Regulation must enable markets for climate neutral products – German certifier TÜV

CLEW: As one of Germany’s leading technical inspection and certification service providers, TÜV Süd has been checking companies’ climate and greenhouse gas neutrality claims for many years. More recently, the number of these claims on many products found in supermarkets or other shops has greatly increased. Did TÜV Süd see an equal rise in applications for certifying these product climate claims?

Georgios Agrafiotis: Audits for greenhouse gas neutrality and carbon footprints have been carried out since the early 2000s by TÜV Süd, so already for roughly 20 years. After a few calmer interim years, requests have grown markedly in the past two or three years, although total figures are still rather moderate.

Could you briefly outline the method and procedure of the average climate claim auditing done by TÜV Süd?

The audits are based both on external norms that are commonly accepted and our own standards in cases where the existing framework does not cover the case at hand. The carbon footprint, for example, is assessed based on the Greenhouse Gas Protocol or a norm by the International Organisation for Standardisation (ISO), which coordinates industry standardisation in about 170 countries. For climate neutrality, an auditing that is done on top of the ‘fundament’ of greenhouse gas certification, TÜV Süd developed its own standard, which was used until 2011 and then discontinued after the introduction of the British BSI’s PAS 2060 norm. In 2023, a respective ISO-Standard for net-zero is expected to come forward. During the COP27 in November 2022, a first definition of net-zero was published.

If a company wants to have its claim certified, we first require a dataset including the company’s carbon footprint that lists all of its emission sources and quantifies the relevant ones. Along with that, the claimant has to submit a methodology that explains what the limits of its reporting are according to defined standards such as ISO, GHG Protocol or BSI. This includes the reviewed timeframe, the legal framework under which the company operates and so on. This is usually followed by an audit session on site to verify whether the submitted carbon footprint is up to date and in line with the actual conditions. Claimants then provide earlier certificates and auditing results from other sources to check for a complete monitoring of business activities and associated emissions of greenhouse gases. If there are no inconsistencies and no further noticeable problems, the report can be completed.

Who were the companies or products that were initially subjected to auditing? Did the scope of auditees expand in the past years?

We have to differentiate two main sectors: on the one hand companies that were included in the mandatory European emissions trading system (ETS), so mainly energy companies or large industrial producers that consume a lot of energy, for example steelmakers – though this was not about climate neutrality claims but rather to rubberstamp their ETS conformity. On the other hand, in the past years more and more companies claim to be climate neutral themselves or to have a climate neutral product to sell. Claims are made for example by industry suppliers, especially to the car industry and the chemicals industry. The range of different products we’re auditing definitely has grown fast over the past two years especially, as we now get up to four times as many requests as in 2019 – even though claims of climate neutrality for entire companies were already being made regularly before that.

Can you explain the difference between the two claims?

The main difference is that the overwhelming majority of company climate neutrality claims were made by companies coming from the service sector, which often didn't manufacture products of their own at all. But for companies where own production is a major factor, the question arises whether claims for company climate neutrality should also include manufactured products, which obviously complicates things. Yet, requests from the manufacturing sector have also started to grow in recent years.

What do you think is driving this trend? Is it pressure by consumers, regulation, or competitive thinking by companies?

In my opinion, all of these factors play a role here. There’s the Fit for 55 initiative by the EU for example, which was the first clear announcement that Europe’s economies will attempt to achieve net-zero emissions by reducing greenhouse gases as much as possible and to compensate the remainder through carbon sinks. And the pressure by society and consumers on producers to conform with environmental protection standards has grown, for example in form of the Fridays for Future climate protest movement. But also more business-driven factors are at play, for example when a company wants to access a support fund that is only open to climate neutral or “sustainable” companies or those striving to become it. A prime example is the EU taxonomy for sustainable investments.

