National climate measures and European emission trading: Assessing the ‘waterbed effect’

How the ETS works

The European Union’s Emissions Trading System (EU ETS) is a cap-and-trade market mechanism, which sets an overall limit on greenhouse gas emissions from power stations, energy-intensive industries and civil aviation (so-called ETS sectors). The cap was set to achieve a 21 percent greenhouse gas reduction from the ETS sectors across the EU by 2020 and a 43 percent reduction by 2030 (both compared to 2005).

The system, created in 2005, includes more than 11,000 power plants and factories in the 28 EU member states plus Iceland, Liechtenstein, and Norway, and covers around 45 percent of the EU’s greenhouse gas emissions.

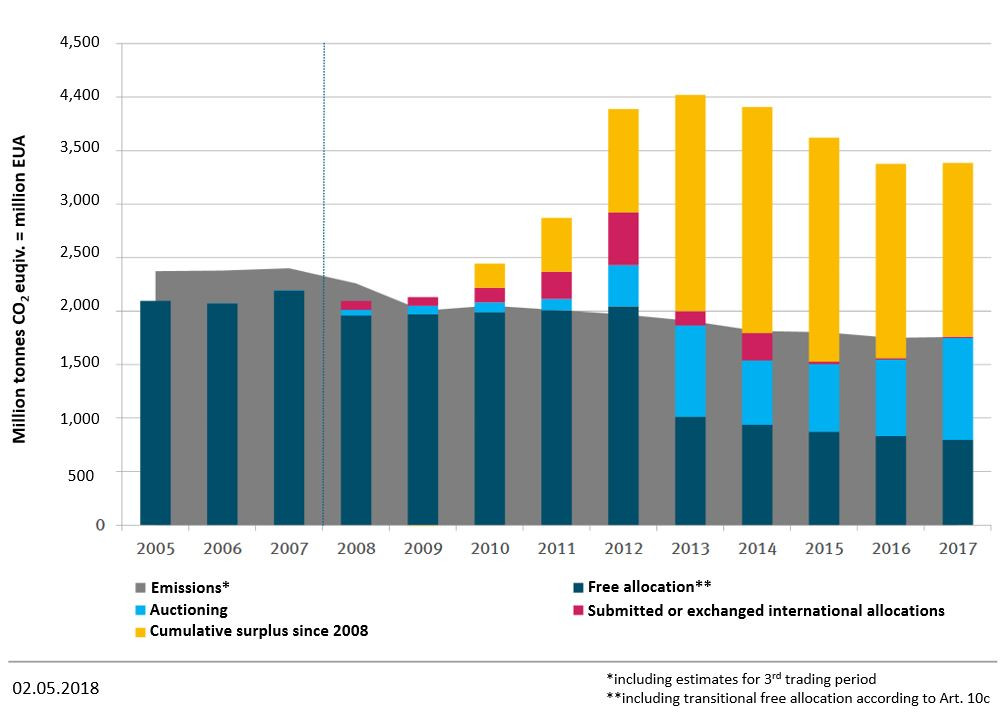

With the ETS now in its third phase (2013-2020), 40 percent of allowances are being auctioned and power generators have to buy all of their allowances through auctions (with exceptions in some member states like Poland, Bulgaria, Hungary, Lithuania, etc.). Once in circulation, EU allowances (EUAs) can be traded freely and since the second trading period (2008-2012) they can be banked for future use by emitters. This means that falling demand (e.g. due to reduced energy and industrial production in an economic crisis) and an ensuing high surplus of allowances in the market lead to falling EUA prices.

