Preview 2022 - What to watch in energy & climate in Germany and beyond

The year 2022 is set to become crucial and decisive in German energy and climate policy, as the new government will start to translate its plans for getting the country on a path to climate neutrality in line with the 1.5°C global warming limit into concrete policy. The coalition composed of the Social Democrats, the Greens and the pro-business Free Democrats (FDP) has concluded a treaty with a strong focus on climate and energy: The parties plan to pull forward the country's coal exit, "ideally" to 2030, and increase the share of renewables in Germany's power mix to 80 percent by that date, among many other steps.

The government under SPD chancellor Olaf Scholz has promised an immediate action programme for climate protection to get the targets within reach, and will address the massive challenges with a reorganisation of policymaking. It has created a new "super ministry" for economy and climate, which will be headed by the Greens' co- leader, Robert Habeck, as well as a new "buildings" department run by the SPD, while the finance and transport ministries will be in the hands of the FDP.

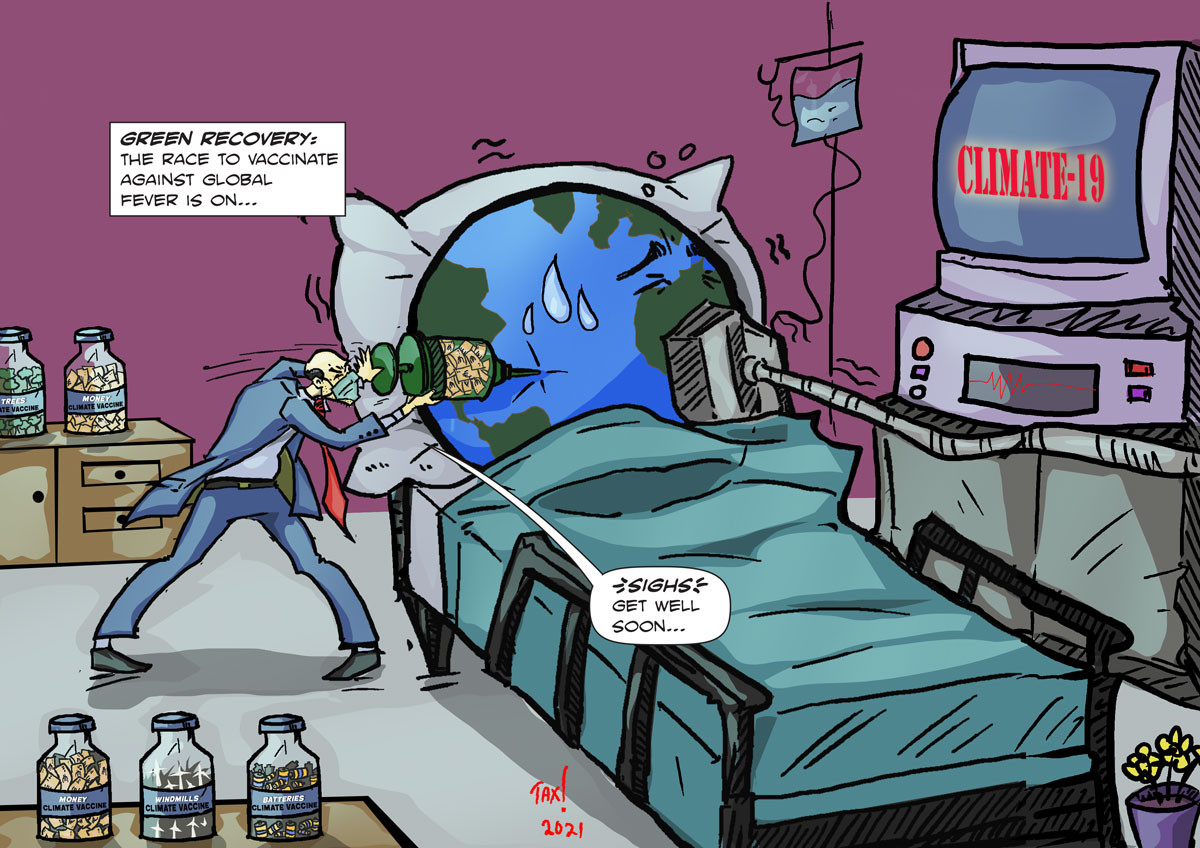

But the start of the new government’s mandate is overshadowed by a powerful new wave of the coronavirus pandemic, which could result in further delays and cause budget constraints. It is also set to impact the energy transition in many other areas, for example in the transport sector.

What follows is a sector-by-sector look at what are set to be next year’s energy and climate highlights.

Renewables expansion

Building much more wind turbines and solar panels at a high speed will be a – if not the – central task for the new government as far as the success of Germany’s climate and energy policy ambitions are concerned. More renewables are needed to replace coal and nuclear power, fuel electric vehicles, allow Germany to pursue its high-flying green hydrogen production plans and a wide range of other measures to reduce the economy’s carbon footprint.

