German commission proposes coal exit by 2038

After more than six months of intensive and multilateral deliberations with a wide range of experts and stakeholders, Germany’s coal exit commission has published its final report on how the country should phase out coal-fired power production. [Full report in English, final version]

Only days before the 1 February official deadline and after some 21 hours of talks well into the small hours of 26 January, the report outlines the agreement between representatives of the country’s industrial sector, environmental NGOs, citizen initiatives and policymakers in a 336-pages document, that also includes detailed lists of projects for structural change in the affected regions. Out of the 28 official members, 27 voted for the deal. Only the representative of the villages threatened by lignite mine extensions in Lusatia voted against the deal, saying there were no assurances that the villages would stay. Greenpeace added a dissenting opion on the exit date, saying they were not satisfied with the late date.

Since the talks' launch under the official title “Commission on Growth, Structural Change and Employment” in June 2018, the delegations have been assessing the coal exit’s impact on Germany’s emissions reduction, power prices and supply security, economic development in coal regions and the future course of Germany’s energy transition, the Energiewende. The report provides a comprehensive overview of all these aspects and also discusses the impact of a German coal exit on power and emissions trading across Europe.

The conclusions are only advisory for Germany’s government and the actual implementation of measures may ultimately deviate from what the commission recommends. However, the government is widely expected to follow the proposals. The report says that “the commission’s members represent a broad sample of the relevant societal, political and economic actors. This provides a basis for a robust societal consensus that everyone involved can rely upon over the coming years.”

Emissions reduction / coal plant decommissioning:

In its opening remarks, the report acknowledges that ending coal-fired power production around the globe is indispensable for effective climate action. It adds that for Germany “as a highly industrialised and export-oriented nation with a relatively large share of coal in power generation, ending coal-fired power production is particularly challenging.”

