means that a faster expansion of renewable power sources will be necessary, federal environment minister Svenja Schulze has said. One of the major sticking points in the final negotiations in parliament on the EEG 2021 have been these overall renewable expansion targets, which many believe should be much higher to account for the future electricity demand from e-cars and heat pumps. This issue was resolved by postponing the adjustment of the target for the renewables share in power consumption (currently at 65%) to the first quarter of 2021.

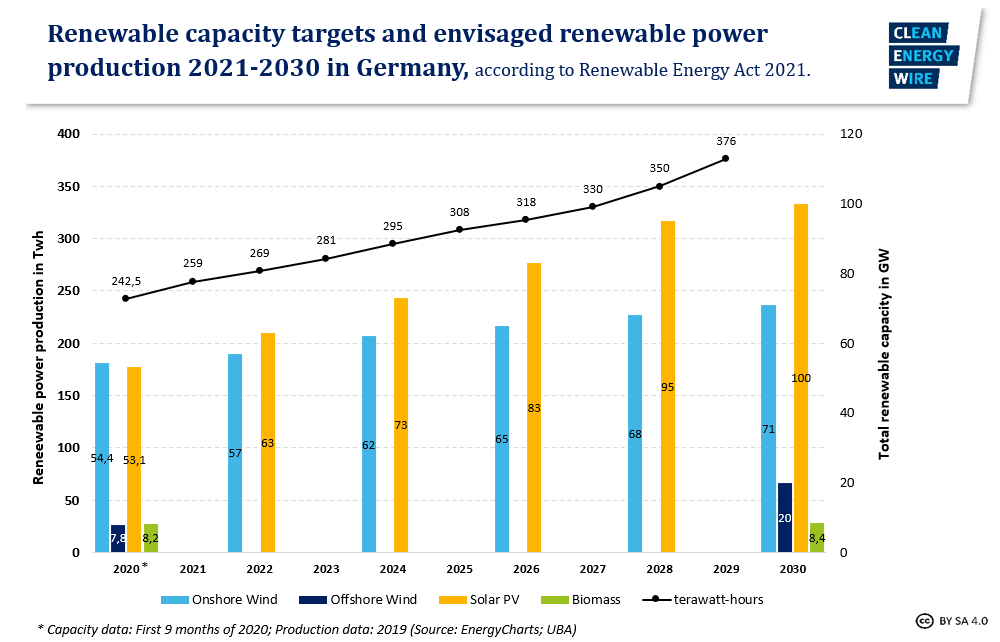

Shortly after this deadline, the coalition reached an agreement to raise expansion targets for Solar PV and onshore wind in 2022, compared to the originally agreed legislation. Solar PV acutions are to rise three-fold, from 1.9 gigawatts (GW) to 6 GW. The tender volume for onshore wind capacity will be raised from 2.9 GW to 4 GW. However, no changes to the 2030 target and the predicted power consumption were made by the coaltion parties who refered these issues to the next government coalition, to be built after the September 2021 election.

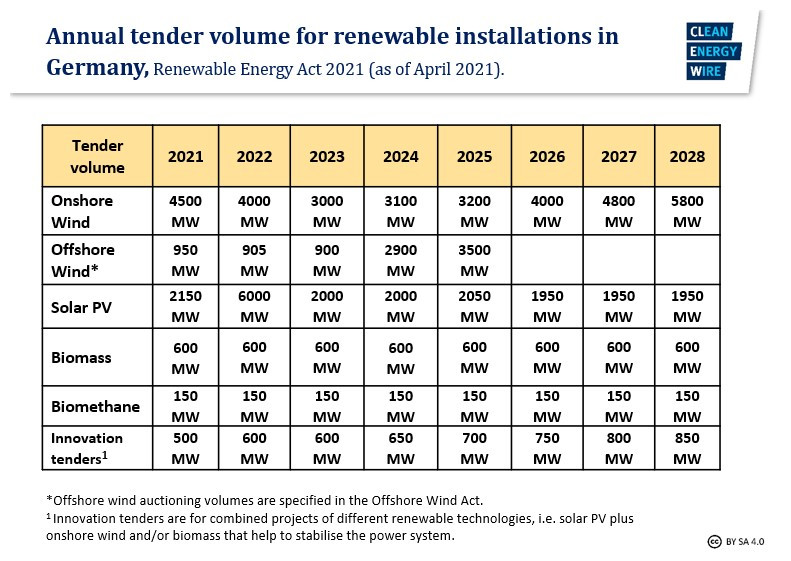

Renewable tenders – new expansion paths to reach the 2030 goal

The new EEG plans increasing solar PV capacity to 100 GW (~52 GW today), onshore wind to 71 GW (55 GW today), biomass to 8.4 GW, and offshore wind to 20 GW by 2030 - targets that slightly exceed those from the Climate Action Programme 2030, which was decided in late 2019. The law sticks to annual deployment targets to make sure that capacity addition is compatible with the 65-percent-renewables target and allows for the adjustment of the power grid to incorporate the growing output from fluctuating renewables.

