Energy transition start-ups shake up the business world

- This analysis is part of a dossier with factsheet, interviews and company profiles. Read it here -

The energy transition’s spread into transport, industry and heating, as well as the rapidly rising share of renewable electricity in many countries around the globe, put a new spotlight on the importance of innovation for the projects’ success. Countless new solutions are required to decarbonise all sectors of the economy, and in many cases it is start-ups that can offer this.

In energy transition pioneer Germany, both the government and large corporations increasingly bet on a vibrant “green” start-up scene when it comes to reconciling the shift to renewables with economic success – some call the country a “Green Energy Valley.” Thanks to their innovative capacity and an irreverent approach, start-ups are both boon and bane for established companies and sectors – they can bring new ideas into staid businesses, but also disrupt entire industries.

“We need to challenge conventional paradigms,” said Christoph Frei, secretary general and CEO of the World Energy Council (WEC). “That’s exactly what the start-ups are about. They deliver this kind of ‘out-of-the-box’ thinking and the necessary attitude. They have no fear of reinventing everything,” Frei told Clean Energy Wire.

The speed of energy transition innovations, often led by start-ups, continues to exceed expectations – witness the dramatic cost reductions in PV solar and battery storage, which have been crucial for their current rapid deployment around the globe.

According to Germany’s environment ministry, around two-thirds of all “green” basic innovations can be traced back to founder companies. “Without the relevant green start-ups, the renewable power sector wouldn’t have developed the way it did,” environment minister Svenja Schulze commented in a survey of the scene.

Start-ups play a crucial role in the success of the energy transition, and also in the economy as a whole. According to research conducted by the Borderstep Institute, “they have created far in excess of one million jobs in Germany over the last ten years.”

Estimates of the number of green start-ups in Germany vary wildly between around 6,000 and several tens of thousands, depending on the definitions used. Around a quarter of all start-ups classify themselves as green because they contribute to sustainability. Of these, around one in ten works in energy or electricity, and around one in 15 in mobility or cars. [See the Factsheet Germany’s green start-up scene in numbers for more details, and the dossier Germany’s Energiewende start-ups – Cutting emissions as a business model for a collection of start-up profiles and interviews.]

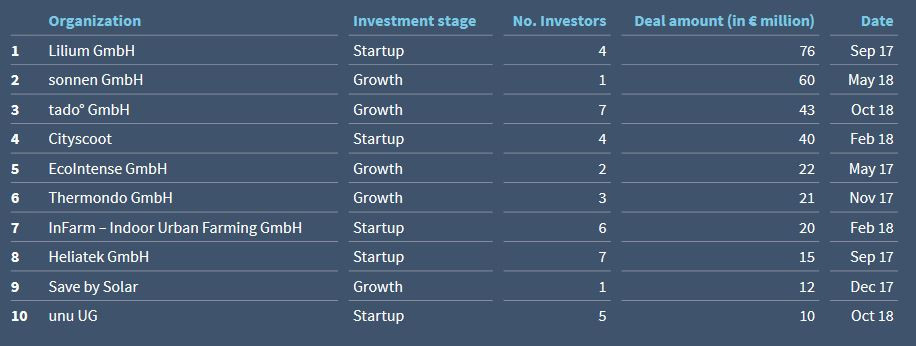

A total of around 4.6 billion euros were invested in German start-ups in 2018, more than ever before, according to business consultancy EY. In this respect, Germany ranks second in Europe behind the UK (7.2 billion euros). But only a fraction of that money went to German start-ups directly engaged in the energy transition: 407 million euros were invested in mobility start-ups (an increase of almost 40 percent versus 2017) and 99 million euros in energy start-ups (plus 15 percent). Much larger sums went into e-commerce (almost 1.7 billion euros), financial technology (fintech), and software (around 700 million euros each).

Germany’s role as “Green Energy Valley”

Innovation experts say that Germany’s example is still vital for the progress of the global energy transition, even if inadequate government action in recent years has meant the country has fallen back in the worldwide race towards decarbonisation.

“Germany has a key role to play,” argued Frei. “The mere fact that the term ’Energiewende‘ has become a globalised word speaks for itself […] If people want to understand what an energy transition could possibly mean, they still look to Germany for what could go wrong, and also for what could go right. Germany has examples to offer for both.”

“Owing to the political framework of the energy transition, there is continuing interest in seeing whether Germany will succeed, and how,” Borderstep’s founder and director Klaus Fichter told the Clean Energy Wire. “Additionally, Germany continues to be renowned for its engineering prowess and technical knowledge, which also generates a lot of interest in the developments in the energy sector.”

With reference to global start-up hub Silicon Valley, Fichter argued that Germany has become a “Green Energy Valley” thanks to the strong presence of start-ups focusing on making the economy more sustainable. This status is also reflected in British bank HSBC’s ranking of the countries’ potential to decarbonise, where Germany comes first, thanks in part to “a particularly large cleantech industry” creating many business opportunities related to the low-carbon transition.