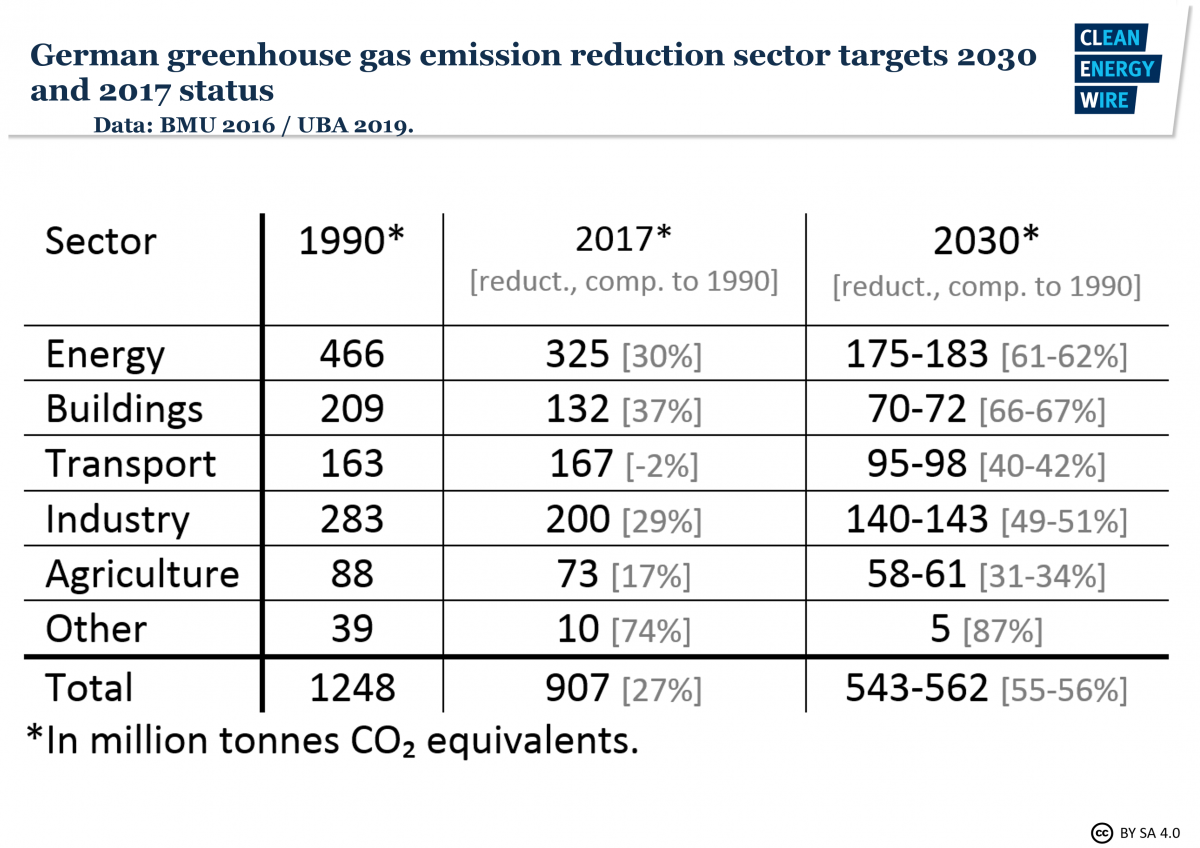

In order to decide on a phase-out plan, the commission first assumed that Germany’s energy sector carbon emissions will sink from about 313 million tonnes in 2017 to roughly 280 million tonnes annually by 2020 thanks to measures already agreed on, such as the European Emissions Trading System (ETS), continued renewables expansion, efficiency measures, and so on.

However, it states that this is not likely to be enough for achieving the country’s 2030 target of reducing emissions in the sector to 175 to 183 million tonnes. Germany’s total emissions in 2017 stood at 907 tonnes.

2018-2022

The decommissioning roadmap is derived from these assumptions. For the period until 2022, the commission says that by 2022 both lignite and hard coal capacity should fall to 15 GW respectively. This would amount to a reduction by nearly 5 GW in lignite and 7.7 GW in hard coal capacity compared to 2017.

Overall, this would mean a reduction of coal capacity by 2022 of at least 12.5 GW, including plants that would go into reserve capacity anyway. Magazine Der Spiegel said this meant an additional reduction compared to the already existing plans to shut down 3 GW of lignite and 4 GW of hard coal capacity by 2020. The commission also recommends switching Germany's "grid reserve" capacity, currently at 2.3 gigawatts (GW), from coal to gas.

2023-2030

For the period from 2023 to 2030, the report says that coal-fired power capacity should fall to a maximum of 9 GW in lignite and 8 GW hard coal. This would amount to a reduction of capacity by 10.9 GW lignite and 14.7 GW hard coal compared to 2017. The commission says the reduction of greenhouse gas emissions over the coming years should happen “as continuously as possible.” In 2025 a "substantial interim step" should take place, reducing at least 10 million tonnes of CO2 emissions, ideally through "an innovation project".

The report says that the measures mean that the energy sector is going to “contribute substantially” to achieving Germany’s 2020 target of reducing CO2 emissions by 40 percent compared to 1990 levels and “reliably” ensure attainment of the sector’s 2030 target.

It states that a review of the coal exit roadmap and the measures carried out until then will take place in 2023, 2026 and 2029. “This is necessary to adequately asses the ramifications of the 2022 nuclear exit and of the decommissioning [of coal capacity] implemented by that time.”

End date for coal in Germany

The commission says coal-fired power generation should end in 2038. If conditions allow, this could be brought forward to 2035. The commission suggests to assess this option by 2032. "The assessment also includes if the assumptions for an end to coal-fired power generation are overall realistic."

The commission also suggests a review mechanism for the final date. “The end date for coal-fired power production should be thoroughly reviewed by independent experts in the years 2026 and 2029 with respect to achieving the climate targets, the development of power prices, supply security, employment figures and the economic situation” in the coal regions, and should be adjusted if necessary.

