Germany aims to accelerate hydrogen market ramp-up with strategy update

Germany’s ruling coalition of the Social Democrats (SPD), the Green Party and the Free Democrats (FDP) has presented a long-expected update to the country’s 2020 National Hydrogen Strategy. The update “shows how the hydrogen market ramp-up can be accelerated through concrete and reinforced measures to contribute to Germany’s transformation into a climate neutral economy by 2045,” says the document. [See the factsheet Germany's National Hydrogen Strategy for details of the update and the original strategy.]

By 2030, the strategy aims for 10 gigawatts (GW) of electrolyser capacity to produce green hydrogen in Germany and make the country a “lead supplier for hydrogen technologies.” It says that by that time, 50 to 70 percent of the country’s total hydrogen demand will be met from imports, with the share rising in the years after that. Thus, the government has said it aims to presentan additional Import Strategy for Hydrogen and Hydrogen Derivatives in 2023. The government also wants 1,800 kilometres of refurbished and new pipelines for a “hydrogen start-up grid” in Germany as early as 2027/2028.

“Investing in hydrogen is investing in our future, in climate protection, in skilled jobs and in energy supply security,” economy minister Robert Habeck said. “In order to successfully implement the strategy, we are also currently working at full speed to create the necessary infrastructure.”

State support also for applications using blue hydrogen

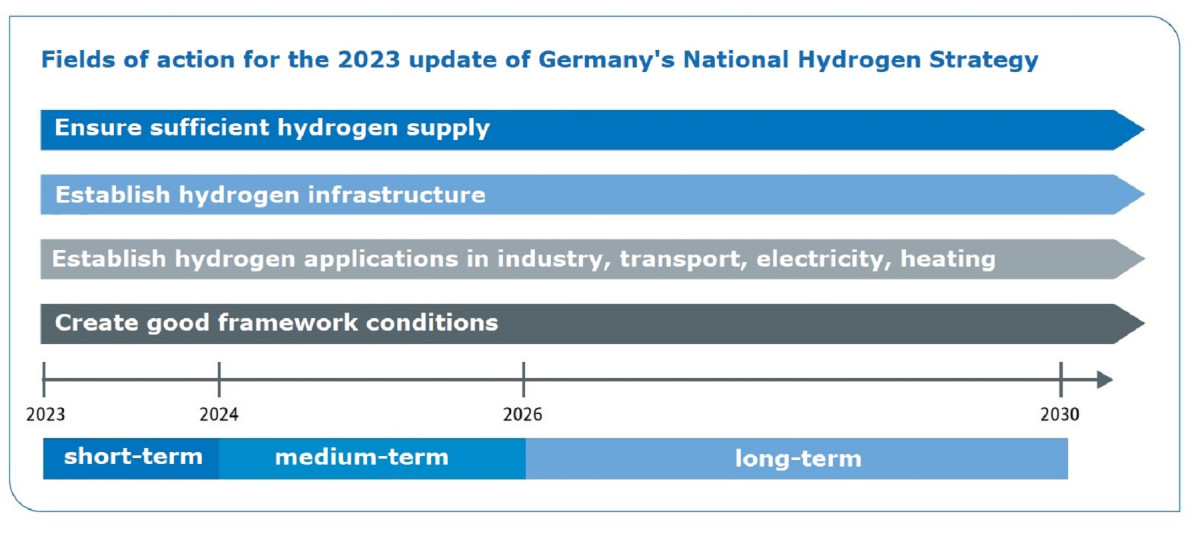

Aside from measures to speed up the market development in several areas (ensure sufficient hydrogen supply by 2030, establish solid hydrogen infrastructure and applications, create effective framework conditions), relevant new decisions concern state support for different forms of hydrogen. “Direct financial support for hydrogen production is limited to the production of green hydrogen,” says the document. However, on the application side, blue (from fossil fuels with CCS), turquoise (from fossil gas, generating solid carbon) and orange (on basis of waste and residual materials) hydrogen could also be supported – “taking into account ambitious GHG limits, including upstream emissions, as well as meeting the legal target of climate neutrality.” [Find more information on the “colours” of hydrogen here.]

