Carbon offsetting – Reports of flawed projects fuel greenwashing concerns

- Contents

- CLEW focus package: 'Climate neutral' products and companies - Greenwashing or sign of serious action? (2023)

- Analysis: Carbon offset market booms despite nagging greenwash concerns (2021)

- Interview: “I wouldn't play avoiding and removing emissions off against each other” – atmosfair CEO (2021)

- Analysis: Staying true to the Paris Agreement could hobble booming carbon offset market (2021)

- Story: Carbon markets – COP26 closes biggest loopholes but lacks clarity on voluntary trade (2021)

CLEW focus package: 'Climate neutral' products and companies - Greenwashing or sign of serious action? (2023)

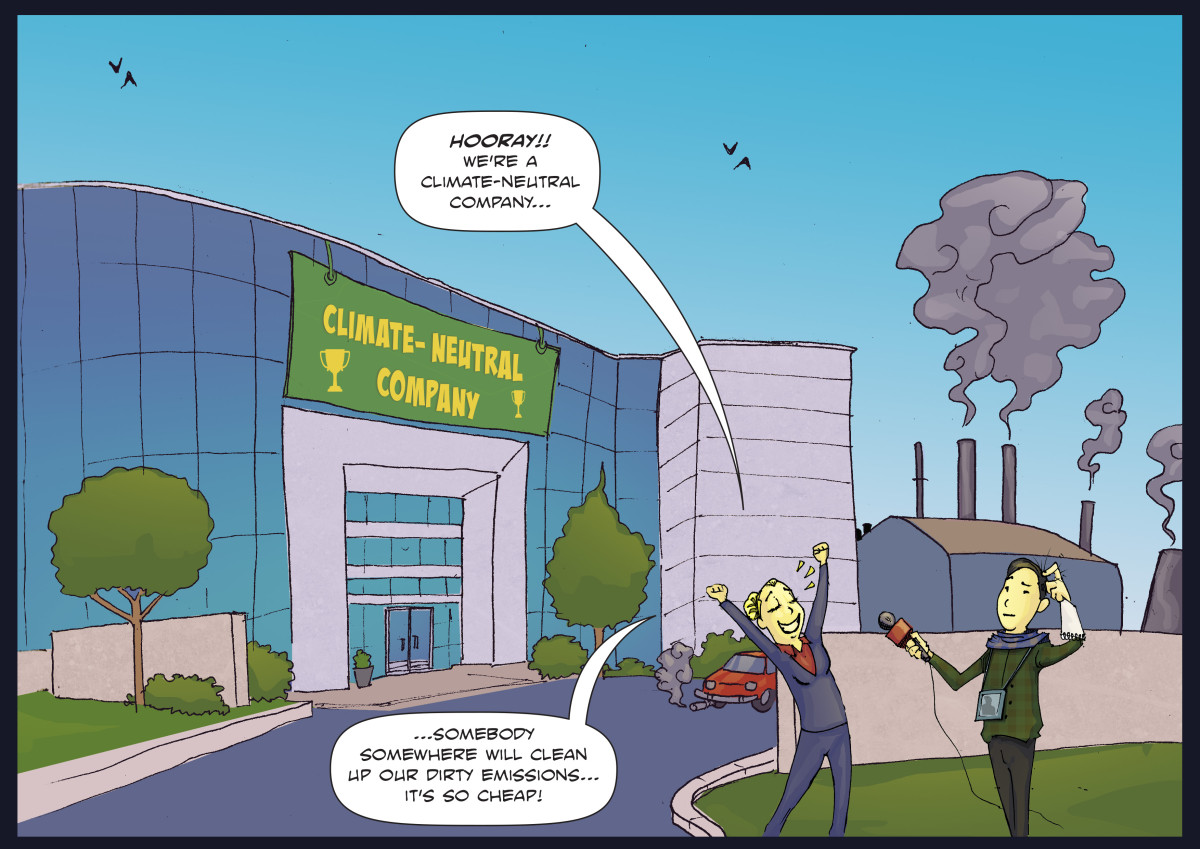

Companies across the globe have started a race to declare themselves and their products "climate neutral." Hardly a day passes without a firm announcing a net zero target or launching a product that is supposedly "climate neutral." Most claims still rely on questionable commitments to compensate continued emissions elsewhere on the planet, inviting accusations that this trend is nothing but greenwashing. But the decarbonisation drive of entire economies will inevitably result in firms no longer having any impact on the climate. Truly climate neutral products will give individual consumers the power to speed up emission cuts. CLEW has zoomed in on the current flurry of company climate claims in a series of articles, interviews, factsheets, a webinar and international collaborations:

Guide: How to unpick a company net zero target in 7 steps (2022)

Based on the methodology of the renowned NewClimate Institute, Clean Energy Wire has produced a step-by-step guide to get to the bottom of corporate climate claims. Find the guide here.