Cutting edge in storage & hydrogen

The energy transition in Germany has now entered a new stage, and is seeping into parts of the economy where decarbonisation has barely begun in earnest so far, such as transport and heavy industries. At the same time, the rising share of intermittent renewable power has put the focus on the question of how to store renewable power – and many German start-ups are at the cutting edge of these endeavours.

Their activities are key to shaping the energy transition “megatrends”: decarbonisation, decentralisation and digitalisation. [See our dossiers Digitalisation ignites new phase in energy transition, Electricity storage is next feat for Germany’s energy transition, and Battered utilities take on start-ups in innovation race for background and plenty of examples for start-up activity.]

“Particularly strong are storage technologies and hydrogen - and energy conversion more generally - meaning power-to-gas, power-to-liquid, and so on,” said Fichter.

International rankings reflect the strength of German start-ups in general, and their leading role in the above lines of business in particular.

For example, the San Francisco-based Cleantech Group compiles an annual Global Cleantech 100 list to show “which types of companies are most likely to have big commercial impact in a 5-10 year timeframe,” and which “represent the most innovative and promising ideas in cleantech and are best positioned to solve tomorrow’s clean technology challenges.”

Ten German start-ups made it onto the current Cleantech list: energy storage companies Electrochaea, Skeleton Technologies and Sonnen; fuel cell and hydrogen specialists Hydrogenious Technologies and Sunfire; energy efficiency specialists Kiwigrid, tado and Thermondo; as well as air taxi innovator Lilium. Even more start-ups on the list hailed from the US (47) and Canada (12).

Sunfire and Hydrogenious are the only start-ups on the list focusing on hydrogen, and from a total of 11 companies active in “energy storage” three are German.

A few years ago, German start-ups were also leading in PV technologies, but the sector has collapsed as production moved to Asia – a timely reminder that the ground can shift quickly in this sector, which is not only sensitive to economic trends but also highly susceptible to regulatory changes. As it turned out, Germany’s solar industry did not manage to wean itself off generous support payments [For more details, read the dossier Stricken solar sector sets out to regain leading Energiewende role.]

The fate of Germany’s PV sector is also a timely reminder that many start-ups fail before they can have any impact. According to an oft-cited study conducted by US researchers Startup Genome, around 90 percent of start-ups fail, while other studies have found that little more than half survive to their fourth year.

According to a report compiled by business consultancy KPMG on German start-ups, around half of all start-up founders had already established another company earlier. “Quite a few start-ups are the result of founders who have already experienced a failure,” the report stated. “Failure is therefore a central issue in entrepreneurship.”

Germany has a reputation as a “country of engineers,” owing to the relative strength of its manufacturing base, which includes carmakers BMW, Daimler and VW, as well as industry giants, such as Siemens [for more details, read the dossier German industry embraces Energiewende transformation challenge.] This is also reflected in the fact that many German energy start-ups focus on hardware innovation. “They don’t create yet another app, or work exclusively with data, but rather puzzle over technical solutions,” says Fichtner. [For more details, read the dossier German industry embraces Energiewende transformation challenge.]

Of all start-ups active in the energy and electricity sectors in Germany, almost 80 percent can be classified as green. The same is true for around 70 percent of young companies active in basic materials, and around 60 percent in transport, “underlining the importance of green start-ups in technical and industrial sectors,” according to a survey published by the Borderstep Institute.

Double impact: Start-up and incumbent innovation

The impact of start-ups goes far beyond the success of their very own business models. They also heavily influence large players in many industries – either by simply inspiring “incumbent innovation” or by cooperation or acquisitions, both on a domestic and on an international level.

The main German power companies E.ON, RWE and EnBW, which were shaken to the core by the energy transition, have now all turned to start-ups for new ideas. They provide services such as training in so-called “incubators” in order to foster innovation outside of conventional company structures, and to secure their survival with future-proof business models.

There is also a trend to establish networks between start-ups and Germany’s famed Mittelstand – small or medium-sized companies (SMEs) that are often family-owned, and whose highly specialised products and services are often international market leaders.

“It’s not about us against them – rather, we can achieve progress together,” according to Stephan Herwig, who is head of marketing at Berlin-based heating efficiency start-up Thermondo.

The World Economic Council’s Frei also stressed the importance of cooperation. “This is not about replacing all of the old with the new,” he said. “Instead, we should ask: ‘How do we help those [incumbents] to get more creative about sector coupling, power-to-x, modern forms of mobility, and so on. So, it’s not A versus B, it’s about inspiring those who have big assets today, and help them manage those assets more effectively.”

According to business consultancy KPMG, half of all start-ups cooperating with established companies plan to realise a pilot project, and a further half cooperate on marketing, while around 45 percent plan cooperation in research and development. Around one in seven use established companies in incubators or accelerators.

One example of the huge impact such cooperation between start-ups and incumbents can have is provided by steelmaker Salzgitter. The company proposes to save almost one percent of Germany’s total CO2 emissions by producing climate-neutral steel using electrolysis technology developed by start-up Sunfire. Even more salient is the example of Europe's largest carmaker VW, which plans to build major battery cell factories in partnership with the Swedish start-up Northvolt.

Half of all green start-ups say they profit from interaction with other start-ups, and almost two-thirds from interaction with established companies.