The German strategy update does not mention hydrogen produced with nuclear energy – so-called pink hydrogen – a source favoured by neighbouring France. The dispute about nuclear energy between Paris and Berlin has turned into an obstacle for the European Union’s renewables push (read more here).

In the fight against climate change, hydrogen made with renewable electricity is increasingly seen as a silver bullet for sectors with particularly stubborn emissions, such as heavy industry and aviation. It is also seen as a way to bolster the electricity system with hydrogen-fired power plants as backup during times of low renewable power generation. Germany has set out to become a global leader in the associated hydrogen technologies, and the government in 2020 penned a National Hydrogen Strategy to fulfil these ambitions. The current coalition agreed to present an “ambitious update” to the strategy to make the country a leading market for hydrogen technologies by 2030.

While the original strategy “remains valid in principle,” the update aims to further speed up the market ramp-up and introduces adjusted targets and new measures. The government argues that against the backdrop of the energy crisis and the war in Ukraine, the supply security goal of the 2020 strategy has gained in importance from a security policy perspective. The update would also send an “important industry policy signal” to the world, strengthening Germany as a business and industry location helping to create future-proof jobs.

The strategy says that increasing energy efficiency and speeding up the expansion of renewable energies are indispensable for reaching Germany’s climate targets. It also emphasises that using renewable electricity directly is preferable in most cases, for example in electric mobility or heat pumps, as it is associated with lower conversion losses compared to the use of hydrogen. While the aim is still to use hydrogen mostly for certain industry processes, aviation and shipping transport and back-up power plants, other applications have been more disputed because of more efficient alternatives using electricity – for example in heat pumps and e-cars. The government now says that for road transport, hydrogen should only be used for heavy duty commercial vehicles, while in the heating sector it would be used in “rather isolated cases.”

Energy industry calls for clear investment framework, NGOs criticise possible support for blue hydrogen

German energy industry association BDEW welcomed the update, calling it a development in the right direction, but lamented that there is no final alignment between funding mechanisms, general framework conditions and market design. “Energy companies are willing to invest in a hydrogen economy, but they need a clear framework, both at national and European level,” BDEW head Kerstin Andreae said, adding that the government should present its hydrogen import strategy promptly.

The German renewable energy federation BEE criticised the strategy for focusing on hydrogen imports by ship instead of domestic production. “Due to its upstream chain emissions, blue hydrogen is not only much more harmful to the climate than green hydrogen, but also more expensive,” BEE head Simone Peter said, adding that Germany is in danger of falling into new import dependencies.

Germany’s industry association BDI largely welcomed the update, saying the revision was overdue in view of the developments on the energy markets. The fact that blue, turquoise and orange hydrogen are explicitly considered is especially positive, BDI head Holger Lösch said. “Until sufficient green hydrogen is available, the industry will have to rely on alternatives.” He called for measures to be implemented quickly and for the government to finalise its planned hydrogen import strategy.

While environmental associations Climate-Alliance Germany and Friends of the Earth Germany (BUND) welcomed the move, they were critical of the use of blue hydrogen and called for improvements in the areas where it will be used, as well as for more civil society participation and clearer sustainability rules. “Two other important aspects are completely missing from the strategy so far: efficiency and the reduction of energy demand,” Verena Graichen, deputy chair of BUND and member of the National Hydrogen Council, said.

The ramp-up of Germany’s hydrogen economy should fall in line with demand, and the country’s economically strong south cannot be disadvantaged, Bavarian business association vbw said. “In addition to the connection to the hydrogen grid from the north, Bavaria also needs a southern pipeline connection from Italy,” vbw head Bertram Brossardt said.