CLEW Guide – Poland's new govt yet to deliver on energy transition promises

With its “CLEW Guide” series, the Clean Energy Wire newsroom and contributors from across Europe are providing journalists with a bird's-eye view of the climate-friendly transition from key countries and the bloc as a whole. You can also sign up to the weekly newsletter here to receive our "Dispatch from..." – weekly updates from Germany, France, Italy, Croatia, Poland and the EU on the need-to-know about the continent’s move to climate neutrality.

(With contributions by Alicja Ptak and Wojciech Jakóbik)

Content:

Key background

- Since the October 2023 parliamentary elections, Poland has been led by a broad, pro-European centre left to centre right coalition. The government, headed by former European Council president Donald Tusk, is made up of Tusk’s Civic Coalition (30.7%), the Third Way alliance (14.4%) and the Left alliance (8.6%). It has pledged to accelerate the country’s energy transition. However, almost a year later it still has not delivered much in terms of legislation or new initiatives. A partial update to the National Energy and Climate Plan (mandated by the EU) has been presented and was the subject of public consultation. Although climate-focused NGOs welcomed the release of the plan, they criticised Poland’s hesitance to choose a more ambitious reform path in an open letter to the climate ministry. Even though Poland is months late with the update, the government says it’s still working on the final version and will finish it in the second quarter of 2025.

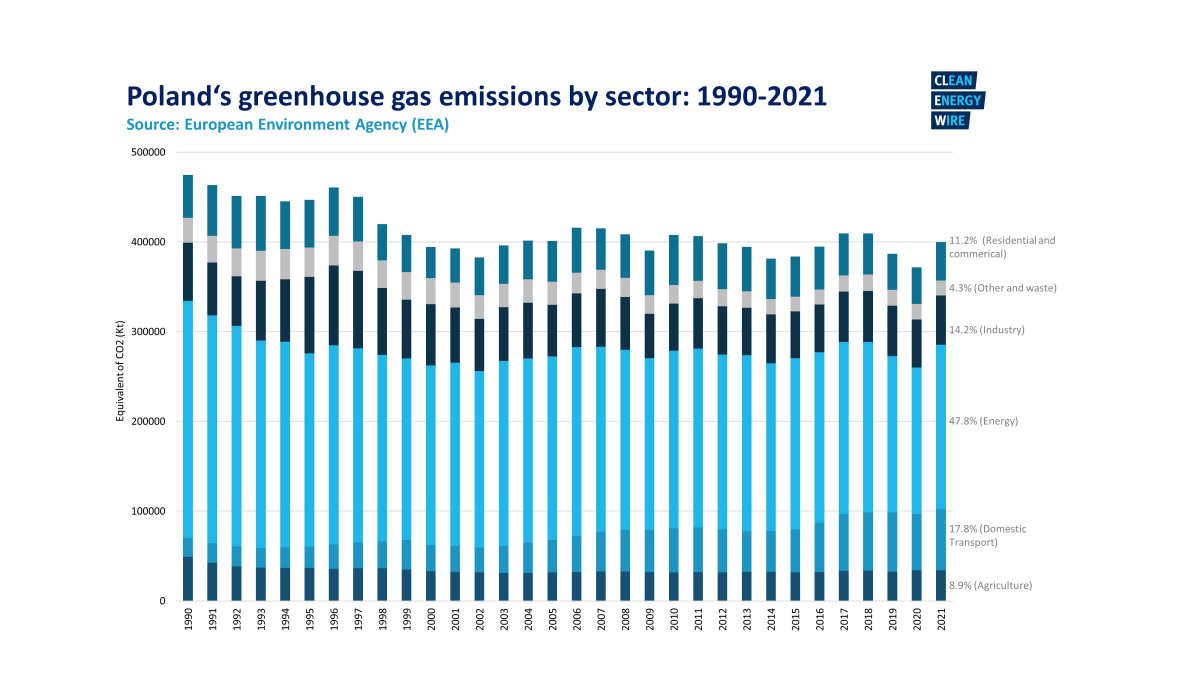

- Poland was responsible for about 11 percent of the EU’s total GHG emissions in 2022. Carbon emissions have fallen over 30 percent since peaking in the 1980s. Most of the reductions occurred in the 1990s during the fall of communism and the shift from an industrial planned economy. Emission levels have not changed significantly since 2001. Poland's current greenhouse gas emission reduction target in the EU for 2030 (for domestic transport, buildings, agriculture, small industry and waste) is 17.7 percent compared to 2005. It is far less than in countries like Germany or Denmark (50%), but Poland's total emissions in 2022 were just two percent below 2005 levels.

