German industry needs policy trigger for deep emission cuts

Making Germany's energy-intensive industry more climate-friendly in time to reach emission targets will require replacing ageing and polluting machinery with new equipment costing billions of euros very soon. But many companies still balk at the prospect, because existing regulations mean they can't recoup the investments. Companies hope this year's numerous policy decisions could bring more clarity on how their expensive proposals for deep emission cuts can become reality.

"2020 will be an eventful year in energy and climate policy," Jörg Rothermel, who heads the association of energy-intensive industry (EID) and is also head of the energy and climate division of the chemical industry association (VCI), told the Clean Energy Wire, with reference to policy decisions expected in Germany and at EU level.

"National climate policy was more than ever in focus in 2019, especially with the introduction of a CO2 price for fossil fuels from 2021, but also with the exit consensus in the coal commission," said Carsten Rolle, who is in charge of energy and climate policy at the German industry association BDI.

"Some decisions were made under enormous time pressure and important implementation issues were initially excluded from the legislative texts. In 2020, it will be essential for industry that the limits on the CO2 price and the expected increase in electricity prices, which were promised in principle, are actually implemented in good time and effectively," he added.

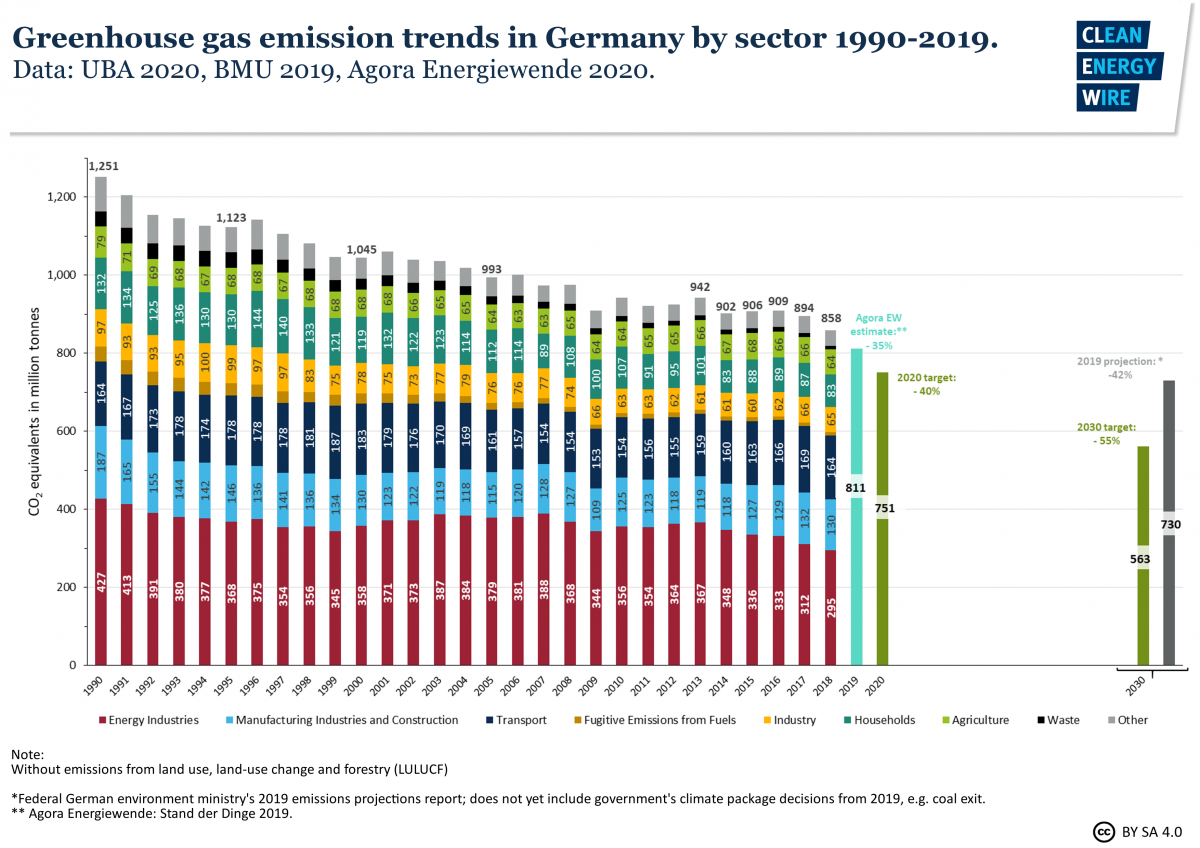

Industry is Germany's second largest emitter of greenhouse gases – trailing the energy sector – and CO2 output has not fallen over the last ten years. Around half of those emissions are caused by companies making steel, cement and chemicals. The technology already exists to make deep cuts, and companies including BASF, HeidelbergCement, gas supplier Linde and Salzgitter have said they are prepared for profound emissions cuts, but still lack the necessary market signal from policymakers. Making the sector climate-neutral by 2050, as required by Germany's climate targets, will necessitate investments worth many billions of euros.

HeidelbergCement, steelmakers thyssenkrupp and Salzgitter, chemical makers BASF and Lanxess, as well as engineering conglomerate Siemens and carmakers BMW, Daimler and Volkswagen, are among the world's top pioneering companies leading on climate policies, according to Carbon Disclosure Project, a not-for-profit charity that runs a global disclosure system for investors.

Financial troubles

But the country's heavy industry is currently weighed down by numerous economic challenges beyond decarbonisation: Trade conflicts related to the US, China, and Brexit, as well as, digitalisation, structural changes and a slowing global economy. This could slow the companies' climate ambitions, as the associated profit drops are unlikely to wet their appetite for expensive projects to reduce emissions.