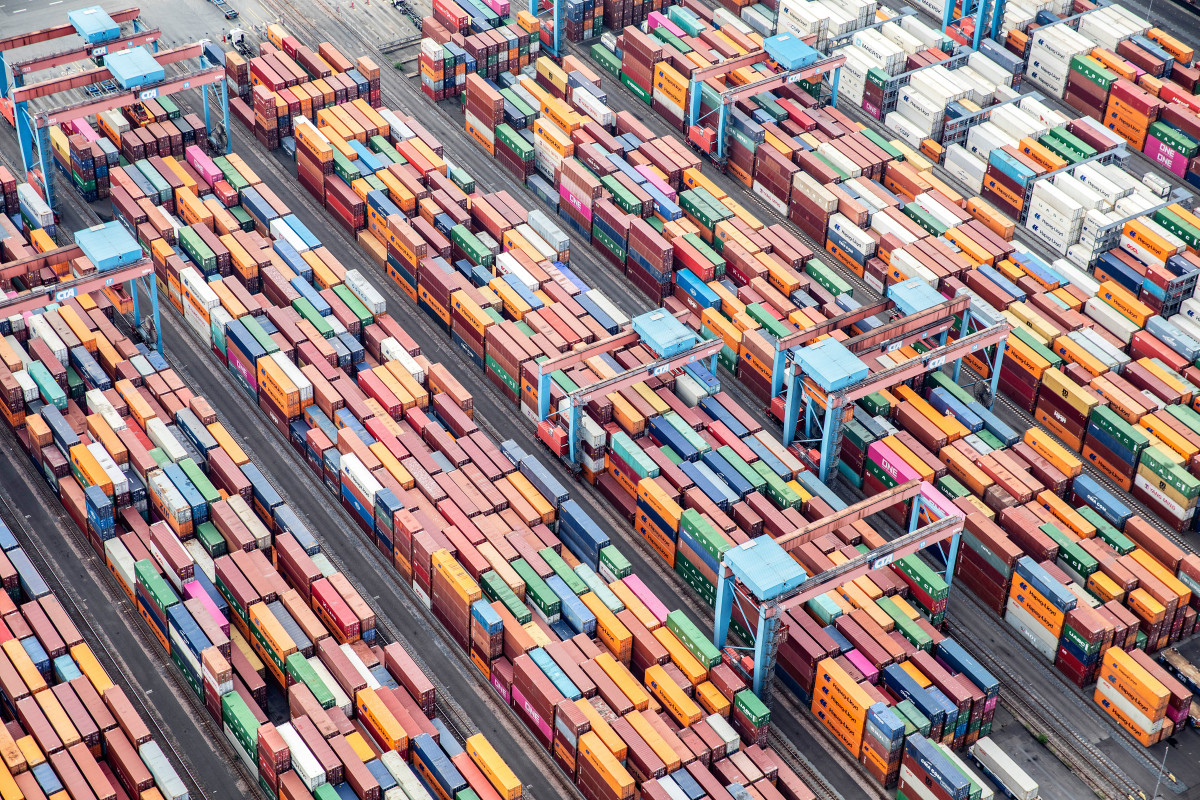

Another important driver are business-to-business relations, especially for companies producing intermediary goods used by other companies, often with more public exposure, which demand more environmentally friendly input materials. Larger companies that buy intermediary goods can pin down pretty well where the biggest emissions factors are located in their supply chains and exert pressure accordingly to improve their own climate balance.

Are companies themselves starting to get a better idea of what their production actually means in terms of its climate impact and how to tackle it?

This started already with the introduction of the ETS. But while the focus here initially had been on entire industries, it has now become narrower and looks at the performance of individual companies. Most larger companies nowadays provide a climate impact record to at least some extent – and once you understand your impact, the logical next step is to look for ways to reduce it.

"Getting fairly accurate figures often is possible, even if this takes some effort"

Besides emission reductions, emissions compensation is another key pillar of climate neutrality claims. There are several organisations who offer compensation projects on the German market alone, even though a commonly accepted and certified label is not available yet. How does the TÜV Süd scrutinise compensation measures in its own neutrality certifications?