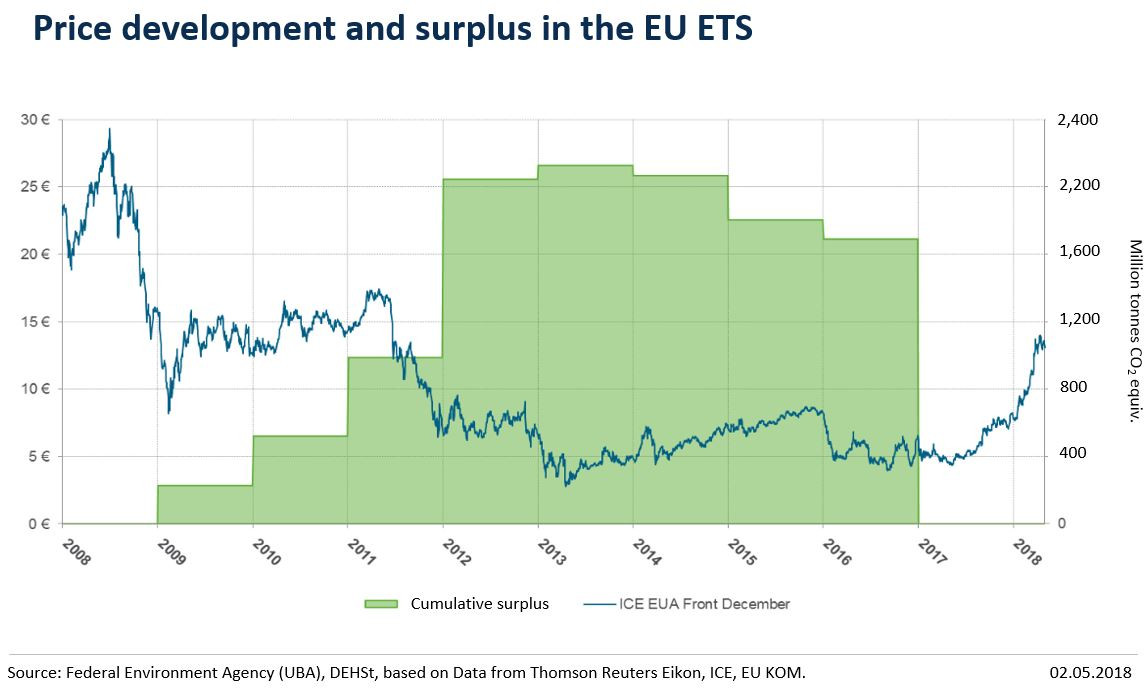

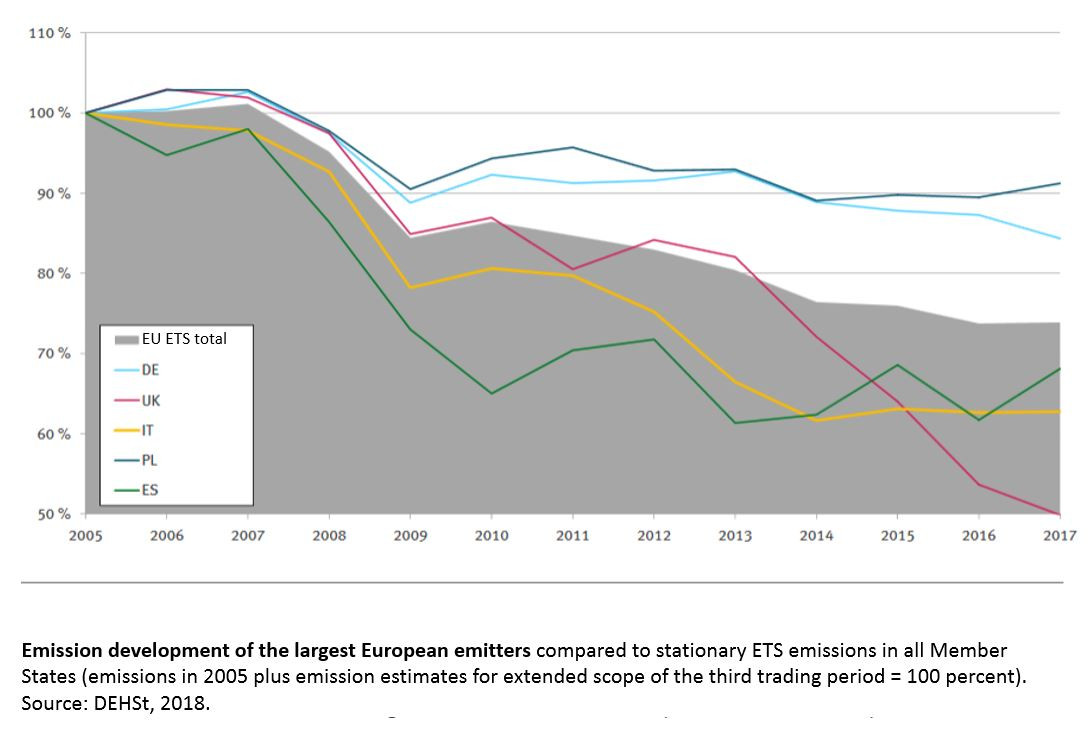

Problems with the ETS include that its caps are not very ambitious, production and emission reductions have occurred due to economic downturns, and international credits have been extensively used. As a result, a large number of surplus emission allowances have accumulated in the EU ETS since 2008 and weakened the instrument, argue the European Commission and Germany’s Federal Environment Agency (UBA), which runs the country’s official Emissions Trading Authority (DEHSt). “These surpluses have contributed significantly to the fall in EUA prices between 2011 and 2017,” UBA says. In those years, prices were as low as 3 euros and never exceeded 10 euros per EUA (see graph below).

Link to figure source.