According to consulting firm EY, Germany’s biggest industrial companies reported their lowest profit margins in four years in 2019, and conditions are unlikely to improve until well into this year. The relatively poor performance for the likes of Daimler AG, BASF SE and Bayer AG was partly down to one-time effects and rising restructuring costs, but was also due to weak global demand and increasing trade barriers, Hubert Barth, EY managing partner for Germany, told Bloomberg. [For further details on the car industry, see our separate 2020 preview]

In a survey conducted by the German Economic Institute (IW), 32 out of 48 business associations said their current economic situation is worse than a year ago – especially in large export-oriented sectors such as cars, engineering and chemicals. But while 12 associations forecast a sales drop for 2020, 19 said their member companies would probably increase turnover in 2020.

Coal exit decisive for largest power consumers – and producers

Rothermel said the law to formalise Germany's coal exit decided last year will be of particular interest, because rules regarding power supply security and power price compensation will be key for energy-intensive companies worried that the phase-out will push up power prices, putting them at a disadvantage vis-à-vis international competitors.

But a leaked draft of the legislation suggests that companies' expectations will not be met, because it does not contain binding compensation for power price increases, according to industry association BDI. "Such an approach by the federal government jeopardises planning security and is not suitable for reliably compensating for disadvantages in international competitiveness," the BDI said.

The coal exit is decisive not only for energy-intensive industry, but also for the country's utilities. The government has already agreed to pay the country's leading coal power provider RWE 2.6 billion euros in compensation over 15 years. The year 2020 will also be crucial for RWE, which aims to become climate-neutral by 2040, because it will need to get its future renewables strategy on track following a massive asset swap with former competitor E.ON. Given the lull in German wind power, RWE will focus on global markets. Further details are expected in March, when both RWE and E.ON will announce details on their new strategy. [Read more about the prospects for renewables in our 2020 preview German wind power industry anxious as technology tops power mix, and Risen from the ruins, Germany's solar power sector has zest for action in 2020]

All eyes on Europe

German industry is also keenly awaiting details on the new EU climate strategy. "The most important event at European level is the implementation of the Green Deal proclaimed by the President of the Commission von der Leyen in concrete legal regulations," Rothermel told the Clean Energy Wire.

"The new EU 2030 climate protection targets planned for the summer play a central role in this process. These will mean that all existing climate protection regulations at both European level (EU Emissions Trading Scheme) and national level (Climate Protection Act, Fuel Emissions Trading Act) will have to be revised again," Rothermel said.

"It will also be interesting to discuss the border adjustment measures announced in the Green Deal," he added.