- The new government has further increased an already challenging target for the 2030 share of renewables in the power mix from 65 to 80 percent, meaning that the buildout of renewable power installations must be accomplished at a pace three to four times faster as in the previous years. This means the government will likely have to revisit Germany’s Renewable Energy Act and formulate how exactly the required expansion is going to take place. This includes definitions for production and installation targets, gauging demand, accounting for capacity dropping out in 2022 after reaching the end of their 20-year guaranteed support period and finding new ways to let nearby residents benefit financially from renewable power installations in their neighbourhood.

- The novel economy and climate ministry led by Green politician Robert Habeck will play a pivotal role in this endeavour. Habeck described the rollout as a difficult task for society and said that his first year in office would likely be filled with creating the legal foundation for the economy’s “eco-social” transformation, while effects will only really take hold later. The required push for renewables construction would without a doubt “change the face of our country,” Habeck said, adding that this will inevitably lead to an intense debate in society and new ways must be found to let neighbouring residents benefit from installations financially.

- In 2022, the first measures to increase the speed of renewables expansion will likely include giving renewables priority at adequate locations where construction is currently blocked due to other “legal interests.” The government might thus resolve the blocking of projects that are held up in courts or administration by introducing legislation that gives the success of climate targets greater importance than for example objections by nearby residents or the sanctity of local conservation areas.

Coal phaseout

The end of coal in Germany is certain but just how fast it will come along still is up for debate. After the previous government agreed on ending the most polluting form of energy production in Germany by 2038 at the very latest, the new coalition has said it “ideally” wants to phase out hard coal and lignite entirely by 2030 in a bid to get the country on track towards its target to comply with the Paris Climate Agreement. While the move has been widely welcomed by researchers and climate activists, coal mining regions and industry representatives have voiced worries that a quicker exit could lead to social hardships and jeopardise power supply security.

- In 2022, the phase-out of hard coal plants in tenders and of lignite plants in a fixed order will continue. The government wants to bring the total coal power capacity down to 30 GW by the end of 2022 and many plants, especially in western region of North Rhine-Westphalia, will drop out of the market before the end of the year. This includes several blocks of lignite plant Neurath owned by energy company RWE, Germany’s largest individual source of greenhouse gas emissions.

- While Germany’s coal states and mining regions in principle have already agreed to support payments totalling 40 billion euros regardless of the phaseout’s speed, some politicians called on coal miners and other residents to protest against the new 2030 deadline, arguing it amounts to a violation of the earlier agreement. Even though a rising CO2 price in the European Emissions Trading System (EU ETS) could already frustrate plant operators’ calculations and speed up their shuttering, people in coal regions will be eyeing closely how the new government intends to assist the regions if the phaseout is pulled forward to the end of this decade.

- Encouraged by the new government’s faster phaseout plans and also by a landmark 2021 ruling by Germany’s constitutional court that has underlined the government’s responsibility to protect citizens from global warming, people in towns still threatened by coal mine expansion hope that their homes could be saved after all due to coal companies revisiting their projected demand for the fossil fuel.

Nuclear phaseout

December 2022 will mark the closure of Germany’s last three nuclear power plants. The government has announced its intention to stick with the hard-fought nuclear phaseout that was re-introduced in 2011. Today, no serious political force, not even the energy industry, is pushing for a longer runtime anymore. As the exit date is approaching, operators have planned fuel and staff availabilities accordingly, making a last-minute change even less likely.

- Despite other European countries embracing nuclear power as a low CO2 energy source - and possibly receiving some tailwind for investing in it from the new EU taxonomy due out in December or January – Germany has chosen to make renewables the main energy source of the future.

- Germany is in the lengthy and difficult process of finding a final resting place for the nuclear waste generated during the use of nuclear power since the 1960s – more discussions are to be expected in 2022 as the areas where the final repository will be located are narrowed down.

- Researchers are confident that phasing out the last reactors will not destabilise the power grid – and they say that higher emissions due to letting coal plants run longer than nuclear will only result in higher CO2 emissions until the boosted renewables expansion kicks in – or not at all because of the overall cap on energy sector emissions under the European CO2 trading scheme.

Power grid, market and supply security

Since renewable power from wind and solar is the pillar of Germany’s decarbonisation strategy, upgrading the transmission power grid is crucial to making sure that decentralised renewable energy is available in the industrial hubs. Time is of the essence too, because as more coal plants and the last nuclear plants in the south of the country are closed down at the end of 2022, the lopsidedness of Germany’s power system will only get worse until the requisite cables and more evenly distributed renewable installations are in place. Grid operators are generally confident that they will keep the lights on throughout the transition, but the new government is under pressure to show results after declaring that it will make renewable infrastructure planning procedures much faster. At the same time, the government has announced an overhaul of the power market design – to account for the rising share of renewables and the need for flexible plants to accompany them.