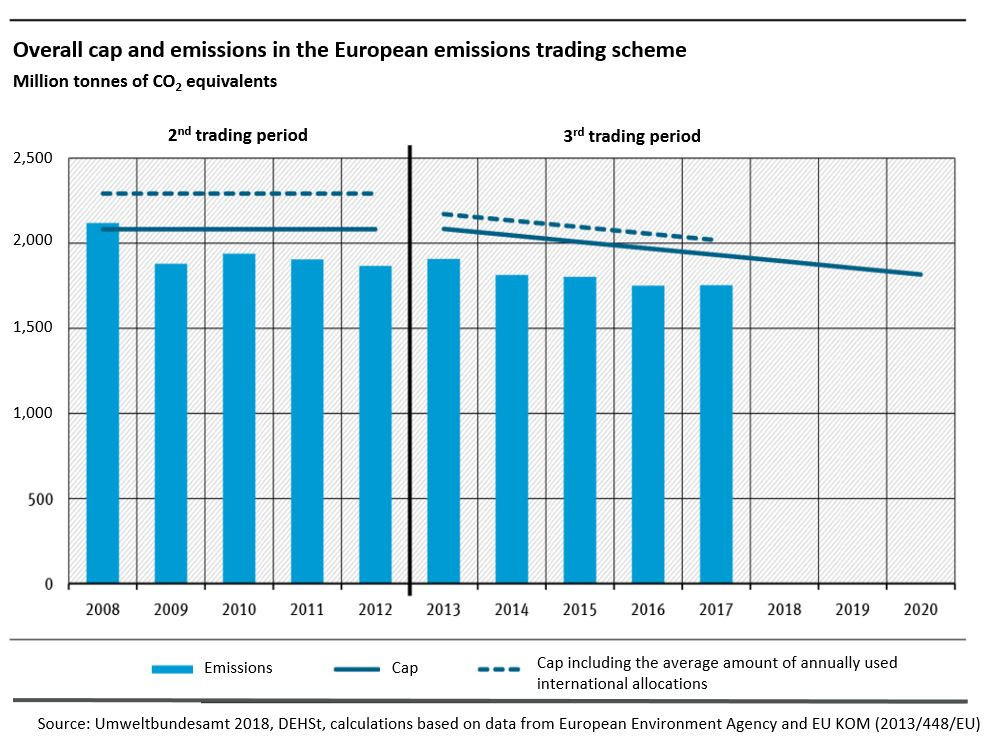

While the cap of the ETS has arguably worked – actual emissions from the ETS sectors in the second and third trading periods (with the exception of 2008) have always been below the cap – the underlying issue of having set the cap too high (also in the years after the economic crisis) has compounded the problem of surplus allowances in the market. At the beginning of the third phase in 2013, the surplus amounted to 2.1 billion allowances. Since then, the surplus has been decreasing and stood at 1.65 billion allowances in 2017. In addition to the existing surplus of (old) allowances, a set amount of EUAs is auctioned off every year.

For the third trading period, the EU member states have set a cap of 15.6 billion EUAs. Each year, the amount of allowances will be reduced by 38 million, therefore the annual cap is decreasing. Additionally, companies can use international allocations from the Clean Development Mechanism (CDM) and Joint Implementation (JI) (Certified Emission Reduction/Emission Reduction Units or CER/ERU) to offset their emissions. However, certain restrictions were introduced in the second trading period.

Link to source.

Link to source.

Reforms to give the ETS teeth

Because of the low EUA prices, the ETS has not produced the anticipated result of making electricity generation from fossil sources like coal more expensive or triggering low-carbon innovation and investment in the industry sector. The EU member states have therefore agreed on a range of reforms to tackle the surplus of allowances in the market.