The companies themselves either commission assessments that are then carried out by consultancies or also get their own sustainability department to do the groundwork. However, they have to abide by the standards agreed in the BSI’s PAS 2060 norm mentioned earlier, which clearly lists the accepted compensation schemes. So, there’s in fact a clear list of widely accepted mechanisms and the BSI standard itself also comes with clear conditions that make these mechanisms effective, such as explicitly enabling additional neutrality contributions and undergoing annual verification themselves.

And even though there’s a vast number of initiatives and offers for compensation that are sometimes rather small and difficult to assess, checking whether a company claiming neutrality actually has its emissions allowances deleted at an official register, such as the German Emissions Trading Authority (DEHSt) gives us a clear indication that the claim has been factually backed up. So, even though every company can in theory claim it has achieved climate neutral production, TÜV Süd would never consider an audit for a product that is not based on the commonly accepted criteria outlined above.

But even if there are solid standards for certification institutions like TÜV Süd, a widely accepted label on the product itself that indicates to customers the climate impact of what they are buying has not been introduced yet. Can any lesson be drawn for climate claims from more well-established but often still contested product labels in other categories, for example the “organic” or “bio” production for foodstuff?

Even though these other labels that certify adherence to environmental protection principles stem from a similar logic as climate labels, there is actually little methodological overlap in how they are assessed and awarded. An aspect that both categories of labels, meaning both “bio/organic” and “climate neutral” claims, share with each other is that both are a mixture of initiatives launched by private companies and politically regulated initiatives – and none is automatically better than the other.

The upcoming ISO norm – as mentioned previously –could mean a substantial step forward in terms of setting commonly accepted rules. While these norms are voluntary, the consensus on them is internationally established and accepted. If a company claims it abides by these norms, there are clear technical criteria that it needs to fulfil.

Aren’t most customers unaware as to what these criteria are?

This might be true for individual private customers who buy the product from a supermarket shelve. But a lot of our work is actually focused on business-to-business trading, where one company buys intermediary goods from another. Checks for technical criteria are done much more thoroughly and systematically by companies than by the average supermarket customer, which means false claims are easily debunked. However, it is still necessary to make certificates more transparent and comprehensible to also allow private customers to make a qualified decision, although technical and legal hurdles are still significant here.

What would you say is necessary from a legal perspective?

The EU initiative on substantiating green claims launched in early 2022 is a step in the right direction, as it aims to compel companies to apply a clear methodology that backs up their advertised claims. Generally, regulation is a major driver when it comes to sustainability, rather than the free market. Markets usually tend to spur harmonisation and standardisation on their own, as the globalised nature of many businesses demonstrates, but this appears to be different for sustainability features.

Shouldn’t regulation rather set the playing field on which market forces work?

Yes, market forces can function also regarding sustainability. But regulation is needed here to achieve a critical mass of involved companies that allow a market to develop in the first place.

Many firms’ business activities reach far beyond the EU’s regulatory influence. How does TÜV Süd assess, for example, whether the claims for climate neutral rubber products from South America that are used by European carmakers are justified?

The number of requests for assessing neutrality claims in globally interlinked production processes so far has been rather limited. But even though standards and procedures of regulatory systems differ greatly around the world, getting a sound idea of the emissions and other aspects of products coming from “far away” countries is not as difficult as it may seem. The range of available data from researchers, state institutions and other actors especially regarding emissions sources has grown considerably in the past years and getting fairly accurate figures often is possible, even if this often takes some effort.

Moreover, BSI’s PAS 2060 standard allows to make conservative assumptions in cases where data is lacking. This means that emissions are assumed to be above expected average values in a given production case if the contrary cannot be proven. The producer then has to deliver a proportionate compensation somewhere else in the value chain to qualify for a neutrality certification. In order to prove that production has been carried out at better standards, there are clear criteria on what companies have to provide us with, which includes delivery slips, bills and other documents that verify things were done in the way claimed. It often involves a fair bit of detective work by going through heaps of documents, recalculating and cross-checking with other reports to assess whether claims are plausible and justified.