- So far, grid expansion has been slow and suffering from delays due to legal challenges. The new government wants to accelerate the grid expansion procedures.

- The energy industry lobby in Germany is very keen to see a new power market design that gives impetus for new investments into flexible natural gas and hydrogen-ready power stations – the government wants to propose a new design in 2022.

- The government will also evaluate capacity mechanisms and other flexibility options to ensure supply security during nuclear and coal phaseouts and introduce a “real” stress test to monitor supply security.

International climate and energy policy

Germany’s foreign policy year kicks off with a bang as the country takes over the presidency of the Group of Seven (G7) on 1 January. Analysts have called it a “sink-or-swim challenge” for the new government and chancellor Scholz, who does not yet have the same level of clout among leaders as his predecessor Angela Merkel had. The presidency means Germany will play a key role in the 2022 international climate agenda.

- While the government has not yet presented an official list of its priorities, the foreign ministry has said that the climate crisis and its consequences will be at the centre of the G7 presidency, and the new coalition sees it as the starting point for an “international climate club” and an initiative to establish climate partnerships.

- Strengthening international climate cooperation ahead of the next UN climate change conference COP27 in Egypt in November will notably depend on Germany’s G7 presidency, say researchers.

- The summit of heads of state and government on 26-28 June in Schloss Elmau in the Bavarian Alps could turn out to be an important stepping stone in the 2022 global climate agenda.

European climate and energy policy

In the European Union, Germany could be asked to step up to the plate early in 2022. France – the other half of the partnership which many have dubbed the “engine of Europe” – will head to the polls to elect a president in April. This means that France’s focus could be on domestic issues even as the country presides over the EU Council and aims to advance the different pieces of legislation to implement the EU Green Deal. The German government could fill the gap and provide the necessary push.

- Germany’s new coalition has said it supports the European Commission proposals included in the so-called “Fit for 55 package” of energy and climate legislation to ensure the EU reaches its 2030 target of reducing greenhouse gas emissions by 55 percent.

- The package contains elements, such as a Carbon Border Adjustment Mechanism and a carbon price on transport and heating fuels, which are contentious among member states. The German government will have to invest considerable time and effort in pushing these through during the negotiations with the member states and the European Parliament.

- Describing the way it sees it role within the EU, the German government has said that “As the largest member state, we will assume our special responsibility in a spirit of service to the EU as a whole.”

Nord Stream 2 and natural gas

The controversial Russian-German Nord Stream 2 gas pipeline is impeding efforts to unite EU countries and has split Europe with Germany on one side and a large group of neighbouring EU member states on the other. At the domestic level, the role of natural gas in the energy transition has been a major issue.

- The new government coalition has so far shown little interest in deviating from Germany’s established position to support Nord Stream 2 (despite the Green Party’s long-standing opposition) or at least let it proceed as a "private sector project". It remains to be seen whether the pipeline will eventually come into service in 2022.

- Tensions between Ukraine and Russia and U.S. sanctions may put the start of Nord Stream 2 further in doubt. The certification procedure, which regulators have put on hold until Nord Stream 2 founds a subsidiary under German law, is expected to last several months– with an uncertain outcome, also because EU regulators will get a say as well.

- Gas industry experts and journalists were surprised at how “gas-friendly” the coalition treaty turned out to be.

- The government says several new modern gas-fired power plants will be needed to ensure supply security during a transitional phase as Germany exits nuclear and coal.

- The question is how to trigger the necessary investments to build these plants and 2022 will see the first debates about a reform of the country’s power market design, which could include some form of capacity mechanism.

Industry and hydrogen

Industry decarbonisation and the 'hydrogen economy' are rapidly picking up speed at both domestic and EU level, but they hinge on the availability of sufficient amounts of renewable power, the presence of competitive business models and the right framework conditions to trigger the requisite investments. Close coordination between the EU and the German government policies will be key to initiating the shift to a climate-neutral manufacturing sector, which many German companies have come to see as an enormous business opportunity. Industry says the new government must act quickly to enable the "greatest transformation in Germany's history."

- The EU's "Fit for 55 package" includes several measures that are central for industry decarbonisation, such as a Carbon Border Adjustment Mechanism (CBAM) to avoid emission-cutting investments leading to competitive disadvantages. The German government says it is in favour of the package and will have to support it during the negotiations with the EU member states.

- German industry says it "can and wants to be a central problem solver on the way to a sustainable economy." The sector hopes that the new combined economy and climate "super ministry" will create important synergies for industry decarbonisation, make good on its promise to cut red tape and provide cost relief for CO2-neutral energy sources.