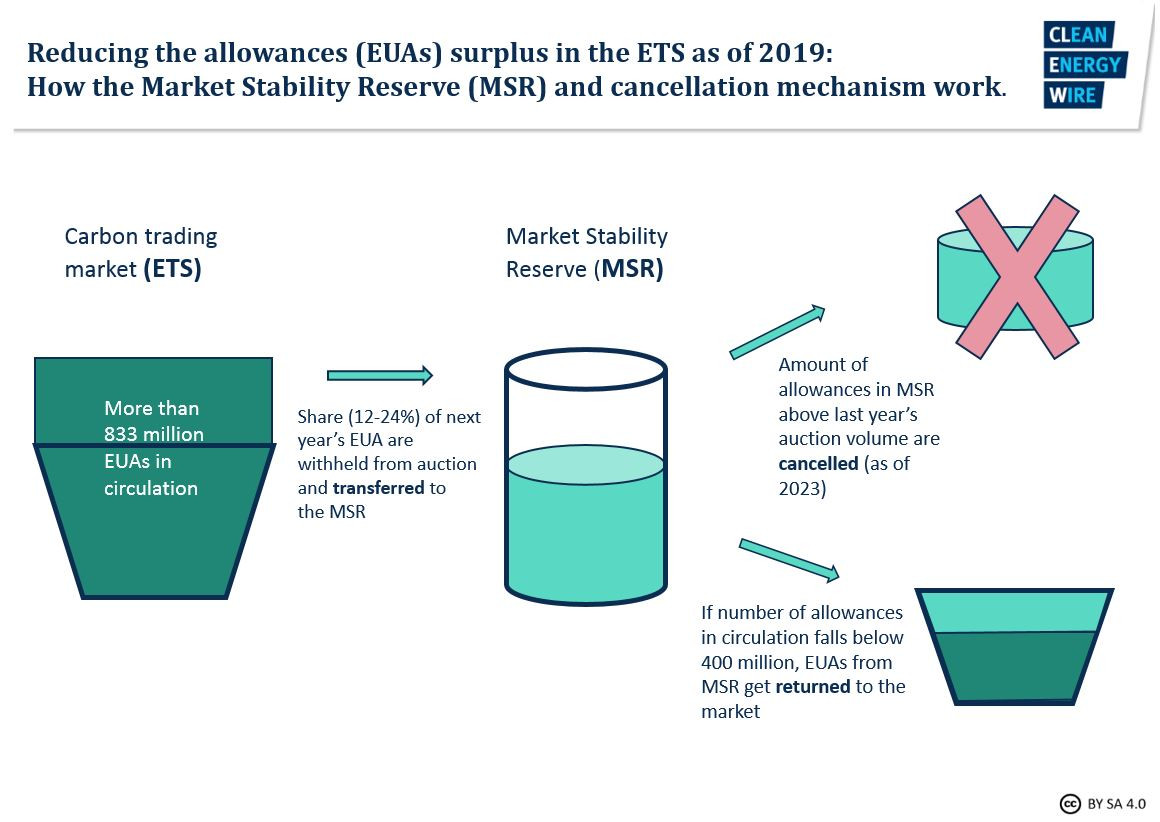

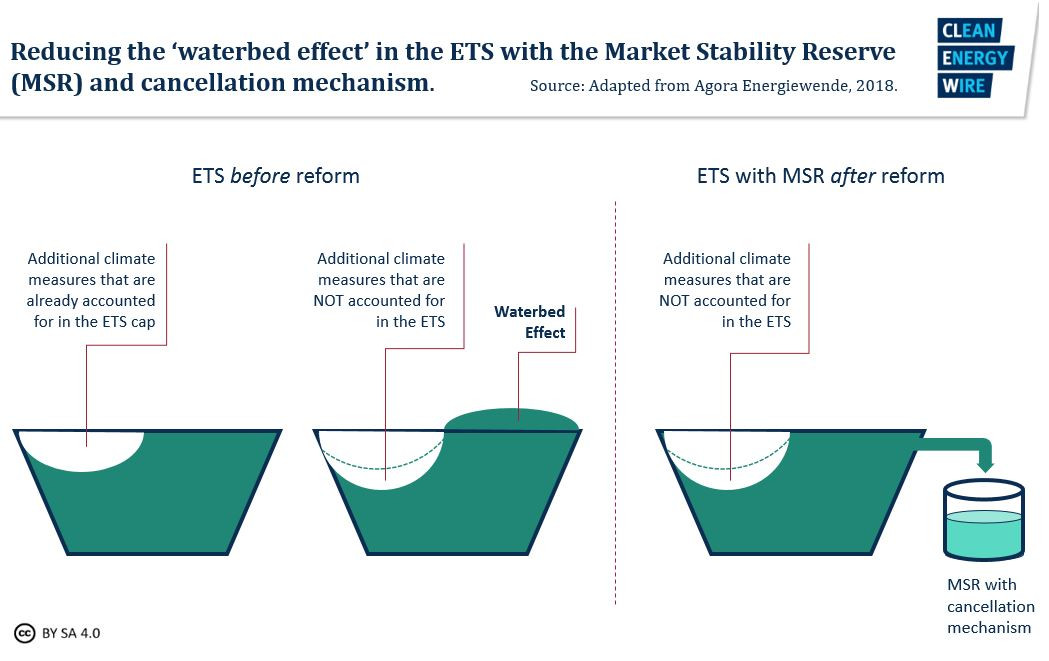

Between 2014 and 2016, the EU temporarily removed 900 million permits from auction (backloading). As of 2019, if too many allowances are in circulation, a share of allowances slated for auction will automatically be transferred into the so-called Market Stability Reserve (MSR), where they can’t be auctioned or traded. Only if the number of allowances in the market falls below a certain level can these EUAs be returned to auctioning. In order to curb the surplus for good and prevent the allowances in the MSR from ever returning to the market (and therefore causing emissions in the future), the latest ETS reform also established an automatic cancellation mechanism: As of 2023, EUAs in the reserve will be cancelled for good, and thus the MSR will not hold more allowances than were auctioned in the previous year. This is expected to limit the number of EUAs in the reserve to around 900 million tonnes of CO2.