-

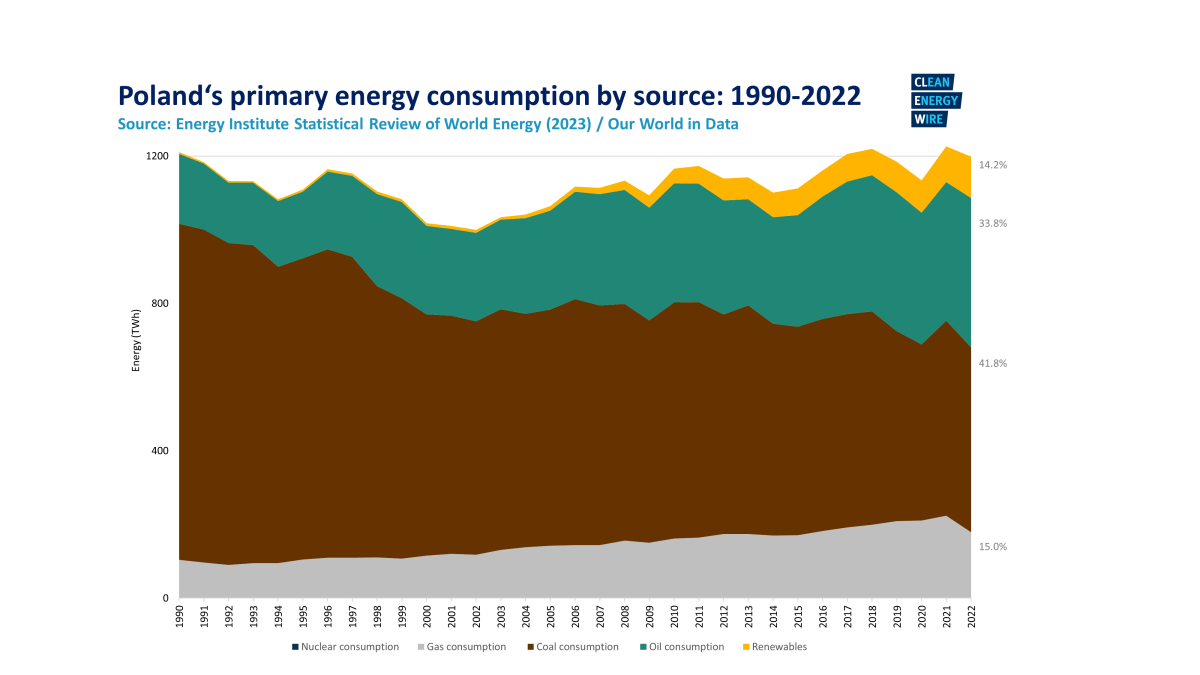

In the past years, Poland saw a significant drop in the share of coal in its electricity mix, from 70 percent in 2022 to about 57 percent in 2024. In the same year, the country increased its share of electricity generated from renewables by 2.3 points, to 29.6 percent. But even with the rise in renewables, coal remains the main source of electricity. Poland’s power sector has the highest carbon intensity in the European Union, making the coal phase-out a key challenge. Moreover, Poland is the only country in the EU that does not have an official date for ending coal power use. The country’s energy sector is dominated by big, state-owned or partially state-owned companies, like the oil corporation Orlen or Polska Grupa Energetyczna (PGE), an energy company that owns coal plants and mines.

- Poland has managed to diversify its gas, oil and coal supplies, after being heavily reliant on imports from Russia. In 2023, subsidies were put in place to keep gas and electricity prices down - but this cost the state tens of billions of euros. The government has extended the price freeze for households until September 2025. After peaking in 2023, the wholesale price for energy has fallen and stabilised in 2024 (though at a level significantly above pre-2022 prices).

- Air pollution is a major public health concern, fuelled not just by cars, but also by furnaces, as no other EU country uses nearly as much coal for heating.

Major transition stories

- The burden of coal – Coal power is the heaviest burden on Poland’s energy transition. The previous government said that Poland would be the last EU country to use coal for power generation well into the 2040s. With ageing plants and subsidies secured for just the next few years, many coal plants will face closure earlier than planned, possibly threatening Poland with a power generation gap. The new coalition government plans to accelerate the deployment of renewables which, if realised, would make the need for coal marginal around the late 2030s. More than a year after taking power, however, it still failed to deliver much of the legislation that would facilitate achieving this ambition. Just transition plans have been drawn up for coal regions, but not all of them will receive EU funding – the lignite mine in the region of Turów was not approved for support as coal extraction is planned to continue until 2044. A year into a new government in the office there are signs that Poland aims at prolonging the capacity market support for coal beyond 2030 and is going to invest in natural gas generation as an interim solution. Extraction at the open-cast lignite mine at Bełchatów, the largest such facility in Europe, is to be finished in the 2030s. Until then, the mine will receive funding. With a rising CO2 price in the EU ETS, coal is driving up electricity prices.