Factsheet: Devil in the detail: The basics of company climate claims (2022)

This factsheet explains the basics for making sense of different types of climate pledges, deciding which emissions count, and the trouble with making climate sins disappear by paying others to do the emission cuts. Read it here.

Q&A: How the EU aims to reign in false green claims on products (2023)

This Q&A answers key questions on the proposal by the European Commission for a set of rules for companies to back up their green claims on products, and the next steps in the legislative process. Read it here.

Story: Corporate run on carbon credits triggers offset gold rush in Mexico's forests (2023)

Mexico is experiencing a carbon offset gold rush, as polluting multinationals turn to the country’s extensive forests in droves to absolve their climate sins. Read the piece here.

Find the full package of company climate claims here.

Analysis: Carbon offset market booms despite nagging greenwash concerns (2021)

Thanks to more and more businesses publicly making “carbon neutrality” or “net-zero” commitments, the voluntary market for carbon emission offsets is booming both globally and in Germany. Critics, however, consider buying into projects that help reduce emissions in the global south, be it wind turbines, efficient cookstoves or forest protection, to be mere greenwashing. Others say they are the best way to transfer money and knowledge for the energy transition to developing countries where people would otherwise be forced to use fossil energy or cut down forests. But the many eager and sometimes too gullible consumers of emission offsets are not always buying emission offsets for the right reasons – and they are often falling for creative carbon accounting by spurious climate projects. Read the article here.

Interview: “I wouldn't play avoiding and removing emissions off against each other” – atmosfair CEO (2021)

From large car manufacturers to globally operating logistics companies – the number of businesses pursuing net-zero targets and wanting to reduce their carbon footprint is growing. As many of the companies cannot or do not want to reduce operational emissions right away, they fall back on what Dietrich Brockhagen calls “the second-best solution” – offsetting emissions. Brockhagen’s non-profit atmosfair is one of the largest providers of carbon offsets in Germany, which they generate by distributing efficient cookstoves in India or solar power in Madagascar. Using these CO2 compensation certificates is still a step in the right direction that can achieve a lot of climate action and support the energy transition in the global south, Brockhagen told Clean Energy Wire. His company is preparing for the offset market to “roughly double every two to three years”. At the same time, atmosfair is making plans for a time when stricter emission inventories could make companies and countries claiming the same emissions reduction, so-called double counting, a no-go – and seriously disrupt the booming offsetting market. Read the interview here.

Analysis: Staying true to the Paris Agreement could hobble booming carbon offset market (2021)

The booming voluntary market for CO2 emission offsets is facing a hairy double counting issue that could stop further growth in its tracks. While high-aiming businesspeople are preparing a new standard to scale the market and make it more transparent at the same time, there is growing concern that double claiming of the same emission reductions by countries where they take place and companies that finance them could harm overall climate ambition. Researchers and NGOs propose new ways of letting companies invest in energy and climate projects in the global south – without letting them use carbon credits towards their emission budgets. But others insist that only the selling and buying of actual offset credits will keep the market alive. The UN climate conference COP26 starting in Glasgow next week could bring some clarity on this – if governments can reach a decision on the infamous Article 6 of the Paris Agreement. But even with new guidance from the climate negotiators, the market will take several years to find its feet and adjust to the new rules, experts say. Read the article here.

Story: Carbon markets – COP26 closes biggest loopholes but lacks clarity on voluntary trade (2021)

Negotiators in Glasgow reached a breakthrough on the rules for global carbon emission reduction trade. After five years of unsuccessful deliberations since the Paris Agreement laid down the framework for a new market where states and private entities can generate and trade carbon offset credits, COP26 finally saw agreement on the “rulebook” for this new market, which proponents see as a way to increase climate ambition in both developed and developing countries. Read the article here.