Members of the industry association BDI also focus on EU policy decisions this year, the lobby group's Rolle said. "In 2020 and beyond, the European level will certainly set the agenda much more strongly by concretising and implementing the Green Deal. The tightening of climate targets aimed at in the Green Deal and the 47 plans and strategies announced contain a number of highly complex issues that will have a major impact on the competitiveness of industry in Europe. These include border adjustment mechanisms, which will be difficult both in terms of trade policy and practical implementation," Rolle said.

"In the BDI, we will be particularly concerned with our climate congress at the end of March, at which we want to work out important connections between, for example, recycling management and CO2 reduction," Rolle said.

Another fixture in the sector's calendar is the Hannover industry trade fair at the end of April, where companies from around the globe will showcase low-emission technologies.

Later in the year, the highly anticipated EU-China summit in September in the German town of Leipzig could become crucial for climate policy and resolving trade issues. Environment minister Svenja Schulze has said the summit would be key for stepping up climate ambitions.

A keenly awaited hydrogen strategy…

Many of Germany's most energy-intensive industrial companies will rely heavily on hydrogen made with renewable power to make deep emission cuts in the longer term. This is why they are also curious to find out more about the government’s plans to boost the development of what has been dubbed a 'hydrogen economy.' According to economy minister Peter Altmaier, the government will probably agree on a hydrogen strategy in March.

"I associate some hope with the announced hydrogen strategy," Rolle said. "If it is also possible, by changing the framework conditions, to advance the desired ramp-up of this technology internationally, this would be a success both in terms of climate policy and industrial policy," Rolle said.

In an initiative presented by the German engineering association VDMA, European business associations have also called for a European hydrogen strategy to boost the associated low-carbon technologies, such as power-to-x.

…that will be key to decarbonise chemicals and steel

These technologies will be particularly important to decarbonise sectors such as steel and chemicals that cannot replace fossil fuels by using renewable electricity directly. Many companies in these sectors have launched pilot projects to test these low-emission technologies. For example, steelmaker Salzgitter proposes to use hydrogen to make climate-neutral steel, but it says it can't realise the plans because they will cost billions of euros – making the steel much more expensive, but not any better. The companies therefore call on politicians to change the framework conditions so steel made with green energy can become competitive.

The same is true for the chemical industry. The German chemical association VCI said in late 2019 that it can become largely greenhouse gas neutral by 2050 – with additional investments totalling 45 billion euros. "This requires a favourable electricity price and large quantities of renewable electricity. And, of course, the further development of the corresponding plant technologies for basic chemicals. Many research projects in this area are already underway," Rothermel told the Clean Energy Wire. But he added that a reliable energy policy and research support were needed to make these plants competitive in the longer term.

The steel and chemical companies' climate ambitions might suffer in 2020 from financial troubles in both sectors. According to the consultancy EY, German chemical companies suffered the biggest profit decline in 2019 compared with other industrial sectors, with a 38 percent plunge.

Things look even bleaker in the steel industry, where many employees have been forced into short-time work because of overcapacities and intense competition from China, and the transformation of the car industry, one of the sector's most important clients. Germany's top dog thyssenkrupp has announced thousands of job cuts in its core division, and the company might even consider a merger with rival Salzgitter, according to media reports.

Just like in the car industry, the need to become more climate-friendly adds to the consolidation pressure in the steel industry, according to Nicole Voigt, partner at BCG consultancy. "In addition to the cost advantages in the development of climate-neutral technologies, the still existing overcapacities also speak in favour of mergers," she told Handelsblatt.

The companies could eventually turn the pressure to cut emissions into a competitive advantage if politicians lend them a hand, for example by creating a European market for green steel, according to industry experts.

"In a global comparison, European companies, especially in Germany and the Scandinavian countries, are clear innovation leaders in climate-friendly steel production," said Götz Erhardt from the consultancy Accenture, adding that "When it comes to climate protection, European steel manufacturers face challenges that no company can meet alone." [Read a report on Salzgitter's plans for emission reductions here.]

But Erhardt also said that policymakers appear to have become more aware of the industry's climate challenge, adding that von der Leyen's Green New Deal programme explicitly mentions the green steel industry as a future market for the European Union.

By the end of this year, some of the thick fog clouding the path to a more climate-friendly industry might have cleared.