- A rapid build-up of green hydrogen production at home and abroad, as well as a rapid rollout of the necessary infrastructure, are preconditions for completing the shift towards a "hydrogen economy," a central part of the industry decarbonisation plans. The new government is expected to rapidly pursue international energy partnerships to secure the necessary imports of green hydrogen and other fuels based on it, and clarify how it plans to achieve the new target of ramping up domestic hydrogen production to a capacity of 10 GW by 2030.

- Hydrogen and other decarbonisation technologies are set to feature prominently at the Hannover Messe, one of the world's largest industry fairs, in late April.

Transport and mobility

Germany has been struggling to lower emissions in the transport sector, which is often referred to as the "problem child" of the country's energy transition. The shift to sustainable mobility will have to gather pace rapidly to enable the country to reach its climate targets. This will not only affect Germany's huge car industry, but also many other policy areas, such as public transport, cycling and walking, and ‘just transition’ issues.

- Transport is considered one of the coalition treaty's weak spots in terms of concrete plans for emissions cuts. Many environmentalists also question the government's determination to push sustainable transport after the FDP's Volker Wissing was put in charge of the transport ministry. Mobility experts have a keen eye on Wissing's actions to see whether these doubts are justified.

- The long-term impacts of the coronavirus pandemic on mobility could be massive but remain uncertain with mobility behaviours still in flux. The year 2022 could finally reveal whether the use of public transport and private cars will return to pre-pandemic levels.

- Tesla's "gigafactory" near Berlin is set to start production in early 2022. This will heat up the rivalry with Germany's established carmakers Audi, BMW, Mercedes, Porsche and VW, which all have ambitious plans to shift to electric cars.

- The development of electric car registrations and new steps to bolster the rollout of charging infrastructure will give a first hint of whether the government's new target of having 15 million electric cars on the road by 2030 is realistic.

- The IAA Transportation international fair will provide an outlook on the future of emission-free commercial vehicles in September.

Buildings

The buildings sector accounts for roughly a third of Germany’s total CO2 emissions, but has been slow to reduce its carbon footprint, missing its 2020 reduction target. The renovation rate of existing buildings remains much too to slow to achieve the climate targets despite various policy initiatives by the previous government.

- The creation of a new buildings ministry led by Social Democrat (SPD) Klara Geywitz has fanned hopes that the sector will finally make more progress in emissions reduction. The exact tasks of the ministry have yet to be clarified.

- The new government has explicitly promised to support the EU's plans for emissions reduction in the buildings sector. As part of its "Fit for 55" package, the EU Commission has proposed minimum energy performance standards, including the mandatory renovation of the most inefficient buildings. The new year will show whether the government pushes for the measures in EU Council negotiations, and how it plans to implement them at home.

Agriculture and forestry

The next years could mark a sea change in German agricultural policy as a Green Party minister will head the department for the first time in 16 years. The sector has long been considered “hard to decarbonise.” Agricultural emissions in Germany have fallen by around 24 percent since 1990, in large part due to the decrease in livestock numbers after the German reunification. Germany’s Climate Action Law sets an emission budget for the agriculture sector of 56 million tonnes CO2 equivalent in 2030 (down from 70 mt in 2020).

- New agriculture minister Cem Özdemir (Green Party) has no track record on this subject but is expected to emphasise making farming more sustainable and climate friendly – some of which the new coalition treaty spells out in some detail, e.g. make changes to the accompanying regulations of the CAP strategic plan to ensure climate action, environmental protection and income security for farmers; present a concept how direct payments under the CAP could be replaced with paying for environmental and climate services and more.

- The new government wants to adopt a national moorland protection strategy.

- The new government wants to present a concept how direct payments under the CAP could be replaced with paying for environmental and climate services.

- The new government will develop a long-term approach for additional climate protection of forests, e.g. by rewarding forest owners for climate action.

- Conventional farmers’ associations, organic farmers and conservationists are pushing for including the proposals of the cross-stakeholder Commission on the Future of Agriculture of 2021 in the government’s new agriculture policy.

Climate movements

As the new government starts putting the coalition treaty plans into action, climate activists will keep up the pressure to make sure the policies are in line with the 1.5C global warming limit outlined in the Paris Agreement and that the energy transition happens in a socially just way.

- Germany’s largest climate action group, Fridays for Future, has presented a list of demands for the first 100 days of the new government, including the introduction of a German CO2 budget with which all new laws and projects should be compatible.

- The new government’s intent to pull forward the coal exit “ideally” to 2030 from 2038, as specified in the coalition treaty, has been a key demand by the movement for years. The movement also calls for a much quicker phaseout of natural gas, saying the fossil fuel should not be used as a ‘bridge technology’ on the way to climate neutrality.

- Social justice and international solidarity remain key issues for climate action groups in Germany. Fridays for Future wants Germany to commit to spending at least 14 billion euros annually on international climate financing.