Info box: How the Market Stability Reserve and the cancellation mechanism work

Between 2014 and 2016, the EU temporarily removed 900 million permits from auction (backloading). In 2015, the member states created the Market Stability Reserve (MSR), which was introduced in 2019. The reserve works according to pre-defined rules when the total number of allowances in circulation (TNAC) is too high. Excess allowances corresponding to 24 percent of the annual surplus will be withheld from auctioning and added to the reserve if allowances in circulation are above a threshold of 833 million at the end of the year before. Allowances from the reserve will be returned to the market via auctions (at a rate of 100 million EUAs per year) in case the TNAC falls to 400 million allowances. Initially intended to be returned to the system in 2019-2020, the 900 million back-loaded permits are to be added directly to the reserve. After 2023, the share of allowances to be transferred to the MSR in case of a surplus will be 12 percent.

In order to reduce the allowances surplus permanently, a number of EUAs held in the stability reserve will be cancelled as of 2023. This happens automatically to all allowances above the auction volume of the previous year. E.g. if the MSR in 2023 holds 2.6 billion allowances, and in the previous year 900 million allowances were auctioned, the difference of 1.7 billion EUAs is cancelled in the reserve. This is to prevent excess allowances from being returned to the market on a significant scale, leading to higher emissions in the medium and long term.

Effects of national CO2-saving policies in the ETS-sector

Apart from the surplus of allowances, the low prices and the inability of the initial ETS to react to unforeseen events like an economic crisis, one major concern with the European carbon market has been its potential incompatibility with additional, mostly national, policies to curb carbon emissions from the power and industry sectors.

Such instruments are, for example, the British carbon floor price; Germany’s support scheme to boost renewable power expansion; Germany’s lignite security reserve; or the planned German coal exit by 2038.

Link to source.

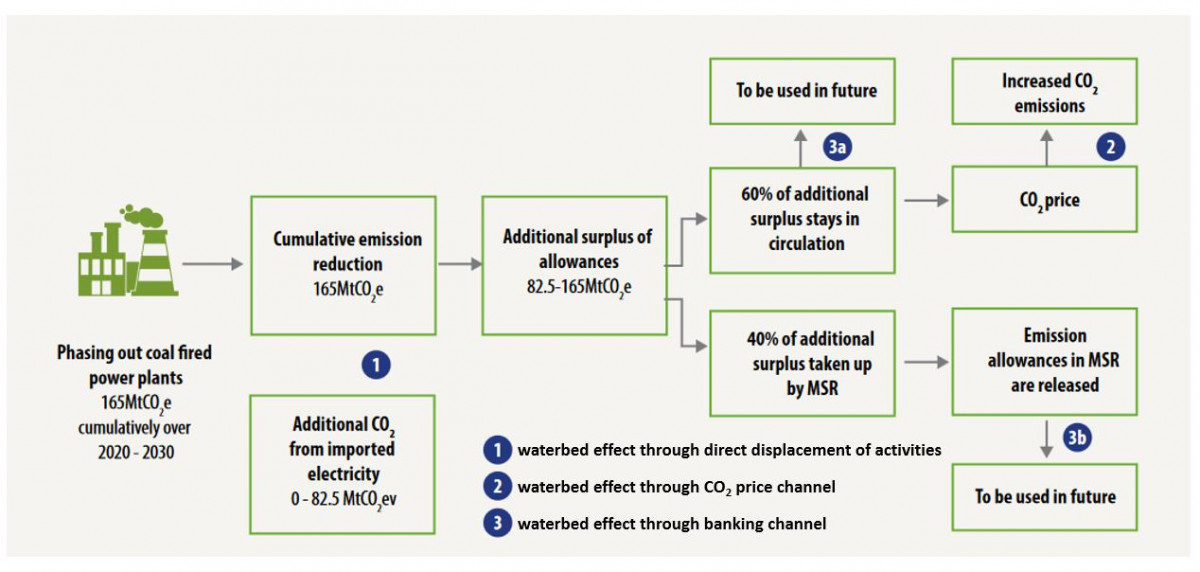

Many scholars (e.g. Frankhauser et al., 2010; Buchholz et al. 2012; Pahle et al., 2018), politicians and energy industry representatives have warned that national ventures to reduce emissions from the power sector cannot actually reduce greenhouse gas emissions on a European level because the overall cap for CO2 allowances is set and saving emissions from German coal plants will only lead to freeing up their EUAs, which will then be bought and used by other emitters in Europe. Just like in a waterbed, where pressure on one end only leads to more water flowing to another part of the mattress, the system as a whole does not lose any water, i.e. carbon emissions – hence the effect is known as the ‘waterbed effect’.