In a dissenting opinion [p. 119 of final report] several commission members came out against the end date 2038. “Neither the planned final exit date 2038 nor the vague path until 2030 are sufficient for an adequate contribution to climate protection from the energy sector,” they said.

Hambach Forest

The commission says it would be "desireable" to keep the embattled forest which is slated for clearing to make room for an extension of a lignite mine. While the commission initially said it would stay out of the debate around the preservation of the ancient woodlands that had become a major demonstration ground for climate acitivists and was saved from being cut down only by a court ruling, its mention in the final report is seen as an acknowledgement of the forest's symbolic value.

Compensation payments

The commission recommends settling questions related to compensation for operators of lignite plants as well as for employees in “mutual agreements.” In cases where this is not possible, it says disputes should be settled “by regulatory law” after a 30 June 2020 deadline. This is meant to provide “planning security in order to ensure a secure power supply.”

Compensation should depend on CO2 emissions, ownership structure, linkages with the mining sector and the respective number of affected employees. The document stresses that all funds will have to be provided through the state’s budget and not through a surcharge on the power price.

The commission also recommends not allowing the construction of new coal-fired plants. For plants already built but not yet operational, a mutual agreement on not commencing operation is desirable, it says. Compensation payments will be lowered with each year that a plant is kept on the grid for all plants younger than 30 years by the time of decommissioning.

Decommissioning of the hard coal plants should happen either by gradually phasing out plants that become obsolete in the framework of Germany’s combined heat and power law or by an auction that awards so-called decommissioning premiums to operators that voluntarily take their plants off the grid.

Emissions trading

With respect to the German coal exit’s effect on emissions trading in Europe, the commission says that “adequate effectiveness of the national decommissioning of lignite and hard coal plants also has to be ensured within the ETS framework.”

This means that emissions allowances “of a defined volume” can be deleted from the national budget after coal plants are taken off the market. “The commission recommends to use this option in proportion to the volumes of CO2 additionally saved” by shutting down the plants. Buying and deleting allowances would already be possible in the current trading period running until the end of 2020, the report says.

CO2 price

The introduction of a price on carbon emissions should be examined also for sectors not covered by the ETS, the commission says. “This will lead to a greater contribution to climate action by these sectors and provide incentives for using the flexible potential of power-to-x installations,” it states. The CO2 price should be designed “in a socially acceptable way.”

In a dissenting opinion [page 118 of the report], several commission members say that a CO2 floor price for the electricity sector - in cooperation with neighbouring countries - should continue to be examined as an instrument to implement the coal exit.

Heating plants

Apart from power generation, “the decommissioning of coal plants in general also applies to plants that produce heat on a large scale and which could make a substantial contribution to reducing emissions in other sectors,” the report says.

While a constant and secure heating supply must not be called into question, the commission says that Germany’s combined heat-and power lawshould be further developed to bring about emissions reduction in the sector.

Power prices

The commission says that wholesale power prices are set to rise in the next years due to higher fuel and CO2 emissions certificate prices. This development will likely be accelerated by Germany’s coal exit, even though a parallel expansion of renewables might dampen the price increase, it adds.

According to the report, “accompanying measures for limiting power prices” are necessary to keep energy-intensive industries competitive and to curb “additional burdens” on commercial and private power consumers in Germany, which already has the highest power prices in Europe.

It recommends a “compensation” mechanism for power consumers, suggesting support with grid fees or a measure with similar effect of "at least 2 billion euros per year. The exact volume should be determined during the 2023 review and paid out of the federal budget. It also recommends the “continuation and further development” of ETS price compensation for energy-intensive companies.