- Battery power-house — Poland is not among the EU’s leading car producers, but there is a sector that stands to gain from the transition to electric vehicles: battery production. In April 2023, Poland overtook the U.S. as the country with the second largest lithium-ion battery production capacity in the world. The sector sees the rise of EVs and energy storage as a huge opportunity. But a BloombergNEF projection sees Poland falling behind the U.S., Germany, Hungary and Sweden by 2027. New EU rules on carbon footprint could also put factories in Poland at a disadvantage.

- Going nuclear – Poland has not been able to successfully build a nuclear power plant, despite ongoing efforts since the 1970s. The first initiative from 1971 made it to the construction phase, but collapsed with the fall of communism and protests. A newer project, which began in 2009, became stuck in an early phase. Now is the furthest any nuclear project has come since the fall of communism, with the U.S. firm Westinghouse as technological partner. While 2033 was the official opening date initially planned, 2035 now looks more realistic. In February 2025, the Polish parliament approvedover 60 billion zloty (14.5 billion US dollars, the funding's currency) for the plant’s development, which would cover around 30 percent of the projected total costs. The rest is expected to come from foreign borrowing. Willingness to provide such borrowing – up to $17.1 million - was expressed by U.S. Export-Import Bank and US International Development Finance Corporation (DFC) which considers providing $1 billion in financing.Poland is also working on selecting a second location for another nuclear power plant and plans to announce the decision until the end of 2025. There are talks to include French EDF in a project in Bełchatów. Another public-private project being considered is a partnership with the Korean firm KHNP. State oil company Orlen is planning to build two Small Modular Reactor (SMR) units by 2035.

- Wind of change – Wind power development has stalled in recent years with the passing of unfavourable legislation. However, the new government is working on a bill that aimed at creating more favourable conditions for onshore wind expansion. Per a draft of its climate plan, Poland could double its onshore wind capacity between 2024 and 2030. Meanwhile, the European Commission has accepted the use of 194 million euros in funding to build a terminal to facilitate the construction and servicing of offshore wind farms in the city of Gdańsk. In early 2025 construction has begun on Baltic Power, the first offshore wind farm in Polish waters, with almost 80 15-megawatt turbines.

- Solar boom — Solar PV in Poland exploded from a marginal capacity in 2018 to over 19,5 GW by August 2024, having supplied 8.7 percent of electricity in 2023 (up from 5.7% in 2022) with both rooftop solar and utility-scale projects. However, this has pushed the outdated electricity grid to its limits, leading to thousands of projects being denied grid connection due to outdated regulations or just too much electricity for the grid to cope with.

- Poland has assumed EU Council presidency - On 1 January 2025, Poland took over the six-month rotating presidency of the EU Council. Security is the main priority of Polish presidency. It is also arguing for quitting all fossil fuels imports from Russia.

- Heating in peril – Sixteen million Poles are keeping their homes warm in winter with district heating, the largest number of district heating customers among all EU countries. The vast majority of district heating systems use coal and are considered inefficient. Experts say the sector is “underinvested, outdated and unprofitable,” with customers bearing the brunt of rising costs. In May 2024, Poland opened its first heating plant based on 100-percent renewable sources. It was, built with government support, using solar, heat pumps and heat storage. In March 2025, EU member states agreed with Poland's proposition of allocating an additional 30 percent of free emission allowances for district heating, a decision hailed by the Climate Ministry as success of Poland's EU presidency.

- Clean(er) air – Poland’s struggle with high air pollution has for years focused on heating, but now it is also starting to tackle cars. As of June 2024, Warsaw had the first Clean Transport Zone (Strefa czystego transportu - SCT) in the country. The city will gradually ban older cars (especially diesel-powered ones) from its centre. There will be, however, numerous exemptions. For example, the ban will not apply to the city’s residents until 2028. Cracow, infamous in Poland for its smog levels, was the first to agree on a Clean Transport Zone, but the bill was overturned by a court on formal grounds.

Sector overview

Energy

- Responsible for 50.1 percent of total GHG emissions in 2022.

- In 2024, coal was the main source of electricity (57.1 %). It remained the largest proportion by far in the EU, despite the significant drop from 70 percent in 2022. Wind and solar power’s share together rose to 23.7 percent and renewables in total reached almost 30 percent.