An additional 500-850 MW per year will be tendered in so called “innovation auctions” that are not technology-specific and where a combination of onshore wind, solar PV, biomass and/or power storage devices work together to stabilise the power system. Agri- and floating PV solutions can also participate in these auctions.

Interim solution for pioneer installations

The law includes an interim solution for small solar PV installations (up to 100 kW) that will stop receiving payments in the 2020s because their 20-year funding period runs out. Marketing the power from these very small installations would not be economically viable for their owners. But in order to prevent them from being deconstructed or from feeding in their power “wildly”, they will be given an interim remuneration for their electricity until 2027, amounting to the market value minus marketing costs.

Old onshore wind turbines, of which some 16 gigawatt could be decommissioned by 2025, are not going to benefit from this rule since even the oldest and smallest ones rarely have a capacity of under 100 kW. They do, however, retain their feed-in priority over conventional power sources and can therefore remain connected to the grid and market their electricity themselves. To alleviate the problems caused by low electricity market prices during the COVID-19 pandemic, the bill does include an interim solution for payments for onshore wind turbines until the end of 2021.

In April 2021, the German government cancelled planned auctions as of 2022 for old onshore wind turbines to secure continued operation after their 20-years feed-in tariffs run out due to concerns over illegal state aid by the European Commission. The temporary support payment to old wind parks during the pandemic had been permitted by the Commission, but further payments as of 2022 and the planned auctions have been cancelled. The BMWi reasoned that, as of 2022, power prices will be stable at around 5 cents per kilowatt-hour again, so that wind installations can achieve enough revenues by selling their electricity on the market.

Changes to the renewables levy on the power price

Nearly every power consumer in Germany helps to fund renewable energies by paying the so-called renewables or EEG surcharge (or renewables levy) on every kilowatt-hour used. Very energy intensive companies can be made (partially) exempt from the surcharge if it impairs their competitiveness on international markets. The levy is used to bridge the gap between the wholesale power price and the guaranteed remuneration that renewable installations receive per kilowatt-hour they feed onto the grid.

Newer installations, in particular those whose feed-in payments have been determined through auctions, receive little more than the average wholesale power price on the market. But a big bulk of older installations are entitled to payments that exceed the market price. Depending on the wholesale power price and the amount of renewable electricity produced, the EEG surcharge changes every year. In 2020, the surcharge amounted to 6.76 cents which is around 20 percent of the price per kilowatt-hour that an average household pays.

The reformed EEG 2021 makes an important change: The EEG levy will now partially be funded from the federal budget. The government’s climate package, agreed in autumn 2019, stipulated that the surcharge will fall by 0.25 cents per kilowatt hour (kWh) in 2021, by 0.5 ct/kWh in 2022. Initially the government will use 11 billion euros towards this power price reduction and as of 2021, the revenue from the new CO2 pricing of transport and heating fuels will also be used. The levy has been set at 6.5 ct/kWh for 2021.

In April 2021 the coalition parties in German parliament also decided a cap on the EEG surcharge for the years 2023 and 2024. Funded from the state budget, the maximum will be set at 5 ct/kWh.

The EEG also promises solutions for those companies that are exempt from paying the levy. The economic downturn due to the COVID19 pandemic was threatening some companies to no longer reach the energy use thresholds for the exemption scheme, putting an additional burden on them if they had to pay the full renewables levy.

Other elements of the new law also aim at reducing costs for consumers, e.g. by decreasing the maximum values in tenders for onshore wind and photovoltaics, as well as increasing competition between solar PV systems by expanding the possible installation area.

Raise public acceptance of renewables expansion

With the new EEG the government wants to make good on its promise to foster acceptance of renewable power installations. It guarantees communities that allow wind parks to be built a share of the park’s income amounting to 0.2 Cent/kWh for 20 years. This amount can be reduced if the wind park operator offers discounted power supply contracts to people living nearby. In addition, wind park operators now have to pay the majority of their taxes to the municipalities where the turbines are located, instead of at their official company address.