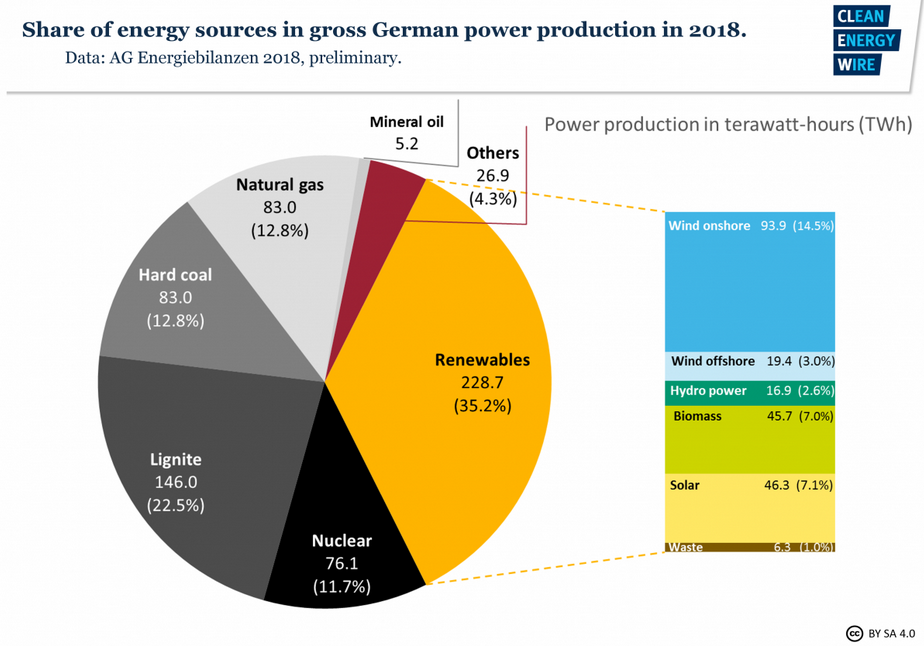

Supply security

Taken together, brown coal (lignite) and hard coal are Germany’s most important fossil power sources. In 2018, coal power accounted for about 35 percent of Germany’s gross power production, roughly the same as renewable energy sources. For the record, the country has one of the most reliable power systems in the world.

To ensure a “secure supply of electricity and heating at the highest level,” the commission says the government’s security monitoring mechanisms ought to be adjusted to the impending changes in Germany’s power production landscape. It recommends performing a continuous “stress testing” of the energy system and including an evaluation of the economic feasibility of new production, especially gas plants, and storage capacities in the government’s monitoring to identify “lacking investment incentives.”

“Supply security should in general be ensured within the domestic market,” the report says. If there is not enough new power production capacity under construction by 2023, the commission recommends “a systematic investment framework” that is capable of providing sufficient incentives for investing in additional plants. It also recommends easing regulation on the construction of new gas plants, which could replace coal plants at the same location.

The commission proposes to use existing capacity reserve mechanisms "extensively" if supply risks become apparent and extend the reserve. However, overall the capacity reserve should be limited.

Economic prospects of coal regions

In December 2018, Germany discontinued domestic hard coal mining, but the lignite mining and power generation sector still directly employs about 20,000 people. Including effects at suppliers, other associated businesses and the loss of purchasing power, the commission estimates that around 60,000 jobs depend directly or indirectly on the lignite economy.

As the commission’s official name “Commission on Growth, Structural Change and Employment” suggests, the economic prospects for coal mining regions as well as for coal workers figure prominently in the report, with almost 40 pages devoted exclusively to measures aimed at cushioning the disruptive effects of a coal exit on regional economies as well as on the industrial value chains of the country as a whole.

The commission did not put a number on the suggested support measures directly. However, media reported that affected regions should get some 40 billion euros in support over the next 20 years and that the amount should be fixed in a separate federal law, which would also be binding for future governments.

The commission says that Germany’s coal mining regions should “remain energy regions also in the future.” This means that the development of innovative technologies, such as electricity storage, renewable energy sources or power-to-gas production should be supported there.

For example, the report says that coal-fired power plant sites in the eastern German mining region of Lusatia should be converted into “industrial parks of a new generation with a focus on renewables and their conversion to energy carriers available over the long term.”

The report says that “not only coal regions should have prospects but Germany as an industrial location as a whole by reconciling climate action with good work and the economy.”