- The lignite plant PGE Bełchatów is the EU's highest emitting power plant, but now it has a plan to close down gradually until 2036 (with a 77% reduction until 2030).

- Poland plans a gradual phase-out of coal, replacing it with a mix of renewables and nuclear generation. New fossil gas plants are also to be built, but some plans have been revised after Russia’s invasion of Ukraine.

- In 2021, Poland adopted the Energy policy of Poland until 2040 (PEP2040) programme with the following main targets: 32 percent of renewables in electricity generation and no more than 56 percent of power from coal by 2030, and the first nuclear power plant starting operation in 2033. The plan has been criticised by NGOs and parliamentary opposition as “unrealistic.”Donald Tusk’s government, ruling since December 2023, is working on an update to the document (with no deadline officially presented yet).

- In a draft update of Poland’s National Energy and Climate Plan (NECP), put to public consultation in September, the climate ministry outlined an “ambitious” transition scenario for 2030: 50.4 percent GHG reduction (compared to 1990); 56 percent of electricity generated from renewables sources; and the share of coal-fired power generation falling to 22 percent (from 61 in 2023). Following the consultation period 25 climate-focused NGOs called on Poland to commit to the more ambitious scenario and not settle for “an unspecified compromise”.

The document is expected to be finished in the second quarter of 2025, before it is put to a vote by the Council of Ministers and ultimately sent to Brussels.

- According to electric grid operator Polskie Sieci Elektroenergetyczne, the installed capacity of photovoltaic panels and wind farms reached a combined 32.1 GW in October 2024, of which around 21 GW are solar PV. In 2014, total capacity was only around 3 GW.

Industry

- Responsible for 14.8 percent of total GHG emissions in 2021.

- It covers about 5 percent of Poland’s GDP and 400 thousand jobs.

- Energy intensity of industry (per GDP unit) is above the EU average, but companies are increasingly looking to improve efficiency and use zero-carbon energy, both in form of renewables and small nuclear reactors.

- CO2-intensive industries in Poland are comprised of both private domestic and international companies (like ArcelorMittal) and partially state-owned companies (like Orlen and Grupa Azoty). The sectors of Polish industry which emit most CO2 are cement, oil and coke as well as chemicals and fertiliser production.

- In 2022, energy-intensive industries struggled with big increases in electricity and gas prices. The high carbon intensity of the power sector is not only driving up prices, but also increasingly threatening their business as more and more clients are looking not just at price, but also at the carbon footprint.

- A draft hydrogen law was presented in September 2024. It aims to regulate hydrogen operating systems and create institutions similar to those already existing for gas, such as the company responsible for gas transmission infrastructure. The aim is to facilitate investments in hydrogen infrastructure.

Buildings

- Responsible for 10.7 percent of total GHG emissions.

- Solid fuels (coal, wood) and district heating (mainly coal plants) dominate in the heating sector, but gas boiler use has increased in recent years and can now be found in a quarter of all buildings (according to incomplete government data).

- The energy crisis has led to a boom in heat-pump sales, but they remain a small percentage of all installed heating systems.

- Until recently, Poles accounted for as much as 87 percent of the total amount of coal burned by EU households, and almost two-thirds of buildings in Poland are characterised by low energy efficiency. In 2022, the government suspended quality requirements for coal sold to households due to the energy crisis, and later extended that until the end of 2023.

- The current government targets are: coal phase-out in city households by 2030 and outside cities by 2040, with all heating covered by “low emission sources” or district heating by 2040 (experts point out that this could be achieved much sooner). The building renovation strategy sets a target of renovating and insulating 236 thousand buildings per year between 2020-2030, with numbers increasing in the next decades.

- Polish cities have some of the worst air quality levels in Europe with buildings being (mainly solid fuels furnaces) the biggest contributor to fine particulate pollution.

- Almost 29 billion PLN (€6.9 billion) were contracted for household heating source replacement in the “Clean Air” governmental programme; but until 2022 it was possible to get a subsidy for a more efficient coal furnace. The programme was suspended in November 2024 due to “irregularities” and is set to return on March 31 2025.

Mobility

- Domestic transport is responsible for 19.9 percent of total GHG emissions and is the only sector that had its emissions increase between 1990 and 2021.

- In 2019, the government adopted the Sustainable Transport Development Strategy until 2030. It assumes an 8 percent rise in CO2 emissions from transport by 2030 (compared to 2017) and has no specific target for the number of EVs. In a draft update to Poland’s National Energy and Climate Plan (NECP), Donald Tusk’s government concludes that it will be “impossible” for Poland to meet the EU’s target of 29 percent of renewable share in the transport sector – it projects a 17,7 percent share by 2030.