The potential impact of German start-up technology on an international level is illustrated by the takeover of home battery specialist Sonnen by Shell in early 2019. The oil major says the takeover is part of its plan to transform itself into “the largest electricity power company in the world” by the early 2030s. Meanwhile, Sonnen says it benefits “enormously” from Shell’s network and wants to become a global market leader. In a possible hint of more deals to come, French oil major Total has said it keeps an eagle eye on “very interesting” German projects that use electricity to make renewable fuels.

The good, the bad, and the ugly

Even if Germany boasts a lively scene of start-ups feeding the energy transition with new ideas, few companies say the country offers ideal conditions.

Firstly, many start-ups complain about overburdening red tape. “Germany is enamoured of laws and regulations, which is not conducive to an environment where start-ups feel at home,” according to Thermondo’s Herwig.

This is especially true in the energy sector, according to Christian Chudoba, founder and managing director of digital “utility in box” start-up Lumenaza. “In general, energy is not a particularly friendly sector for start-ups because it’s heavily constrained by regulation,” Chudoba told the Clean Energy Wire. “That makes it difficult to find a niche, and also to grow.”

Three-quarters of green start-ups say they want less regulatory and bureaucratic hurdles.

A second problem concerns financing, which is often particularly acute for green start-ups, because many need relatively large sums to realise their ideas. On average, greentech companies put their future financing needs at 200,000 euros on average, whereas non-green start-ups only need 35,000 euros on average.

Some young companies also blame conservative investors for financing troubles. “In Germany, people want to invest as little money as possible in a safe business case and reach break-even as quickly as possible,” according to Frank Pawlitschek, who runs the e-car charging start-up ubitricity. “But the government has understood the problem and is trying to do something about it,” he adds.

One reason for the reluctance of investors is the history of Germany’s solar industry, which went from a spectacular boom in the first decade of the millennium to an ugly bust a few years later. Many investors burned their fingers, making them more reticent to invest in the sector. But a long period of extremely low returns on conventional investments has forced many investors to take larger risks again, easing the flow of capital.

“There is a misunderstanding on the investors’ side that investments in green start-ups mean lower returns,” says Frank Ackermann, co-founder of the sustainable finance platform SDG Investments.

According to ubitricity’s Pawlitschek, many start-ups can now also turn to alternative funding sources. Several Mittelstand firms “have woken up and realised that cooperation with smaller partners and early investments offer a lot of innovative potential that is not accessible for them otherwise. Even large industrial companies now realise it can be worth entering the field with early investments.”

In 2018, slightly more than half of all venture capital deals were realised by private investors, a third by public investors, such as the KfW bank or start-up funds, and 15 percent by strategic investors, such as established companies aiming for a strategic partnership, according to KPMG.

But start-ups and experts agree that financing has significantly improved in recent years, thanks partly to new government programmes, for example the economy ministry’s start-up portal “GO!,” its Energy Research Programme, the “Research Network Startups” or the government’s “Hightech Strategy 2025.” The EU also has programmes in place to foster green start-ups and small to medium-sized companies (SMEs).. For example, the European Commission’s “Green Action plan for SMEs” is aimed at “turning environmental challenges into business opportunities.” These programmes not only provide financing but also aim to foster entrepreneurship in a population often deemed overcautious when it comes to founding a company.

“Germany needs a new entrepreneurial spirit and more people who can put their ideas, creativity and skills into practice in their own start-up,” said economy minister Peter Altmaier.

Borderstep’s Fichter says Germany now has “excellent conditions” for start-up formation and innovation support, but he concedes the country is not on a par with the US when it comes to large volumes. “When it’s about pumping 50, 80 or even 150 million dollars into a start-up, Germany is not on the same level as Silicon Valley.”

Ubitricity’s Pawlitschek agrees with this assessment: “In Germany, and in Europe more generally, it is also difficult to organise financing with a volume that allows you to think big.”

A third constraint for Germany’s growth-hungry start-ups is simple geography. “The US is simply a huge market, with one language and one culture. It offers a similar number of households as Europe, but we’re split up into 28 countries, with many different languages, cultures, regulations, borders and tax systems, which all slow you down. Being in the US makes it much easier to scale up operations,” according Christian Deilmann, co-founder of the home thermostat start-up tado.

On the plus side, “Germany also boasts a very strong education system, translating into strong new blood in engineering and digital expertise, which means that Germany is nevertheless an attractive location for start-ups – especially here in Berlin, where a lot of international talent is based these days,” according to Thermondo’s Herwig.

Hendrik Sämisch, who co-founded the virtual power plant operator Next Kraftwerke , also focuses on Germany’s bright side. “I never felt that bureaucracy was a problem while launching and nurturing a start-up. Also, Germany’s political system is stable, and the infrastructure is good – you can get anywhere you want and our internet connection is reliable – what else do you need?”

in Berlin in April 2019. Source: dena. Still from video advertising the German Energy Agency's (dena) start-up competition.](https://www.cleanenergywire.org/sites/default/files/styles/gallery_image/public/dena_video.jpg?itok=Ij2Y6Qrf)