Other potential side effects of unilateral CO2 saving instruments include

- falling demand for EUAs in one country reduces the overall price of allowances. This in turn reduces the market’s ability to trigger low-carbon investments, which can lead to a lock-in of high-carbon capital stocks and/or a change in the merit order, i.e. making fossil-fuelled power plants more expensive than less carbon-intensive electricity production

- companies banking and transferring allowances for future use. This can lead to potentially higher emission levels in the future

- increased fossil fuel power production in other countries with the possibility of an increase in net imported electricity from these sources to the country that e.g. phased-out coal plants

Link to source.

‘Waterbed effect’ then and now – the impact of Germany’s renewable energy growth and lignite reserve

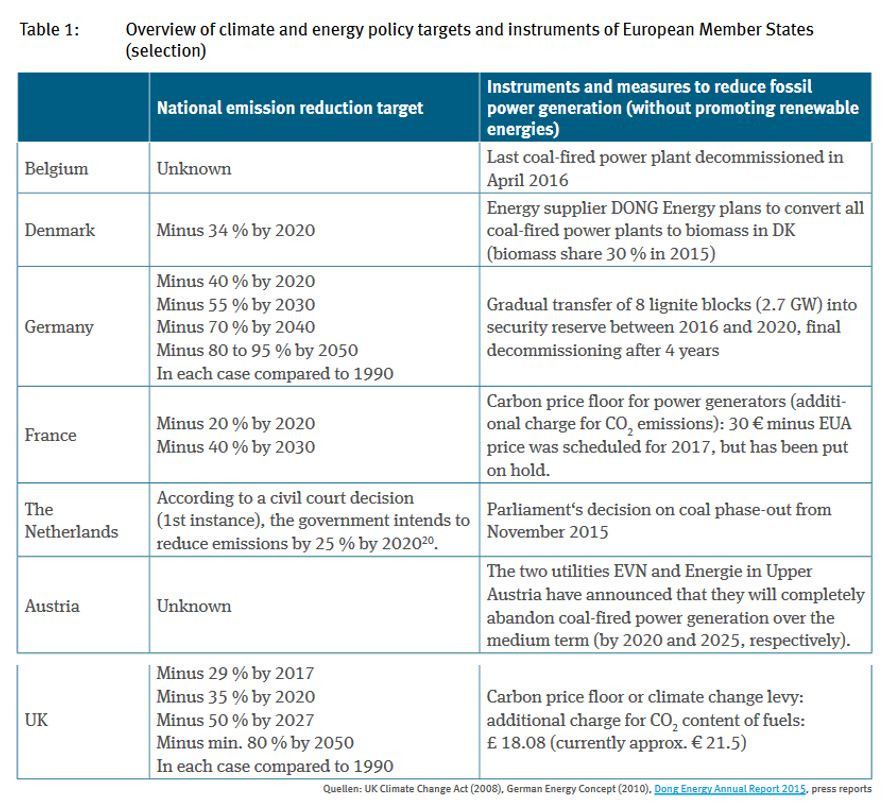

Due to flaws in the ETS (e.g. large surplus of allowances, very low prices that don’t trigger power plant fuel switch), several European countries have introduced instruments and measures to reduce emissions from fossil power generation.