- The PiS government, in its official plans, was aiming for zero-emissions public transport in the biggest cities by 2030, as stated in Energy Policy of Poland (EPP2040). In 2016, then-deputy prime minister Mateusz Morawiecki announced that there will be one million electric cars in Poland by 2025, but, as of January 2025, Poland has just 146,000 electric cars, including almost 74,000 all-electric BEVs. According to Eurostat data, in 2023, Poland had the EU’s joint-lowest share of fully electric cars. The country also has just under 9,000 charging points.

- A new electric car subsidy program was launched in February. Worth PLN 1.6 billion (€380 million), the program provides subsidies of up to PLN 40 000 (€9,540) for the purchase of an electric car (if all conditions are met). The funds come from the EU's Recovery and Resilience Facility.

- Transport is the area of the transition which the United Right government was most squarely behind, at least rhetorically, promoting electromobility and even initiating a state-led project of Polish EV brand “Izera.” Now the project’s future is in question as the new coalition will be reviewing controversial initiatives from the PiS era. In September 2023, state auditors published a report stating that the project was "96 percent behind schedule." Over a year later, however, there is still no decision on the construction of the production plant.

- Poland is the EU’s leader in road freight, but the industry could be left out from the European market without a transition to zero emission trucks.

- Poland is Europe's biggest producer of lithium-ion batteries, and second-largest in the world (after China).

Agriculture

- Responsible for 9.5 percent of total GHG emissions in 2021, mostly in the form of nitrous oxide and methane (caused in around equal 40 percent parts by soil related emissions and direct livestock emissions).

- There is no governmental emissions reduction target; the government only points to EU-wide targets for 2030 and 2050.

- The government sees biogas as an important project in developing circular economy in rural areas and providing low carbon energy.

- The effects of climate change, especially drought, are already impacting Polish agriculture.

- Like in much of the Europe, big farmer protests took place in Poland in the first months of 2024. The biggest issue was food imports from Ukraine, but opposition to elements of the EU Green Deal were also among the reasons for the protest. Agriculture minister Czesław Siekierski (PSL/Third way) also called some elements of the EU’s climate policy “irrational”, and the government supported loosening some requirements by the EU.

Land use, land-use change and forestry (LULUCF)

- Forests and other areas remain a carbon sink and removed 35,6 million tonnes of CO2 equivalents in 2022. Around 30 percent of Poland is covered by forest (a number similar to countries like France or Germany) and around 80 percent of them are state owned and managed by a special public company, State Forests National Forest Holding. In 2022 State Forest had a record income of 13.5 billion PLN (~€3.1 bln) from selling wood. In recent years, the company has come under criticism from NGOs and private citizens for a number of issues, from lack of transparency to logging in old-growth forests. The Donald Tusks government is working on reforming the institution and protecting 20 percent of forest.

- The level of CO2 removal by forests has been decreasing over the last decade, with a sharp fall in recent years (from over 40 million tonnes to just over 20 million tonnes). According to Poland's emissions report, the main reasons are due to the long-term effects of disasters like permanent drought and storms with strong wind causing trees to fall. Timber harvesting is also on the rise.

- The former United Right government has been pointing to forest sequestration as a climate solution, including during COP24 in Poland; but sequestration levels have been falling and in 2021 it amounted to only 52 percent of Poland’s target for 2030. A solution proposed by the State Forestry organisation to counter this problem has had a marginal effect.

- In one of the first decisions of the climate ministry under the new government, logging was temporarily halted or at least reduced in in 1.3 percent of state-managed forests (78 percent of forest in Poland are managed by State Forests) . The locations were chosen for environmental and social significance. The coalition has promised to increase protection of 20 percent of the public forests by next election (in 2027).

- The new ruling coalition also wants to create Poland’s first new national parks in over two decades, as well as expand existing ones. It notes national parks cover only 1.1 percent of Poland’s land area compared to an EU average of 3.7 percent.

Find an interviewee

Find an interviewee from Poland in the CLEW expert database. The list includes researchers, politicians, government agencies, NGOs and businesses with expertise in various areas of the transition to climate neutrality from across Europe.

Get in touch

As a Berlin-based energy and climate news service, we at CLEW have an almost 10-year track record of supporting high-quality journalism on Germany’s energy transition and Europe’s move to climate neutrality. For support on your next story, get in touch with our team of journalists.

Tipps and tricks

- CLEW’s Easy Guide to Germany’s transition with background information and links to key energy and climate data.