The government also wants to help the so-called “tenant electricity scheme” get off the ground. While homeowners have long been able to profit from the energy transition by installing solar panels on their roofs and receiving feed-in payments in return, people living in rented flats have not been able to participate. Landlords of such blocks of flats often don't have enough incentives to install solar PV on these houses and letting their tenants use it. The EEG 2021 raises the level of the tenant electricity surcharge and makes it possible for landlords to be exempt from paying commercial tax to increase attractiveness even further.

More wind turbines and biomass in the south

In a bid to incentivise wind expansion in (less windy) southern Germany, the new EEG introduces a “quota for the south” (15% of successful tenders have to come from the south between 2021-2023 and 20% as of 2024). A similar quota (of 50%) also applies to tenders for biomass installations. The idea is to reduce the imbalance in generating capacity tilted towards the north of the country, which would have negative implications if north-south grid connections are not completed in time before nuclear power stations in the power-hungry southern industry regions are shut down entirely at the end of 2022.

In return, the law gets rid of the so called “grid congestion zones”, areas (mostly in the North of Germany) where onshore wind expansion had to be smaller because a high input of more renewable power would have likely caused grid problems. The ministry states that this instrument did not work “for several reasons”.

Negative power prices

Negative power prices occur when very low electricity demand, for example on national holidays, coincides with high power input from solar PV and wind during particularly sunny and/or windy days. Negative market prices drive up the renewables surcharge, so the EEG 2021 is forcing new renewable installations to react more flexibly to avoid excess production during such times. They will cease to receive their feed-in remuneration when the spot market price is negative for four, instead of six consecutive hours.

The government reasons that plant operators will have to “find their own ways of hedging against negative price phases, for example by entering into cooperation agreements with storage operators, by using new plant technology that enables more continuous electricity production or by entering into hedging transactions on the electricity futures market”. The rule may be tightened even further after the energy ministry has reviewed the renewable targets in the beginning of 2021.

Solar PV

The bill obliges solar PV installations on rooftops of over 750 kilowatt-peak (kWp) to participate in tenders. All smaller rooftop PV installations receive a set feed-in remuneration, the same will apply to citizen run solar parks. The EEG 2021 also gives the option to rooftop PV systems as of 300 kW to participate in tenders. All systems between 300 and 750 kWh are offered the choice of either participating in a tender or taking advantage of fixed feed-in tariffs and consume part of their electricity themselves. The latter will only receive feed-in payments for 50 percent of the electricity they generate.

Smart metering

The energy ministry is sent back to the drawing board on the mandatory installation of smart meters for small renewable facilities (previously as of one kW capacity up to 7 kW), to find an approach that “advances the digitalisation of the energy transition but at the same time doesn’t place an excessive burden on the affected renewable plant operators.”

Incorporating hydrogen

In line with its new hydrogen strategy, the government (partially) exempts producers of green hydrogen from having to pay the renewables surcharge on the power they use. Companies producing hydrogen with renewable electricity sources and who make sure that their facilities and product contribute to grid stability and the overall sustainable development of the energy supply, are fully exempt from the levy, others only partially. However, these green hydrogen producers have to use renewable power installations that have not been subsidised via the Renewable Energy Act (EEG), for example those getting renewable electricity under a power purchase agreement (PPA).

As one of the key technologies for a climate-neutral society, and in the view of the high costs during the time of scaling and learning, cost-reducing framework conditions are needed for green hydrogen, the government reasons. The support is also given to prevent production from migrating abroad.

The government estimates that up to 290 hydrogen projects will apply for the partial or complete exemption by 2030. By that time, the market ramp-up phase for hydrogen will be completed and a full exemption from the EEG levy will no longer be necessary, the government argues.

What is missing in the bill

The government coalition has postponed a range of decisions on renewable energy legislation to 2021. This includes the decision on higher renewable targets in line with the new EU 2030 climate target (see above) and the specifications on tenders for old wind turbines (see above).

In an addition to the bill, parliament listed further actions that it expects the government to take in the area of renewables promotion in the near future. These include a concept on how the renewables surcharge could be abolished in favour of an alternative, budget-neutral financing model; more legislative changes to facilitate repowering of existing wind farm sites and better framework conditions for power purchase agreements (PPA) between renewable operators and private consumers.

For criticism of the bill see the article “Breakthrough in Germany’s renewables reform: wind and solar capacity to grow faster”.