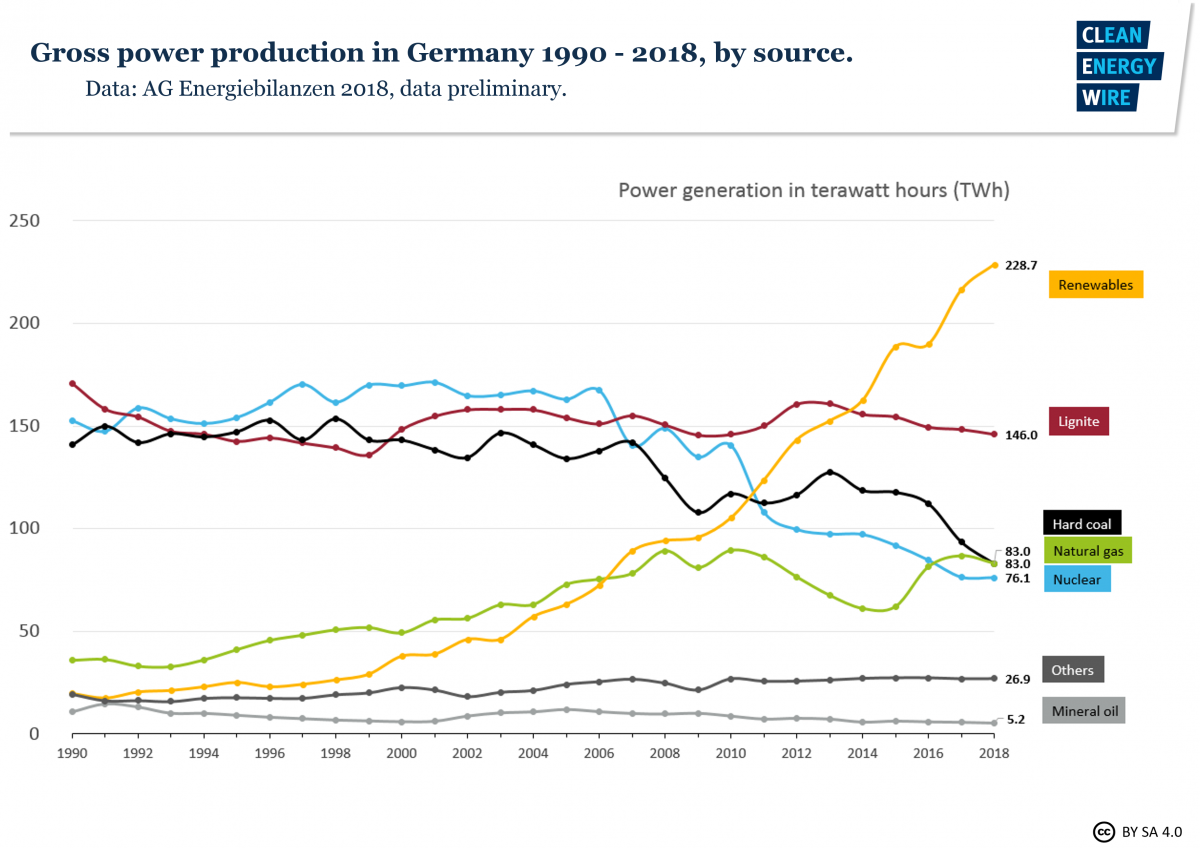

In Germany, the two measures that could have led to a ‘waterbed effect’ in the EU ETS are the country’s renewable energy expansion in the power sector, driven by generous feed-in tariffs for renewable installations, and the so-called “lignite security reserve”.

During the second and third trading periods of the EU ETS (2008-2012 and 2013-2020), Germany increased its share of renewable power in national electricity consumption from around 16 percent to 38 percent (in 2018).

In 2017, the use of renewable energy sources in the power sector saved 135 million tonnes of CO2 equivalent, up from 56 million tonnes in 2005, according to the Federal Environment Agency (UBA).

Another unilateral instrument introduced by the German government in 2016 to reduce emissions from the power sector is the so-called “lignite security reserve”. By 2020, a total capacity of 2.7 GW of lignite coal plants will be mothballed -- a measure the government expects to reduce CO2 emissions by 11 to 12.5 million tonnes.

Between 2005 and 2017, emissions in the European ETS sectors fell by 26 percent. Germany, which in 2016 contributed a total of 26 percent to the Union’s ETS emissions, reduced its emissions under the ETS by 15 percent. Almost two-thirds of the country’s ETS emissions come from fossil thermal power stations.

Link to source.

The annual emissions cap in the EU ETS will stand at 1.8 billion tonnes of CO2 equivalent in 2020.

Both Germany’s renewable power expansion and the “lignite security reserve” reduce national emissions under the EU ETS without these reductions being triggered by the market. Several economists, power station operators and politicians have argued that none of these efforts have actually curbed Europe’s emissions for the reasons listed above (see Effects of national CO2-saving policies in the ETS-sector)

However, quantifying the exact ‘waterbed effect’ of Germany’s unilateral climate actions -- e.g. by pinpointing where and when additional emissions occurred due to freed-up allowances or how the German instruments affected the price of allowances -- is hardly possible, economists Manuel Frondel, head of the Environment and Resources research department at RWI, and Grischa Perino, professor of environmental economics at the University of Hamburg, told Clean Energy Wire. Instead, simulations can give an idea of the effects – and provide a range of conclusions depending on the kind and size of additional national CO2 savings.

Simulations conducted by Van den Bergh et al. (2013) suggest that the deployment of renewables in western and southern European countries (i.e. not only in Germany) between 2007 and 2010 could have lowered EUA prices by 46 euros in 2008 and more than 100 euros in 2010, causing a displacement of emissions from the electricity sector to other ETS sectors of more than 10 percent of historical CO2 emissions in the power sector. An earlier simulation model developed by De Jonghe et al. (2009) came to similar results.

Prompted by the ‘waterbed effect’ theory, other researchers and NGOs have conducted analyses that suggest a rather limited impact of past national policies on the overall functioning of the EU ETS. They give the following reasons:

- Structural surplus in the ETS: Since the overall cap has always been set considerably higher than the actual emissions in the EU, it wouldn’t have required freed-up allowances to enable power plants and industry to emit more than they currently do

- “Historic” surplus: Due to the up to 2 billion excess EUAs in the market and to the very low allowance prices throughout much of the third trading period, freed-up allowances numbering a few million (e.g. in the case of the German lignite reserve) are “a drop in the ocean” without much effect

- When setting the cap for each trading period, the EU’s integrated climate and energy legislation takes national policies, such as Germany’s renewables targets, into account

- While the practice of banking cheap surplus allowances (freed up because of national measures) and their future use are real worries, this danger has been (at least partially) neutralised by the Market Stability Reserve and its cancellation mechanism (see above). Analysts also consider it “unlikely” (in the light of the Paris Agreement and the EU’s own climate targets) that member states would permit old allowances to suddenly flood the market in the second half of the century

An empirical study conducted by Koch et al. (2014) suggests that the ‘waterbed effect’ triggered by renewables deployment is “rather modest in terms of magnitude,” while variations in economic activity (i.e. due to an economic crisis) have a much stronger influence on EUA prices.

An analysis by NGO Sandbag comes to the conclusion that only 2-8 percent of allowances freed up by additional national climate action will be used, “resulting in additional emissions in the short term”.

Future of the ‘waterbed effect’ after the latest ETS reform

Most researchers agree that after the 2017 ETS reform for the fourth trading period establishing the Market Stability Reserve and the automatic cancellation mechanism, the ‘waterbed effect’ will be more or less diminished in the future. If more allowances are freed up by national climate action in the ETS sectors, more EUAs will be transferred to the MSR, and as of 2023, more of these will be cancelled automatically from the reserve – the overall cap in the ETS is thus dynamically adapted to a higher-than-normal fall in emissions (see Reforms to give the ETS teeth).

Some doubts remain as to the exact extent to which the new rules will be able to prevent the ‘waterbed effect’ from happening. Since the MSR doesn’t absorb the complete surplus on the market (but rather 24%/12%, see above), and since small EUA price depressions due to additional national policies will still occur, unilateral emission reductions will be accompanied by approximately 80 percent of corresponding EUAs to be deleted (up until 2024).

Grischa Perino and the think tank Agora Energiewende both warn that further ETS reform will be needed to keep the ‘waterbed effect’ from re-occurring after 2024. They argue that such a reform to further reconcile national climate action with the ETS is likely to take shape in the early 2020s because the calls for a Europe-wide carbon floor price (directly linking the supply of allowances to the price) are getting louder and under the Paris Agreement, the EU will at the same time be required to ratchet up its climate change mitigation efforts.

The case of the German coal exit proposal

In February 2019, the government’s multi-stakeholder task force on the German coal exit and its ensuing effect on coal mining regions and industry published a recommendation on how the country could phase out all coal-fired power production by 2038. A national coal exit being the epitome of a unilateral emission reduction initiative in the ETS sector, the commission report specifically stated that the government should cancel a corresponding number of EUAs when coal plants are taken offline. Apart from the automatic reduction of the volume of allowances in circulation due to the MSR plus the cancellation mechanism (see above), the latest ETS reform enables member states to withhold EUAs from auctioning and cancel them if they are retiring fossil power stations.

Again, this will not prevent a ‘waterbed effect’ 100 percent. Firstly, part of the emissions saved from the decommissioned coal plants will instead come from substituting sources, such as gas-fired power stations. Secondly, cancelling allowances leads to a reduced surplus in the carbon market, therefore fewer EUAs are transferred to the MSR and deleted.

If the entire European Union pursued a coal exit, the share of surplus allowances transferred to the MSR each year would have to increase to 30 percent to avoid depressing the carbon price signal, the above analysis showed.

To make national actions entirely compatible with the European carbon market in the ETS sector, some researchers and politicians have suggested that governments should simply buy the amount of emissions that they want to save. This would increase EUA prices for everyone and therefore trigger emission reductions across the whole system. In Germany, rising carbon prices would see power production shift away from the most carbon-intensive plants (e.g. lignite, followed by hard coal) in favour of less polluting sources like natural gas.

However, many others argue that this option carries a range of risks and uncertainties if and when the climate targets are achieved. Apart from the EUA price, other variables, such as fossil fuel prices on the world market, economic development, capital costs and interest rates, can influence the performance of CO2 emitting power plants and industry. The lifetime of power generation from carbon-intensive lignite in particular is difficult to predict because its generation in old, written-off plants with locally mined coal is cheaper than both hard coal and gas-fired electricity production and therefore more resilient to increasing CO2 prices. The German mining union IG BCE estimates that only an EUA price over 70 euros per tonne of CO2 would lead to a fuel switch from lignite to natural gas in Germany.